If you’re thinking about securing your assets and ensuring your loved ones avoid the stress of probate, you’ve probably asked: What’s the cost to set up a living trust? It’s a smart question—and one with a range of answers depending on how you go about it.

In this guide, we’ll break down the typical costs involved, compare different setup options (like attorneys vs. online platforms), and help you understand what influences pricing.

Whether you’re just starting to explore estate planning or ready to take the next step, this article will give you the clarity and confidence to make the right decision for your legacy.

What you’ll learn:

- What Is a Living Trust and Why Do You Need One?

- How Much Does It Cost to Set Up a Living Trust?

- What Factors Influence the Cost of a Living Trust?

- Hidden and Ongoing Costs You Should Know

- Living Trust vs. Will: Cost and Value Comparison

- How to Save Money When Setting Up a Living Trust

- Why Trust Guru Offers a Smarter Way to Set Up Your Trust

- Frequently Asked Questions

What Is a Living Trust and Why Do You Need One?

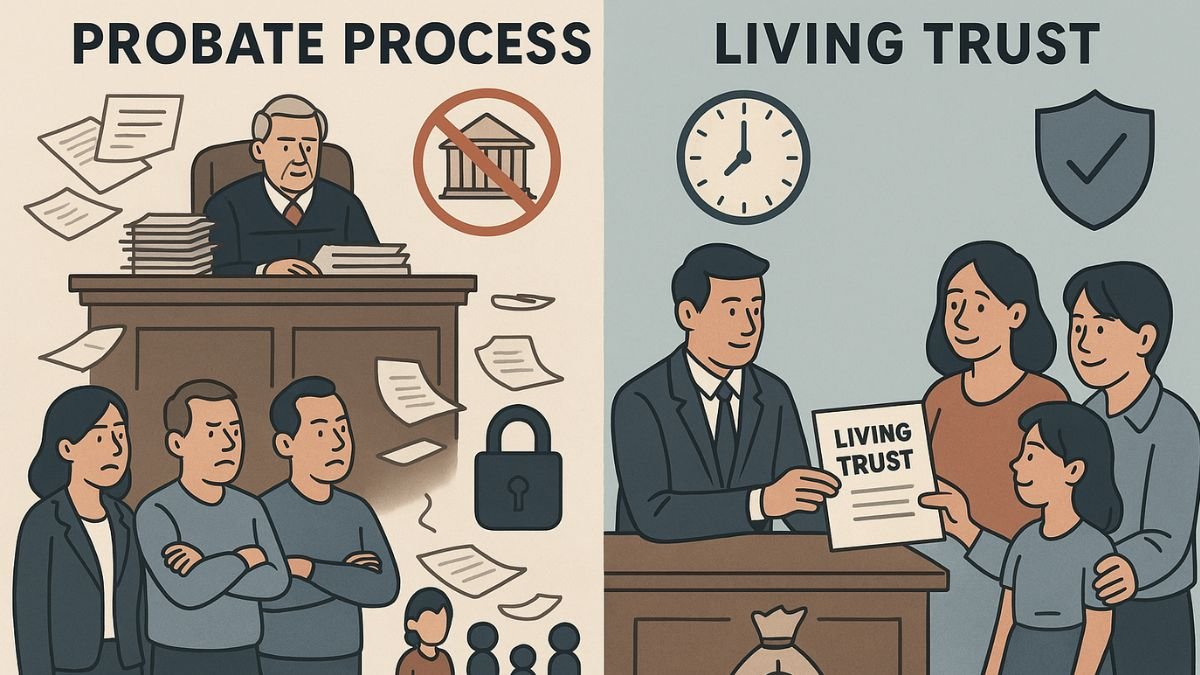

A living trust is a legal document that lets you decide how your assets—like real estate, bank accounts, and investments—will be managed and distributed after your death. Unlike a will, a living trust allows your estate to avoid probate, which is the often lengthy and costly court process that occurs when someone passes away without a trust or with only a will in place.

Living trusts are a core part of many estate plans because they offer both flexibility and control. You can create one while you’re still alive (hence the name “living”), and you can make changes or even revoke it later if your circumstances change.

This type of trust is known as a revocable living trust. In contrast, an irrevocable trust generally can’t be altered once it’s set up but may offer added asset protection or tax advantages in certain situations.

