Setting up a trust fund is one of the smartest ways to protect your assets, plan your estate, and ensure your loved ones are taken care of—but what about the price tag? Trust fund setup costs can vary widely depending on how you approach the process, and understanding those costs upfront is key to making informed decisions.

In this guide, we’ll break down exactly what goes into the cost of establishing a trust, from legal fees to administrative expenses.

Whether you’re considering a DIY route, hiring a traditional attorney, or exploring modern options like Trust Guru, you’ll learn what to expect—and how to avoid costly surprises.

What you’ll learn:

- What Is a Trust Fund and Why Might You Need One?

- Overview of Trust Fund Setup Costs

- Breaking Down the Costs: What Are You Paying For?

- DIY vs. Professional Services: What’s the Real Cost?

- Hidden Costs and Mistakes to Watch Out For

- Conclusion: Plan Smart, Protect More

- Frequently Asked Questions (FAQs)

What Is a Trust Fund and Why Might You Need One?

Definition and Purpose of a Trust Fund

A trust fund is a legal arrangement that allows you to transfer ownership of your assets—such as real estate, investment accounts, or retirement savings—into a separate entity, known as a trust. This trust is then managed by a trustee (which can be a person or an institution) on behalf of your chosen beneficiaries.

In simple terms, a trust fund gives you more control over how and when your assets are distributed, both during your lifetime and after you pass away. Unlike a will, which takes effect only after death and often requires probate (a lengthy and public court process), a trust can operate seamlessly while you’re alive and helps avoid many of the delays and legal hurdles associated with traditional estate plans.

This overview from FreeWill provides a helpful starting point for understanding trust structures.

Trusts come in different forms—revocable, irrevocable, living trusts, and more—each tailored to different needs. Whether you’re looking to protect your estate from taxes, preserve your legacy, or provide for loved ones with specific instructions, a trust fund offers a powerful, flexible tool for long-term planning.

Common Reasons People Set Up Trusts

Many people assume that trusts are only for the ultra-wealthy, but the reality is quite different. If you own property, have dependents, or simply want to make your estate easier to manage, a trust can be a practical, cost-saving solution.

Here are some of the most common reasons people choose to set up a trust:

- Avoiding probate: Trusts allow your assets to pass directly to beneficiaries without going through the court system, saving time, money, and privacy.

- Asset protection: Trusts can shield assets from legal disputes, creditors, or even divorce proceedings, depending on how they’re structured.

- Planning for incapacity: A trust ensures your finances are managed by someone you trust if you become unable to do so yourself. For medical and financial authority during incapacity, many people also consider healthcare directives and powers of attorney.

- Tax benefits and estate planning costs: Certain trust structures can help reduce estate taxes and long-term administrative expenses. For help with ongoing filings, trust tax compliance services are a smart consideration.

- Legacy planning: You can set conditions for how and when assets are distributed, which is especially useful when providing for minors, individuals with special needs, or blended families. The Motley Fool breaks down these benefits well.

Setting up a trust fund isn’t just about wealth—it’s about wisdom. Whether you’re planning for the future of your family or simply want to make sure your affairs are handled the right way, a trust can offer peace of mind and control when it matters most.

Key Takeaway: A trust fund is a smart, flexible estate planning tool that helps protect your assets, avoid probate, and ensure your legacy is passed on according to your wishes. It’s not just for the wealthy—it’s for anyone who wants more control, clarity, and confidence in their financial future.

Overview of Trust Fund Setup Costs

Creating a trust fund is a proactive step toward securing your financial legacy—but it does come with upfront costs that vary based on how you approach the process. Whether you opt for a do-it-yourself kit, hire a traditional estate planning attorney, or use a modern platform like Trust Guru, understanding the cost to establish a trust is essential for making an informed decision.

Let’s break down what you can expect in terms of average pricing and what factors can drive those costs up or down.

Typical Price Ranges

Trust fund setup costs can range widely depending on the service provider and the complexity of your needs. Here’s a general breakdown of what you might pay:

- DIY Trust Kits: $300–$1,000

These are usually online templates or software solutions that guide you through creating a basic trust. They’re budget-friendly but often lack legal customization or review. - Traditional Estate Planning Attorneys: $1,000–$3,000+

Hiring an attorney offers the most personalized and legally robust service but comes with higher fees—especially if your situation is complex. Here’s what to expect when working with an estate planning attorney. - Online Estate Planning Platforms (e.g., Trust Guru): $500–$1,200

These services strike a balance by offering attorney-reviewed documents and customized solutions at a more affordable rate than law firms.

Looking for a full overview of options? See our full range of services.

