Understanding how gift tax works is an essential part of smart financial planning—especially in 2025, when federal thresholds and tax implications can significantly impact your estate strategy.

Whether you’re helping a loved one with a down payment or transferring assets to family, it’s important to know when a gift becomes taxable, what the IRS expects, and how to stay compliant while maximizing your exclusions.

In this guide, we’ll break down the current 2025 gift tax rules, exemptions, and filing requirements in clear, everyday language. You’ll learn how to give generously without triggering unnecessary taxes—and how strategic gifting can help protect your legacy for years to come.

What you’ll learn:

- What Is the Federal Gift Tax and Who Pays It?

- 2025 Gift Tax Limits and Exemptions Explained

- Common Misconceptions About Gift Tax

- How Gift Tax Is Calculated

- Strategic Gifting and Estate Planning in 2025

- How to File a Gift Tax Return (Form 709)

- Final Thoughts + Key Takeaways

- Frequently Asked Questions (FAQ)

What Is the Federal Gift Tax and Who Pays It?

The federal gift tax is a tax imposed by the IRS on the transfer of money or property from one individual to another without receiving something of equal value in return. In simple terms, if you give someone a large gift—whether it’s cash, stocks, real estate, or other assets—you might be subject to this federal tax. But here’s the key detail: the person giving the gift (the “giver”) is typically responsible for paying the gift tax, not the person receiving it.

This federal tax only applies when gifts exceed certain thresholds set by the IRS, which we’ll explore further in the next section. For now, understand that not every gift is taxable, and many fall under exemptions that make them completely tax-free. You can learn more directly from the IRS Gift Tax overview.

What Qualifies as a “Gift”?

A gift is generally any transfer of money or property where the giver receives nothing—or less than fair market value—in return. This includes obvious gifts like giving your child $25,000 for a house down payment, but it can also include things like forgiving a debt, selling something at a steep discount, or paying someone else’s tuition.

For example:

- Giving your niece $10,000 to help with college? That’s a gift.

- Selling your vacation home to a friend for $100,000 when it’s worth $300,000? The $200,000 difference may be considered a gift.

Is Gift Tax the Same as Income Tax?

No—gift tax is not the same as income tax. Recipients of gifts do not pay income tax on the money or property they receive. However, the giver may be required to report the gift to the IRS and possibly pay gift tax if the gift exceeds the annual exclusion limit. This is part of how the federal tax system distinguishes between income and non-income transfers.

Unlike income tax, which applies to earnings from work or investments, gift tax applies to voluntary transfers that aren’t part of a business transaction or compensation for services.

Gift Tax vs. Estate Tax: What’s the Difference?

Both gift tax and estate tax are part of the federal government’s broader approach to taxing wealth transfers, but they apply at different times:

- Gift tax applies to transfers made during your lifetime.

- Estate tax applies to transfers made after death, typically through your will or trust.

The IRS views them as a unified system, and both draw from the same lifetime exemption limit. That means the more you use of your lifetime gift exemption while you’re alive, the less of that exemption remains for your estate when you pass away. For an in-depth explanation, refer to the IRS guide on Estate and Gift Taxes.

Key Takeaway: The federal gift tax is a tax on giving—not receiving. If you’re transferring significant assets during your lifetime, you may need to report those gifts and understand how they impact your overall estate plan. Knowing when gift tax applies, and how it differs from income and estate tax, is the first step toward protecting your legacy.

2025 Gift Tax Limits and Exemptions Explained

The IRS adjusts gift tax limits annually to keep pace with inflation, and in 2025, two key numbers shape your gifting strategy: the annual gift tax exclusion and the lifetime gift tax exemption. Understanding these figures is essential for giving wisely and avoiding unnecessary tax burdens.