Learn what a revocable living trust is, why it matters, and how it could protect your legacy—all in plain, approachable terms.

For anyone looking to protect their legacy, maintain privacy, and ensure their estate is passed on smoothly, a living trust is a powerful tool. It’s especially useful for those with real estate, blended families, or loved ones with special needs, as it allows for detailed instructions and safeguards that a standard will can’t provide.

Want to make sure your trust plan works for both your spouse and children from a previous marriage? read our guide on blended family living trusts

If you’re concerned about errors that could undermine your estate plan, you may also want to review the common mistakes to avoid when creating a living trust.

How a Living Trust Works

To understand how a living trust functions, it helps to look at the key roles involved:

- Grantor: This is you—the person who creates the trust and transfers assets into it.

- Trustee: This is the person or institution you choose to manage the trust. While you’re alive, you can act as your own trustee. After your passing, a successor trustee takes over and follows your instructions.

- Beneficiary: These are the individuals or organizations you name to receive your assets.

All of these roles are outlined in a legally binding trust agreement, which ensures your wishes are carried out without the interference of the court.

Think of it like setting up a secure lockbox for your assets: you decide what goes in, who holds the key (the trustee), and who receives what when the time comes (the beneficiaries). And unlike a will, the contents of your trust are private and distributed directly—no probate court required.

Benefits of Setting Up a Living Trust

A well-structured living trust offers several key advantages:

- Avoid Probate: This is one of the biggest benefits. With a living trust, your estate doesn’t get tied up in court, saving your loved ones time, stress, and money.

- Faster Access to Assets: Because there’s no probate delay, your beneficiaries can receive their inheritance more quickly—often within weeks instead of months or years.

- Privacy: Wills become public record; trusts don’t. This means your family’s financial matters stay confidential.

- Continuity in Case of Incapacity: If you become ill or incapacitated, your trustee can step in and manage your affairs without court involvement.

In short, setting up a living trust is about protecting your assets, minimizing family conflict, and ensuring your wishes are honored—clearly, efficiently, and privately. You may also consider documents like healthcare directives and powers of attorney to cover medical or financial decisions during incapacity.

Key Takeaway: A living trust is more than a legal document—it’s a thoughtful, proactive way to care for your family, reduce future burdens, and make your estate plan work exactly how you want it to.

How Much Does It Cost to Set Up a Living Trust?

One of the most common questions in estate planning is: How much does it cost to set up a living trust? The answer depends on how you choose to create your trust and the complexity of your estate. On average, the cost to set up a living trust in the U.S. ranges from $500 to $3,000 or more.

This wide range reflects the variety of providers and approaches available. You might work with a dedicated estate planning attorney, use an online legal service, or attempt to draft a trust yourself using downloadable templates or software.

Each option comes with its own pricing structure, level of support, and potential risks—especially when it comes to ensuring your trust is legally sound and state-compliant. If you’re still weighing your approach, it’s worth reviewing the living trust setup options to see what method best aligns with your estate planning needs and budget.

Let’s break down the typical trust prices by provider type.

Cost by Provider Type

| Provider Type | Typical Cost Range | What’s Included | Considerations |

| Attorney-Led | $1,500–$3,000+ | Custom-drafted trust, legal consultation, document review | High level of expertise; best for complex estates |

| Online Services | $200–$1,000 | Guided trust creation, templates, customer support | Affordable and faster, but may lack legal personalization |

| DIY Methods | $50–$200 | Downloadable templates or software | Lowest cost, but highest risk of errors or invalid setup |

Attorney-Led Services ($1,500–$3,000+)

Working with an estate planning attorney offers the most tailored and legally precise approach. You’ll typically receive a revocable living trust, supporting documents (like a pour-over will or power of attorney), and hands-on guidance through funding your trust.

However, attorney fees for living trust creation can vary significantly. If you’re unsure about the value of hiring legal help, read more about what an estate planning attorney does.

Online Platforms ($200–$1,000)

Online services offer a middle-ground option for many families. These platforms walk you through creating a living trust via guided forms and automated document generation. Some include attorney review, while others rely solely on templates. These tools can work well for straightforward estates, but may not account for complex family dynamics or local legal nuances.