Here’s a side-by-side comparison to help visualize the differences:

| Setup Method | Estimated Cost | Includes Legal Review? | Level of Customization | Ease of Use |

| DIY Kit / Software | $300–$1,000 | ❌ | Low to Moderate | Moderate |

| Traditional Attorney | $1,000–$3,000+ | ✅ | High | Low (in-person) |

| Trust Guru | $500–$1,200 | ✅ Attorney-reviewed | High | ✅ Digital-first |

Note: These ranges reflect common pricing and may vary based on geographic location and trust complexity.

Factors That Influence the Cost

Not all trusts are created equal, and the trust fund legal fees you encounter will depend on several important factors:

- Type of Trust: A revocable living trust is generally less complex (and less costly) than an irrevocable trust, which may require more legal oversight due to its permanence and tax implications.

- Asset Complexity: If you own multiple properties, run a business, or have international holdings, your trust structure will likely be more complex—and more expensive. For entrepreneurs, business asset protection strategies can be essential.

- State-Specific Requirements: Some states have unique laws or filing fees that can add to your total trust formation expenses.

- Legal Assistance Required: Customized planning, legal strategy, or consultations with tax advisors can all increase costs.

- Ongoing Administration: Trusts aren’t a one-and-done deal. You may need to amend documents, fund new assets into the trust (see trust funding assistance), or pay annual trust administration fees. This SmartAsset guide dives deeper into these cost factors.

Key Takeaway: The cost to establish a trust can range from a few hundred dollars to several thousand, depending on your chosen method and the complexity of your estate. Knowing your options—and what you’re paying for—empowers you to invest wisely in your future.

Breaking Down the Costs: What Are You Paying For?

Understanding the trust fund setup costs means knowing exactly what you’re paying for. Whether you go the DIY route or hire a professional, several components make up the total cost of creating and maintaining a trust. Here’s a breakdown of the key fees to expect—and what they cover.

Legal Fees and Attorney Costs

If you choose to work with an estate planning attorney, trust attorney fees are typically the largest portion of your expense. These fees cover personalized legal advice, customized drafting, and ensuring your trust complies with both federal and state laws.

- Standard Attorney Fees: $1,000–$3,000+ for basic revocable trusts

- Complex Trusts or High-Asset Estates: $3,000–$5,000+ depending on complexity

Working with an attorney is especially valuable if you have a blended family, a business, or a unique distribution plan. For future updates, amending or restating a trust may also add to the cost. However, for many people, it may be more cost-effective to use an attorney-reviewed online service like Trust Guru, which combines expertise with accessibility.

Document Preparation and Filing Fees

Even simple trusts require professional preparation to avoid errors and ensure legality. These administrative fees include the creation, review, and execution of the trust documents.

- DIY Preparation Tools: $300–$1,000

- Professional or Online Platform Preparation: $500–$1,500

In some states, there may also be filing fees if your trust involves recording property deeds or notarizing multiple documents. Trust Guru typically includes these essentials as part of its flat-rate pricing, reducing surprises later on.

Trust Administration and Maintenance Fees

Once your trust is created, you may encounter trust administration fees for ongoing management. These apply more often to irrevocable trusts or when a third-party trustee is involved.

- Annual Trustee or Management Fees: 0.5%–1.5% of trust assets per year

- Amendment or Update Fees: $100–$500 per revision

- Asset Transfer Support (a.k.a. “trust funding”): May be included or charged separately

You may also want to consider trustee support services if you are naming someone else to manage the trust long-term.

Online platforms like Trust Guru simplify this by offering bundled services, including future updates and easy-to-use interfaces for asset management.

Additional Costs for Complex Trusts

Some trust types naturally carry higher costs due to legal complexity, tax planning, and the need for specialized language. If your needs go beyond a basic revocable trust, expect additional investment.

- Revocable Trust Setup Fees: $1,000–$2,500

- Irrevocable Trust Setup Costs: $2,500–$5,000+

- Special Needs Trusts or Asset Protection Trusts: May require added legal and tax planning, often exceeding $5,000

For example:

- Special needs trust services can involve added legal considerations

- Charitable trust solutions are ideal for philanthropic goals

- Digital asset trust planning protects crypto, logins, and other digital wealth

These trusts often involve intricate asset arrangements or special legal protections, making expert guidance essential. This finance strategist breakdown gives a comprehensive overview of these trust types and their requirements.

Key Takeaway: From legal advice to document prep and administration, each part of the process plays a role in your overall trust formation expenses. Knowing where your money goes helps you spot hidden costs—and choose a setup option that delivers real value and peace of mind.

DIY vs. Professional Services: What’s the Real Cost?