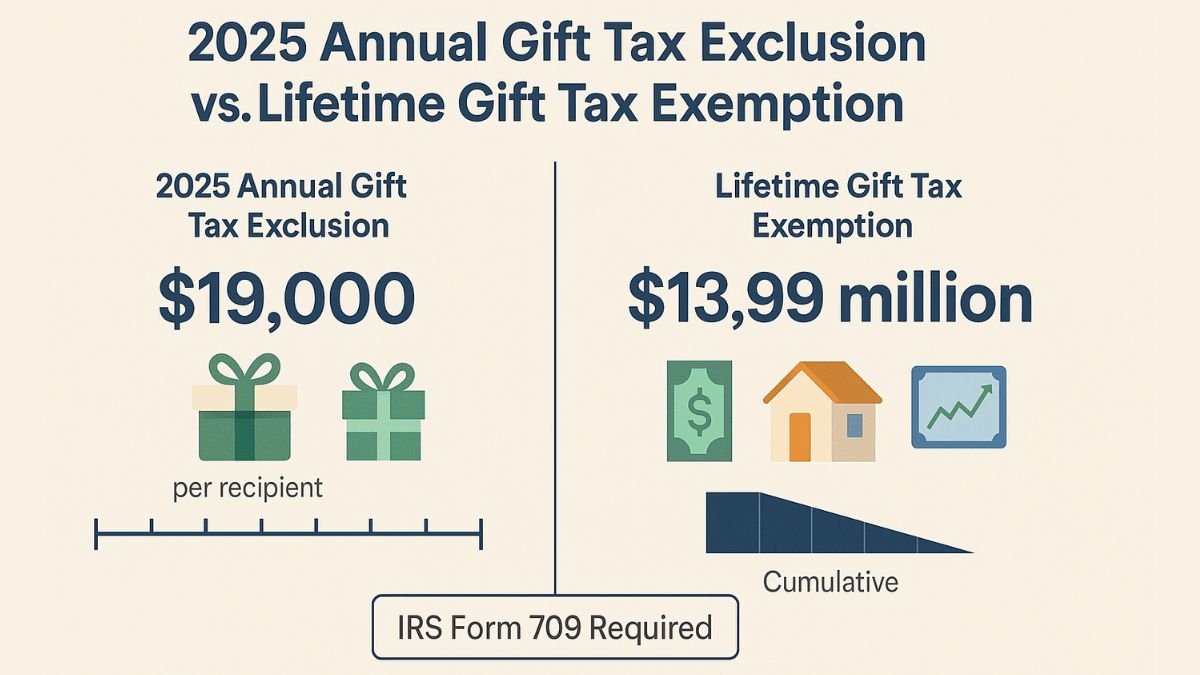

2025 Annual Gift Tax Exclusion: $19,000 Per Recipient

For the 2025 tax year, you can give up to $19,000 to as many individuals as you like without needing to file a gift tax return or paying any federal gift tax. This is known as the annual exclusion, and it applies per recipient, not per donor. So if you have three children, you could gift each of them $19,000 this year—a total of $57,000—without triggering the gift tax or using up any of your lifetime exemption.

This exclusion covers most routine, generous gifting between family and friends—birthday presents, wedding gifts, and support for adult children often fall well under this limit.

2025 Lifetime Gift Tax Exemption: $13.99 Million

If your gift exceeds the annual limit, it doesn’t automatically mean you’ll owe taxes. Instead, the excess amount counts against your lifetime gift and estate tax exemption, which is set at $13.99 million per individual in 2025. This cumulative exemption applies to all taxable gifts made during your life, as well as what’s passed on through your estate when you die.

Let’s say you gift your child $100,000 in 2025. The first $19,000 is covered by the annual exclusion. The remaining $81,000 would reduce your lifetime exemption, leaving you with $13.909 million remaining (assuming no prior gifts were made).

For affluent households, combining this with financial strategies tailored for high-net-worth individuals can significantly enhance estate planning effectiveness while minimizing long-term tax liability.

When You Need to File a Gift Tax Return (IRS Form 709)

Even if you don’t owe taxes, you must file IRS Form 709 if your gift to any one person exceeds the annual exclusion of $19,000. This form is due when you file your income taxes (typically by April 15 of the following year). It’s a way for the IRS to track your usage of the lifetime exemption.

You also need to file Form 709 if:

- You split a gift with your spouse (more below)

- You make a gift of future interest (e.g., a gift that the recipient can’t access immediately)

- You give a gift that isn’t entirely tax-exempt (like a discounted sale of property)

Key Tip: Filing Form 709 doesn’t necessarily mean you owe gift tax—it simply records the transaction and applies it against your lifetime exemption if necessary. For added guidance, consider trustee support services if trusts are involved in your gifting. For step-by-step instructions, refer to the official IRS instructions for Form 709.

What Happens If You Exceed the Limit?