DIY Methods ($50–$200)

For those comfortable handling legal documents, DIY trust creation tools offer the lowest upfront cost. You can purchase templates online or through software programs. However, these come with significant risks: if your trust isn’t legally valid, correctly funded, or compliant with your state’s laws, your assets could still end up in probate. In other words, while the fees for drafting may be minimal, the long-term cost of a mistake could be high.

Key Takeaway: The cost to set up a living trust varies widely depending on how much customization, legal oversight, and support you need. While it’s possible to go the DIY route, most people find peace of mind—and protection—in working with a reputable service or legal professional.

What Factors Influence the Cost of a Living Trust?

While many people focus on the average price tag, the cost to set up a living trust can vary significantly based on your personal circumstances. The final amount you’ll pay depends on several key elements—like the type of trust you need, the complexity of your estate, and whether legal professionals are involved. Understanding these factors can help you choose the right path and avoid unnecessary costs.

For example, comparing trust fund setup costs side-by-side can clarify which option offers the most value based on your goals.

Below are the most common factors that affect trust prices and how they relate to your unique estate planning needs.

Type of Trust – Single vs. Joint

One of the first decisions you’ll make is whether to create a single trust or a joint trust. A single trust is typically used by individuals, while a joint trust is designed for married couples or domestic partners who share assets.

- Single Trust: Simpler to structure, usually involves one grantor and set of instructions.

- Joint Trust: Often more complex, as it includes shared and separate property, and may have dual sets of instructions for asset distribution.

Because of these nuances, a joint trust often costs more than a single trust, especially when an attorney is needed to customize it. Ultimately, the cost depends on how your assets are structured and what level of control and flexibility you want over them.

Complexity of Estate and Asset Types

The complexity of the trust often mirrors the complexity of your estate. Someone with one property and a single bank account will typically pay less than someone managing multiple investment portfolios, rental properties, or a business.

Assets that can impact cost include:

- Real estate properties (especially across multiple states)

- Business interests

- Retirement accounts and investment portfolios

- Bank accounts and cash assets

- Collectibles or intellectual property

The more varied and valuable your holdings, the more detailed your trust document must be. It also takes more time (and legal expertise) to correctly transfer assets and title them into the trust, which can increase the overall cost.

Plus, large or diversified estates may trigger special considerations like estate tax planning, further influencing pricing.

Level of Customization and Legal Review

The more tailored your living trust needs to be, the higher the legal costs for trust setup. For example, if your estate involves:

- Children from multiple relationships

- Beneficiaries with special needs

- Specific conditions for inheritance

- Charitable donations or complex tax strategies

…then your trust will require more precise legal language, and likely attorney involvement. If you’re planning for a loved one with a disability, it’s essential to understand how a special needs trust compares to a living trust so you can select the right structure to protect their benefits and long-term care.

This is where working with an estate planning attorney becomes especially important if your trust involves business succession planning, charitable goals, or beneficiaries with disabilities Attorneys ensure your trust aligns with state-specific laws, accounts for contingencies, and avoids common pitfalls. While this professional review adds to the cost, it also adds long-term value and peace of mind.

For more complex cases, legal review helps avoid oversights and supports compliance with legal risk oversight.

Key Takeaway: The complexity of your trust—including your estate size, asset types, and legal requirements—plays a major role in determining how much you’ll pay. Whether you’re creating a single trust or a joint trust, factoring in these variables early will help you choose the most cost-effective and secure approach.