When it comes to setting up a trust, you have several paths to choose from—each with its own balance of cost, convenience, and legal security. Should you go it alone with a DIY kit? Hire a traditional estate planning attorney? Or opt for a modern, guided solution like Trust Guru?

For ongoing updates, professional platforms like Trust Guru often include amendment support and tools like income distribution management.

Here’s a breakdown of how each approach compares so you can confidently choose the option that best fits your budget and needs.

Pros and Cons of DIY Trust Setup

DIY trust creation typically involves downloading legal templates or using online tools to fill out forms on your own. It’s the most affordable option up front but comes with limitations.

Pros:

- Lower upfront cost (typically $300–$1,000)

- Fast and convenient for simple estates

- No need to schedule consultations

Cons:

- No legal review or customization

- Higher risk of errors or omissions

- May not hold up if challenged in court

- Doesn’t include help funding the trust

A DIY approach might work for a straightforward living trust cost scenario with few assets, but it’s risky if your estate is even slightly complex.

Pros and Cons of Hiring a Lawyer

Working with an estate planning attorney offers the highest level of legal protection and personalized service, but it comes at a premium.

Pros:

- Full legal support and customization

- Ideal for complex estates or blended families

- High confidence in legal compliance

Cons:

- Costs range from $1,000–$3,000+, depending on complexity

- Requires in-person meetings and more time

- Less flexible for tech-savvy clients

For individuals with significant assets or unique trust goals, this route provides peace of mind—but the trust formation expenses can add up quickly.

Where Trust Guru Fits In – The Best of Both Worlds

Trust Guru bridges the gap between costly legal services and risky DIY kits by offering expert-reviewed, legally sound trusts at an affordable price point.

Pros:

- Flat-rate pricing with no surprise fees

- Attorney-reviewed documents for legal security

- Nationwide compliance in all 50 states

- Fully digital, guided experience—no office visits

- Customer support to help with trust funding

Cons:

- May not cover ultra-complex tax planning needs (but referrals are available)

This post explains how trusts compare to wills and why the added protection may be worth it.

Trust Guru is ideal for those who want professional-grade protection and guidance without the law firm price tag. It’s especially valuable for those navigating estate planning for the first time.

Comparison Chart: DIY vs. Lawyer vs. Trust Guru

| Feature/Service | DIY Kit | Traditional Lawyer | Trust Guru |

| Estimated Cost | $300–$1,000 | $1,000–$3,000+ | $500–$1,200 |

| Legal Review | ❌ | ✅ | ✅ Attorney-reviewed |

| Customization | Limited | Full | High |

| Ease of Use | Moderate | Low | ✅ Fully digital and guided |

| Includes Trust Funding Help | ❌ | Maybe (varies) | ✅ Included |

| Best For | Very simple estates | High-net-worth, complex | Most middle-income families |

Key Takeaway: Whether you’re focused on affordability, legal strength, or ease of use, there’s a trust setup option that fits your needs. Trust Guru offers a reliable, cost-effective middle ground—combining professional-grade security with transparent pricing and user-friendly tools for today’s digital estate planners.