If your gift exceeds the $19,000 annual exclusion and your lifetime exemption has already been used up, you may be required to pay gift tax on the excess amount. Federal gift tax rates range from 18% to 40%, depending on the size of the gift. For most people, this situation is rare—but high-net-worth individuals or those making large real estate or business transfers should plan carefully.

This is why understanding the gift tax limit and your remaining lifetime exemption is critical for strategic wealth transfer.

Joint Gifts by Spouses: Doubling the Exclusion

Married couples can maximize their giving by splitting gifts, effectively doubling the annual exclusion to $38,000 per recipient in 2025. However, both spouses must consent to the split and each must file Form 709 indicating the arrangement.

For example, if a couple gives their granddaughter $30,000 in 2025, they can split the gift—allocating $15,000 to each spouse—and stay within their individual limits. But if they want to use the full $38,000 exclusion, both spouses need to agree and file accordingly.

| Gift Tax Thresholds for 2025 | Amount |

| Annual Exclusion (per recipient) | $19,000 |

| Joint Exclusion (married couple) | $38,000 |

| Lifetime Gift Tax Exemption | $13.99 million per individual |

Summary: In 2025, you can gift up to $19,000 per person tax-free—and even more if you’re married. Only gifts that exceed this limit and surpass your lifetime exemption are subject to federal gift tax. Filing IRS Form 709 helps track these gifts, even if no tax is owed. Strategic planning can help you give generously while staying within the limits.

Common Misconceptions About Gift Tax

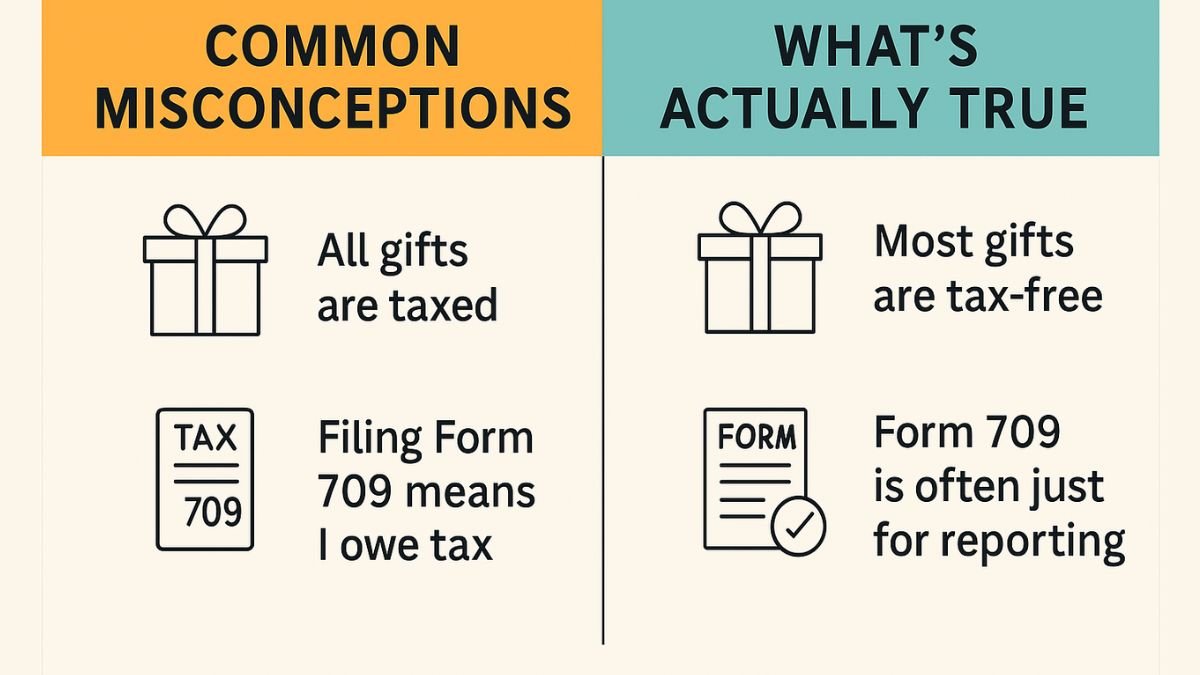

The idea of the federal gift tax often triggers confusion—and sometimes unnecessary worry. Many people assume that giving a large gift automatically means owing tax or that all gifts must be reported to the IRS. In reality, most gifts are either exempt or fall well below the threshold where taxes apply. For a list of frequently asked questions, visit the IRS Gift Tax FAQ page.