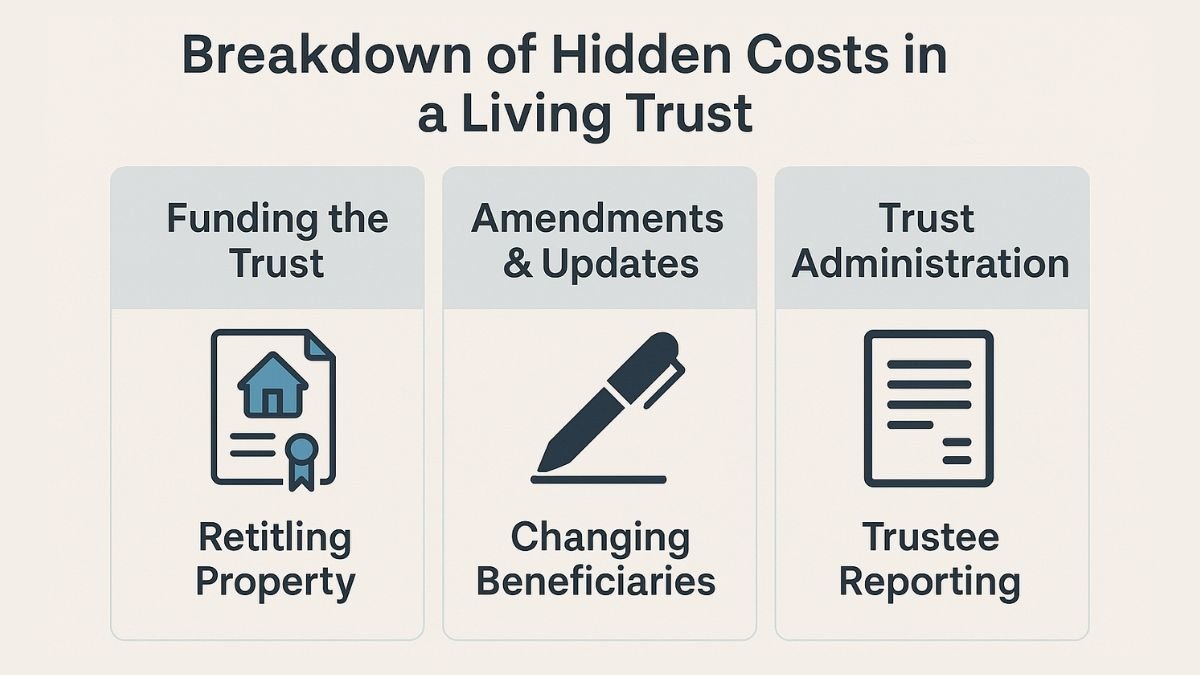

Hidden and Ongoing Costs You Should Know

When budgeting for your living trust, it’s easy to focus on the upfront setup fee. But there are several hidden and ongoing costs that can catch you off guard if you’re not prepared. From transferring your assets to making future updates, it’s important to understand where additional costs might come into play—so you’re not surprised later.

Let’s take a closer look at the common “gotchas” involved in maintaining a trust over time.

Funding the Trust

Trust funding assistance is often overlooked but essential. Without it, your assets may still go through probate. This means transferring assets into the trust, such as re-titling your real estate, updating the ownership of bank accounts, and changing beneficiaries on retirement or investment accounts.

If you’re unfamiliar with this process, here’s a detailed breakdown on how to fund a living trust so you can avoid costly mistakes that might undermine your estate planning.

While some online platforms offer funding guides, many people need professional help to handle this process correctly, especially when it involves:

- Retitling property deeds

- Changing titles on vehicles

- Updating account registrations

- Reassigning business ownership

If these steps are skipped or done incorrectly, your assets may still go through probate—even if you’ve established a trust. Depending on how many assets you need to move, funding can require extra time, legal support, and sometimes recording fees or notary services, all of which contribute to the overall cost.

Amendments and Updates Over Time

Life events may require amending or restating a trust, especially after a divorce, birth of a child, or major financial change. You may experience events like marriage, divorce, the birth of a child, changes in state laws, or a shift in your financial situation. When this happens, your trust may need to be amended or redrafted.

These updates might include:

- Changing a beneficiary or successor trustee

- Adding newly acquired property or accounts

- Revising inheritance terms

- Updating instructions for healthcare or incapacity

Depending on how your trust was originally created, making changes could be simple or involve additional drafting fees. Some services charge per amendment, while others offer bundled plans with future updates included. In more complex situations, you may need to cancel the trust and start over, which increases legal costs.

Trust Administration and Maintenance

Finally, there are ongoing responsibilities tied to managing and maintaining a trust—especially after the grantor passes away. While you may serve as your own trustee during your lifetime, your successor trustee will eventually take over.

Common administrative costs include:

- Trustee compensation (if a professional or corporate trustee is used)

- Recordkeeping and reporting

- Legal or accounting support to distribute assets and manage taxes

- Annual maintenance fees (in some professional trust arrangements)

Even during your lifetime, you may incur expenses to manage investments or maintain properties held in the trust. And if the trust remains active over many years—for example, distributing assets gradually—those administration costs can add up.