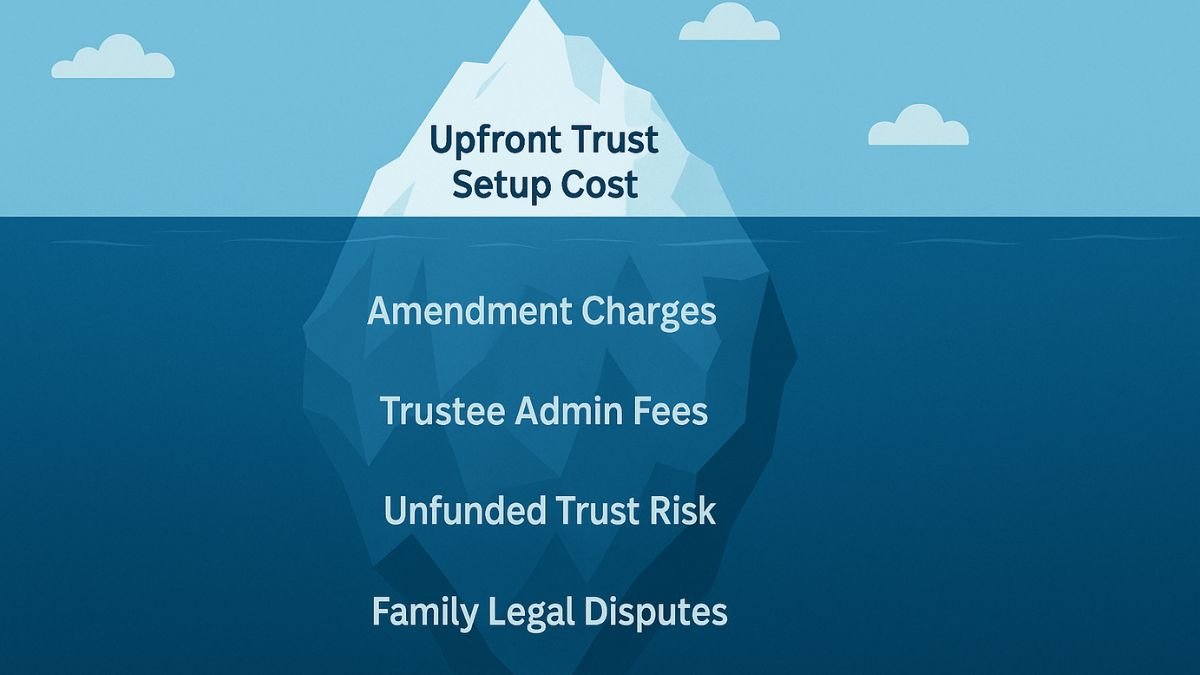

Hidden Costs and Mistakes to Watch Out For

While setting up a trust fund can be one of the smartest moves in estate planning, overlooking key details or cutting corners can result in unexpected expenses—or worse, failed protections. Many people focus only on upfront pricing, but the real cost of a trust often lies in what you don’t see right away.

Let’s explore the most common hidden costs and mistakes people make when setting up a trust—and how you can avoid them.

Probate and Legal Challenges from Incomplete Trusts

One of the biggest assumptions is that once your trust documents are drafted, you’re in the clear. But an incomplete or improperly funded trust can still lead to probate—the very issue many people are trying to avoid.

Common mistakes include:

- Failing to transfer assets into the trust (a.k.a. “funding” the trust)

- Using generic templates that don’t reflect state-specific laws

- Leaving out essential details like successor trustees or distribution rules

If a court finds the trust unclear or invalid, your estate could still be subject to probate proceedings—bringing court fees, attorney costs, and emotional strain for your family.

Potential Cost: $3,000–$10,000+ in legal fees and months of court delays.

Amendment Fees and Ongoing Admin Costs

Life changes—and your trust should evolve with it. Whether you buy new property, get remarried, or change your mind about who receives what, your trust will need updates to stay current.

Here’s what many people overlook:

- Amendment Fees: These can range from $100–$500+ depending on the provider. DIY options may require a full re-do.

- Ongoing Trust Administration Fees: If you’ve named a professional trustee or use an external service, annual fees typically range from 0.5%–1.5% of trust assets.

- Recordkeeping and Tax Filing Costs: Irrevocable trusts in particular may require annual tax filings or special reporting.

While some services include amendments and basic admin in their pricing, others charge for every change. Understanding your provider’s trust administration fees is critical.

The Cost of Not Having a Trust at All

Perhaps the biggest hidden cost is the one that comes from not creating a trust. Many people assume a will is enough, but a will alone doesn’t avoid probate. And if you pass away without a clear estate plan, the state decides how your assets are distributed—which can lead to legal battles and long delays.

What this could mean for your loved ones:

- Probate court fees: $2,000–$5,000 or more, depending on your state

- Delays in asset distribution: 6 months to 2 years

- Family conflict or contested wills: Leading to tens of thousands in legal expenses

Trusts aren’t just a legal safeguard—they’re a way to minimize stress and protect your heirs from emotional and financial burdens.

Financial Impact of Common Mistakes

| Mistake | Potential Cost |

| Incomplete trust (probate risk) | $3,000–$10,000+ |

| Unfunded trust (requires court action) | $1,000–$5,000+ |

| Missed amendments (incorrect beneficiaries, tax risk) | $100–$500+ per change |

| Ongoing trustee fees (over lifetime) | 0.5%–1.5% annually of assets |

| No trust at all (probate + legal battles) | $5,000–$20,000+ |

An improperly managed trust can still land your estate in probate. Make sure to avoid common oversights and consider professional help. If you’re acting as a trustee or naming a successor, trustee transition planning can make the handoff smoother.

Key Takeaway: Cutting corners on your trust setup—or skipping it altogether—can cost far more in the long run than investing in a well-structured plan upfront. By choosing a reliable service like Trust Guru, you can avoid common pitfalls, eliminate hidden fees, and ensure your trust does what it’s designed to do: protect your legacy with clarity and confidence.