Not All Gifts Are Taxed

One of the most important things to understand is this: just because a gift exceeds the annual exclusion doesn’t mean you’ll owe taxes. In fact, many gifts are completely tax-free thanks to the IRS’s built-in exclusions and exemptions. The $19,000 annual gift tax exclusion (per recipient) for 2025 already covers a wide range of generous giving.

Even if you surpass that amount, you still may not have to pay a gift tax—you simply need to report the excess on IRS Form 709 and deduct it from your lifetime gift tax exemption. That’s a big difference, and it’s why filing doesn’t always mean writing a check to the IRS.

Medical and Educational Gifts Are Exempt (If Paid Correctly)

Did you know you can pay unlimited amounts for someone else’s qualified medical or education expenses without it counting as a taxable gift? The catch: the payment must be made directly to the institution or service provider, not to the individual.

Here’s how it works:

- Paying your grandchild’s college tuition? Make the check payable to the university—not the student—and it won’t count toward your gift tax limits.

- Covering a friend’s hospital bill? If you send the payment straight to the hospital, that’s also tax-exempt.

These are excellent ways to provide meaningful support without using up your annual or lifetime exclusions.

Filing a Gift Tax Return Doesn’t Mean You Owe Tax

Filing IRS Form 709 is often viewed as a red flag—but it’s really just a reporting mechanism. If you give more than the annual exclusion to a single recipient in a year, you’re required to file a gift tax return, but that doesn’t necessarily mean you’ll have to pay a gift tax.

For example, if you give your daughter $30,000 in 2025, you’ll report the excess $11,000, but unless you’ve already used your entire $13.99 million lifetime exemption, no tax is due. The IRS simply keeps a tally of your taxable gifts over time.

Gifts to Spouses and Charities Are Generally Exempt

You can make unlimited gifts to your U.S. citizen spouse without triggering the gift tax—this is called the unlimited marital deduction. Gifts to qualified charitable organizations are also exempt, allowing you to support causes you care about while keeping your tax planning simple.

However, gifts to non-citizen spouses may be subject to different limits, and it’s important to consult a tax advisor in those cases.

What Counts as “Fair Market Value Gifts”?

Gift tax calculations are based on the fair market value (FMV) of the asset at the time of transfer. This means:

- Gifting a car worth $40,000 to your nephew is considered a $40,000 gift, regardless of how much you paid for it originally.

- Selling your home to your child for $100,000 when it’s worth $300,000? The $200,000 difference is considered a gift.

Understanding FMV is critical, especially when gifting assets like real estate, investments, or collectibles. Underestimating the value can lead to underreporting and potential tax consequences. This is particularly important when navigating creditor protection scenarios or asset transfers.

Real-World Examples to Clarify the Confusion

| Scenario | Tax Implication |

| Gifted $15,000 to your niece for a wedding | No tax or filing required (under $19K limit) |

| Paid $25,000 to a university for a grandchild’s tuition | Not taxable if paid directly to the school |

| Gave your adult child $50,000 to buy a home | File Form 709 for $31,000; likely no tax due |

| Donated $100,000 to a registered charity | Fully exempt from gift tax |

| Sold your classic car to a friend for $1 | Gift tax applies to the car’s FMV minus $1 |

Key Takeaway: The majority of personal and family gifts won’t cost you in taxes—especially if you plan carefully. By understanding what counts as a taxable gift, how to properly file when required, and the value of exclusions, you can gift confidently while protecting your financial future.

How Gift Tax Is Calculated

Once you understand which gifts may be taxable, the next step is learning how gift tax is calculated. The IRS uses a relatively straightforward formula based on the fair market value (FMV) of the gift, but the actual tax owed—if any—depends on how much you’ve already gifted in your lifetime and where that amount falls within the IRS’s graduated tax brackets.

Let’s break it down so you can see how gift tax liability is determined and how it ties into your broader estate planning strategy.

Fair Market Value: The Starting Point

Gift tax is based on the fair market value of the gift at the time it’s given. This is the price the asset would sell for on the open market between a willing buyer and seller. It’s not what you originally paid for the item—or what you think it’s worth—it’s what it could reasonably fetch today.

Examples:

- If you give someone a painting appraised at $25,000, that’s the value used for tax purposes—even if it cost you $10,000 years ago.