Successor trustees may need ongoing trustee support services to manage records, taxes, and asset distribution. Trusts with long-term terms may also benefit from income distribution management and tax compliance services.

Key Takeaway: While setting up a living trust has clear benefits, it’s just the beginning. Be sure to budget for funding, amendments, and long-term administration so your trust continues to protect your estate—and your loved ones—exactly as intended.

Living Trust vs. Will: Cost and Value Comparison

When planning your estate, one of the most important decisions you’ll face is whether to create a living trust or a will—or both. While a will is often cheaper upfront, a living trust can offer long-term savings, faster asset distribution, and more control over how your estate is handled after you pass away.

If you’re considering your tax exposure, state taxes and estate planning may also influence which path you take—particularly for higher-net-worth individuals.

Learn more about the key differences between a living trust and a will to make the most informed decision for your estate planning strategy.

Here’s a side-by-side look at the key differences to help you compare the cost and value of each option.

Living Trust vs. Will: Quick Comparison

| Feature | Living Trust | Will |

| Setup Cost | $500–$3,000+ | $0–$1,000 |

| Goes Through Probate? | No | Yes |

| Time to Distribute Assets | Weeks | Several months to over a year |

| Privacy | Private (not public record) | Becomes public during probate |

| Control Over Distribution | High (can set terms, conditions) | Basic (one-time distribution) |

| Handles Incapacity? | Yes (trustee can manage assets) | No (requires separate documents) |

| Ease of Updates | Moderate (requires amendment) | Easy (simple to revise) |

| Tax and Asset Protection Options | More flexibility with advanced planning | Limited without extra documents |

This cost comparison of will vs trust reveals a fundamental trade-off: while a will is cheaper and simpler to create, it can cost your loved ones more in time, legal fees, and stress down the road. A living trust, on the other hand, requires more upfront investment but offers greater value and peace of mind for many families.

When a Trust Makes More Sense Than a Will

A will might work fine for smaller, straightforward estates—but there are many situations where a living trust offers significant advantages:

- You own real estate in multiple states

- You have a blended family or want to manage complex inheritance scenarios

- You want to keep your estate details private

- You’re planning for incapacity and need someone to manage your finances if you become unable to do so

- You want to avoid probate delays and expenses

- You have minor children or beneficiaries who require structured distributions over time

In these cases, a trust can help create a more seamless, controlled, and secure transfer of wealth. And while it may require a higher upfront cost, the savings in time, legal fees, and emotional strain for your family can make it well worth it.

If you’re planning to leave gifts to a nonprofit, consider charitable trust solutions, which are structured to provide tax benefits while supporting causes you care about.

Key Takeaway: When comparing a trust versus a will, think beyond the initial cost. A living trust can simplify complex estates, protect your privacy, and help your loved ones avoid costly probate proceedings—making it a smarter long-term estate planning option for many families.

How to Save Money When Setting Up a Living Trust

Creating a living trust doesn’t have to break the bank. With the right approach, you can prepare a revocable trust that’s both legally sound and budget-friendly. Whether you’re working with an attorney, using an online platform, or exploring a hybrid solution, there are smart ways to optimize your spending without sacrificing peace of mind.

For a clear breakdown of the step-by-step process, check out our guide on how to set up a living trust.

Here are two key strategies to help you save money while still protecting your legacy.

Choosing the Right Provider for Your Need

One of the most important ways to reduce costs is by selecting the right provider based on your estate’s complexity, personal preferences, and legal needs. You may find it helpful to follow a quick checklist for making a living trust when comparing service providers or platforms to ensure nothing is overlooked.

- Online Services: If your estate is relatively simple—think one home, a few bank accounts, and clear beneficiaries—an online platform can help you create your trust for as little as a few hundred dollars. Some services even include access to attorney-reviewed documents or optional upgrades for more customization.

- Estate Planning Attorney: For more complex estates—such as those involving business ownership, blended families, or special needs beneficiaries—working with a trust attorney ensures your living trust is comprehensive and state-compliant. While more expensive, this option can prevent costly mistakes later on.