How Trust Guru Simplifies and Saves You Money

When it comes to estate planning, clarity and confidence matter just as much as cost. That’s why Trust Guru was built with one mission in mind: to make high-quality trust creation simple, affordable, and stress-free—without sacrificing legal integrity. Whether you’re new to trusts or upgrading an outdated estate plan, Trust Guru offers an expert-guided solution that puts you and your legacy first.

Flat Fee Transparency

No surprise billing. No hourly rates. No upsells.

At Trust Guru, pricing is straightforward. You’ll know exactly what you’re paying for from the start, with comprehensive packages that include everything from personalized trust documents to guidance on funding your trust. Most plans fall between $500 and $1,200, making them far more accessible than traditional law firms—without cutting corners on quality.

What’s included:

- Attorney-reviewed documents

- State-specific compliance

- Step-by-step digital walkthrough

- Unlimited updates for one year (with optional renewal)

Unlike DIY kits that may leave you guessing or attorneys who bill by the hour, Trust Guru offers all-inclusive pricing designed to give you financial peace of mind.

Nationwide Legal Validity and Attorney-Reviewed Plans

Trust Guru’s documents aren’t just templated PDFs—they’re developed in partnership with licensed estate planning attorneys and accepted in all 50 U.S. states. That means your trust is:

- Reviewed for legal soundness

- Customized to fit your personal and financial situation

- Designed to avoid probate and other legal pitfalls

No matter where you live—or where your assets are—Trust Guru’s plans are crafted to hold up under scrutiny and serve your family when it matters most.

Client-First, Hassle-Free Process

You don’t need to visit a law office or wade through legal jargon. With Trust Guru, the entire experience happens online, on your schedule.

How it works:

- Answer a few easy-to-understand questions

- Review your customized trust documents

- Receive attorney-reviewed paperwork ready to sign and notarize

Trust Guru’s attorney-reviewed process is built to eliminate uncertainty and hidden fees. You can also explore additional legal safeguards such as legal compliance and risk oversight to protect your assets and fulfill fiduciary duties.

Need help? Our client success team is available to guide you at any step. Plus, our digital dashboard makes it simple to make updates, add assets, or download your documents anytime.

Ready to Protect Your Legacy?

Book a free consultation today to see how Trust Guru can help you set up your trust fund quickly, affordably, and with confidence. Our team is here to make estate planning less stressful—and far more secure.

Conclusion: Plan Smart, Protect More

Setting up a trust isn’t just about paperwork—it’s about peace of mind. A well-crafted trust helps you protect your assets, avoid probate, and ensure your loved ones are taken care of exactly as you intended. And while the trust fund setup costs can vary, the cost of doing nothing—or doing it wrong—can be far higher.

From DIY kits to attorney-led services, you have options. But only Trust Guru delivers the perfect balance: legal strength, expert support, and flat-fee transparency—all without the stress or expense of a traditional law firm.

If you’re ready to take the next step in securing your financial legacy, contact our team to start your journey with confidence.

Book your free consultation today and get started on a smarter, simpler path to estate planning.

Frequently Asked Questions (FAQs)

The cost to set up a trust fund typically ranges from $300 to $3,000+, depending on the method you choose. DIY kits are usually the cheapest option at around $300–$1,000, while hiring an estate planning attorney can cost $1,000–$3,000 or more. Online platforms like Trust Guru offer a middle ground, with attorney-reviewed plans priced between $500 and $1,200.

Setting up a trust yourself is generally cheaper upfront, but it comes with more risk. DIY trust kits can cost as little as $300, but without legal guidance, mistakes or omissions can lead to probate, extra legal fees, or even invalidation of the trust. A professional service like Trust Guru offers legal peace of mind with a much lower cost than traditional attorneys, combining affordability with expert support.

Some common hidden fees include:

Amendment or update charges (typically $100–$500 per change)

Ongoing trust administration fees, especially if using a professional trustee (0.5%–1.5% of trust assets annually)

Asset funding fees for adding property or accounts into the trust

Legal review costs if not included upfront in DIY solutions

Trust Guru’s flat-fee pricing includes most of these services, helping you avoid unpleasant financial surprises.

Yes. A revocable (living) trust is typically less expensive and easier to manage, with setup fees ranging from $1,000–$2,500. An irrevocable trust is more complex and often requires advanced tax and legal planning, which can push costs to $2,500–$5,000+. The difference reflects the legal work and long-term structure needed for each.

Absolutely. Online platforms like Trust Guru provide legally valid, attorney-reviewed trust documents accepted in all 50 states. You can create your trust from the comfort of your home—without paying traditional law firm rates. For many, this option offers the best mix of cost, convenience, and compliance.