- Gifting publicly traded stock? The value is based on the average trading price on the date of the transfer.

Knowing the FMV of complex assets like property or business interests may require a professional appraisal, especially when planning large gifts.

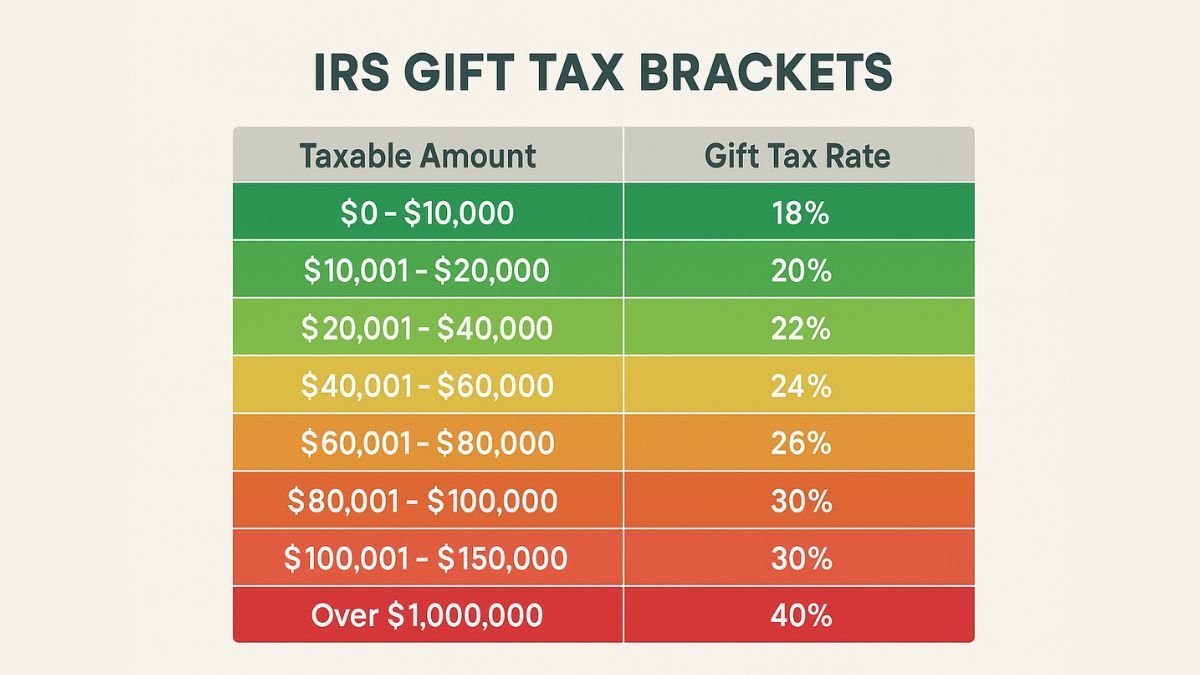

IRS Gift Tax Rates: 18% to 40%

Gift tax liability is calculated using the IRS’s progressive tax brackets, which range from 18% to 40% depending on the total taxable gift amount. The more you give beyond your lifetime exemption, the higher the applicable tax rate.

Here’s a simplified version of how the brackets break down:

| Taxable Amount Over Lifetime Exemption | Gift Tax Rate |

| $0 – $10,000 | 18% |

| $10,001 – $20,000 | 20% |

| $20,001 – $40,000 | 22% |

| $40,001 – $60,000 | 24% |

| $60,001 – $80,000 | 26% |

| $80,001 – $100,000 | 28% |

| $100,001 – $150,000 | 30% |

| $150,001 – $250,000 | 32% |

| $250,001 – $500,000 | 34% |

| $500,001 – $750,000 | 37% |

| Over $1,000,000 | 40% |

These brackets apply only to the portion of gifts that exceed your lifetime gift tax exemption, which is $13.99 million per individual in 2025.

Using Your Lifetime Exemption: One Gift at a Time

The IRS keeps a cumulative total of all taxable gifts made during your lifetime that exceed the annual exclusion amount. Each year, those excess amounts are subtracted from your lifetime exemption.

Let’s say you give your daughter $100,000 in 2025:

- The first $19,000 is covered by the annual exclusion

- The remaining $81,000 counts against your lifetime exemption

- You file Form 709, but you don’t owe any tax—unless you’ve already used up the $13.99 million

Once your lifetime exemption is exhausted, any further taxable gifts are subject to the gift tax, calculated using the brackets above.