- Hybrid Models: Some services combine the convenience of digital platforms with on-call legal support, offering a living trust with an attorney at a reduced price compared to traditional law firms. This middle ground is great for those who need guidance but want to avoid hourly billing.

Explore the key differences between online, attorney, hybrid model setup trust in our detailed guide on online vs. attorney-prepared living trusts. Learn which option fits your estate complexity, budget, and long-term planning goals.

Some families may benefit from combining trust services with business asset protection strategies, especially if they own LLCs or family-run companies.

Tip: Ask potential providers if they offer flat-fee packages. This makes it easier to budget and avoids surprise costs down the line.

Bundling Estate Planning Documents

Another way to reduce expenses is by bundling your trust with other essential estate planning tools. Rather than paying for each document individually, many providers offer packages that include:

- Power of Attorney (for financial decisions)

- Advance Healthcare Directive or Living Will

- HIPAA Authorization Forms

- Pour-Over Will (used to catch any assets unintentionally left out of the trust)

These documents work together to ensure your wishes are honored—not just after death, but during your lifetime as well. Bundling your living trust with a will, powers of attorney, and healthcare directives can reduce costs and offer comprehensive coverage.

Our will drafting services ensure you’re not missing key pieces in your estate plan.

Tip: If you’re preparing a revocable living trust, ask if the provider includes a comprehensive estate planning bundle. Since a trust is vital but only one piece of the puzzle, a complete package offers better value and coverage.

Key Takeaway: To keep costs down, choose a provider that matches your needs and consider bundling services for added value. Whether you opt for an attorney, a digital tool, or something in between, smart planning ensures you create a revocable living trust that’s both affordable and effective

Why Trust Guru Offers a Smarter Way to Set Up Your Trust

When it comes to creating a living trust, you deserve a solution that’s straightforward, legally sound, and tailored to your life—not a maze of confusing paperwork or hidden fees. That’s where Trust Guru stands out.

At Trust Guru, we believe estate planning should be simple, accessible, and affordable for every family. Our platform combines the ease of an online experience with the confidence of attorney-reviewed documents, giving you a clear path to set up a trust without unnecessary delays or legal headaches.

Here’s why thousands trust us with one of the most important steps in their legacy planning:

- Transparent Pricing: No surprise fees or hourly rates—just clear, flat-fee packages designed to fit your needs and budget.

- Attorney Review: Every trust is carefully reviewed by licensed attorneys to ensure legal accuracy and state compliance.

- Nationwide Coverage: Whether you’re in California, Florida, Texas, or anywhere else, your trust will be valid in all 50 states.

- User-Friendly Process: Answer a few simple questions online, and we’ll guide you through the rest. You can complete your plan from the comfort of your home, without ever stepping into a law office.

Whether you’re starting from scratch or refining an existing plan, we’ll help you create a living trust that protects what matters most—your legacy. Trust Guru offers a smarter, more approachable way to protect your assets and your family.

Frequently Asked Questions

The average cost of a living trust typically ranges from $500 to $3,000+, depending on how it’s created. DIY options can cost as little as $50–$200, online services usually range between $200–$1,000, and working with an estate planning attorney may cost $1,500–$3,000 or more. The right choice depends on your estate’s complexity and how much customization you need.

Several elements can influence the cost of creating a living trust, including the complexity of your estate, whether you’re setting up a single or joint trust, the types of assets involved, and the level of legal customization required. More assets, blended families, business ownership, or unique distribution instructions can increase the cost due to the complexities of estate planning.

Yes—online services offer a more affordable option for setting up a basic living trust, often costing between $200 and $1,000. However, if your situation is more complex or requires legal advice, working with an attorney—while more expensive—can be a smarter long-term investment. Attorney fees for living trust creation typically start around $1,500 and increase with complexity.

Some of the hidden costs of living trusts include fees for funding the trust (like retitling real estate), future amendments or updates, and trust administration after the grantor passes away. If a professional trustee is appointed, ongoing maintenance and management fees may also apply.

Yes—a living trust can help you completely avoid probate for assets that are properly transferred into the trust. This means faster asset distribution, lower court and legal fees, and more privacy for your family. Avoiding probate is one of the biggest benefits of choosing a living trust over a will.