Example Calculations: How It Works in Real Life

Scenario 1: Large One-Time Gift

You give your son $100,000 to start a business in 2025.

- $19,000 is exempt (annual exclusion)

- $81,000 is reported on Form 709

- You owe no tax, but your remaining lifetime exemption drops to $13.909 million

Scenario 2: Exceeding the Lifetime Exemption

You’ve already used your full $13.99 million exemption over the years.

You now give an additional gift of $500,000.

- The entire $500,000 is taxable

- At a 40% tax rate, you would owe $200,000 in gift tax

Why It Matters: The Risk of Using Up Your Exemption Early

Using your lifetime exemption while it’s at a historically high level can be smart—but there’s a catch. That exemption is scheduled to drop significantly in 2026, likely to around $6–7 million unless new legislation intervenes.

If you’ve already used your full exemption before the reduction, you won’t be penalized retroactively—but new gifts made after the drop may be taxed much sooner.

Key Takeaway: Gift tax is calculated based on fair market value and only applies once you exceed generous annual and lifetime limits. By tracking your cumulative gifts and understanding how the IRS applies its rates, you can make strategic decisions that protect your assets and reduce long-term tax liabilities.

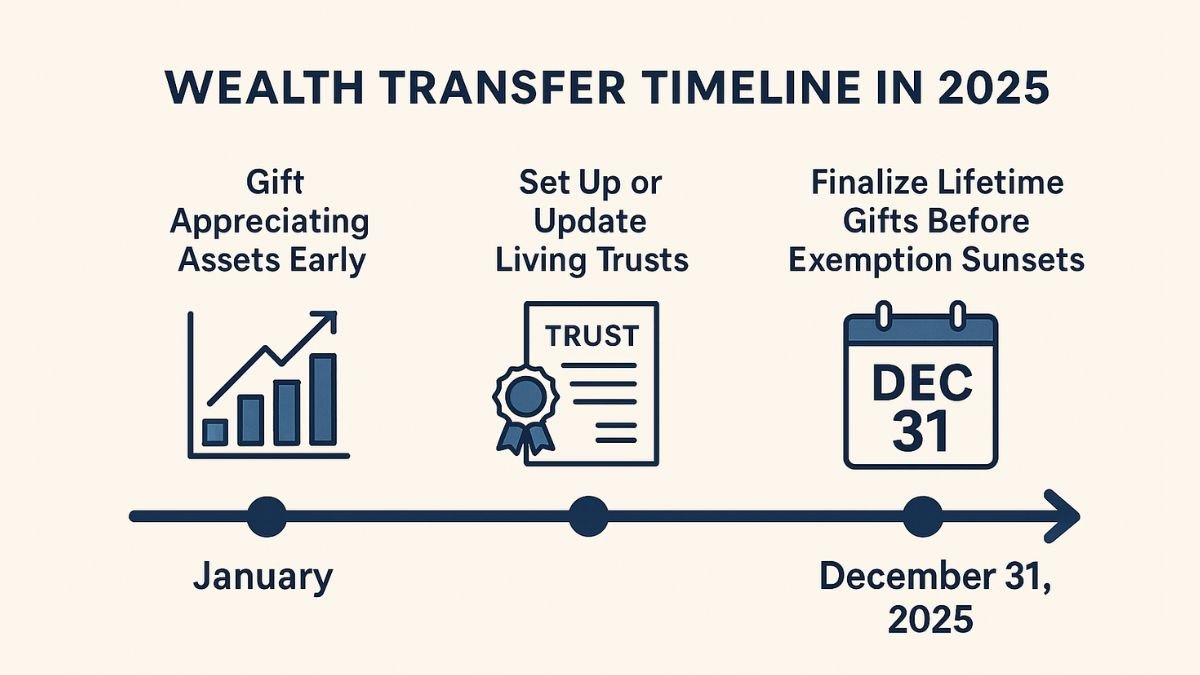

Strategic Gifting and Estate Planning in 2025

For those looking to preserve wealth across generations, strategic gifting is more than a tax-saving tactic—it’s a cornerstone of long-term estate planning. When thoughtfully integrated into your broader financial strategy, gifts can minimize estate taxes, ease administrative burdens, and ensure your legacy is passed on according to your wishes.

In 2025, high federal exemption levels and evolving tax laws present a narrow but powerful window of opportunity for forward-thinking individuals and families.

Gifting to Family Members in Lower Tax Brackets

One smart strategy is to gift assets to family members in lower tax brackets—such as adult children or grandchildren. By transferring appreciating assets (like stocks, business shares, or property) before they increase further in value, you not only reduce the size of your taxable estate but also potentially allow future gains to be taxed at the recipient’s lower income tax rate.

For example:

- Transferring $100,000 in stock to your child in 2025 could mean any capital gains from that point forward are taxed at their rate, not yours.

- Gifting rental property to a grandchild could shift future rental income into a lower bracket.

These types of gifts, especially when made under the annual gift tax exclusion or structured to use part of the lifetime gift tax exemption, can be powerful tools for long-term wealth transfer.

Using Living Trusts to Manage Gifts and Legacy

While direct gifts can be effective, many individuals choose to use living trusts to manage their estate planning more holistically. A living trust allows you to:

- Control how and when assets are distributed

- Avoid probate and reduce court involvement

- Reduce the potential for family conflict

- Protect privacy, since trusts are not public records like wills

Trusts also enable more nuanced gifting strategies—such as providing funds for education, housing, or business support while maintaining oversight. For example, a trust can be designed to distribute gifts over time or after certain milestones, rather than all at once.

Importantly, assets transferred into a properly structured trust are removed from your taxable estate, helping reduce your federal estate tax exposure down the road.

Why 2025 Is a Critical Year for Gifting

The current lifetime gift and estate tax exemption is at a historic high—$13.99 million per individual in 2025. But unless Congress takes action, this generous exemption is scheduled to sunset after December 31, 2025, cutting it roughly in half in 2026 (to about $6–7 million).

That means any gifts you make in 2025 that utilize your full exemption are locked in—even after the reduction. This creates a once-in-a-generation opportunity for families to shift substantial assets without triggering federal gift or estate tax.

Gifting now can secure tax benefits under the current law, even if you’re not ready to transfer full control of your wealth. Trust structures can provide flexibility and peace of mind.

Work with a Trusted Partner: Trust Guru

Navigating the complexities of estate planning and gift tax rules doesn’t have to be overwhelming. At Trust Guru, we specialize in helping individuals and families:

- Build personalized trust structures

- Avoid probate and reduce legal hassles

- Strategically plan gifts to minimize taxes

- Secure their legacy across generations

Our clear, compassionate approach ensures you stay in control—while protecting what matters most. Contact our team today and discover how a well-timed gift or trust can shape your financial future.

Ready to plan smarter and give with confidence? Book a free consultation with Trust Guru today and discover how a well-timed gift or trust can shape your financial future.

How to File a Gift Tax Return (Form 709)

If you’ve made gifts in 2025 that exceed the annual exclusion of $19,000 per recipient—or if the gift meets other IRS criteria—you may be required to file a gift tax return using IRS Form 709. While filing does not necessarily mean you owe taxes, it is an essential step in documenting how much of your lifetime gift tax exemption you’ve used.

Understanding when and how to file can help you stay compliant and make the most of available tax benefits.

When Do You Need to File IRS Form 709?

You are required to file a gift tax return for the 2025 tax year if:

- You gave more than $19,000 to any one individual

- You split a gift with your spouse to take advantage of double exclusions

- You made a gift of future interest, meaning the recipient does not immediately benefit from the gift

- You transferred assets at less than fair market value

- You contributed to certain types of irrevocable trusts

In most cases, no tax will be due unless your lifetime gifts have exceeded the $13.99 million exemption, but the return must still be filed so the IRS can track your exemption usage.

Example: If you gave your nephew $30,000 in 2025, you’d need to file Form 709 to report the $11,000 over the exclusion—even though no tax is due if you’re still within your lifetime exemption.

How to File Form 709: Deadlines and Requirements

Form 709 is due by April 15, 2026, alongside your federal income tax return. If you request an extension for your personal taxes (Form 4868), the gift tax return deadline is extended as well.

To prepare, gather the following:

- The full legal names of gift recipients

- A description of each gift and its fair market value at the time of the transfer

- Documentation such as appraisals, valuations, or property records for non-cash gifts

- Your Social Security Number and signature

As of 2025, Form 709 must be filed on paper—the IRS does not accept electronic submissions for gift tax returns.

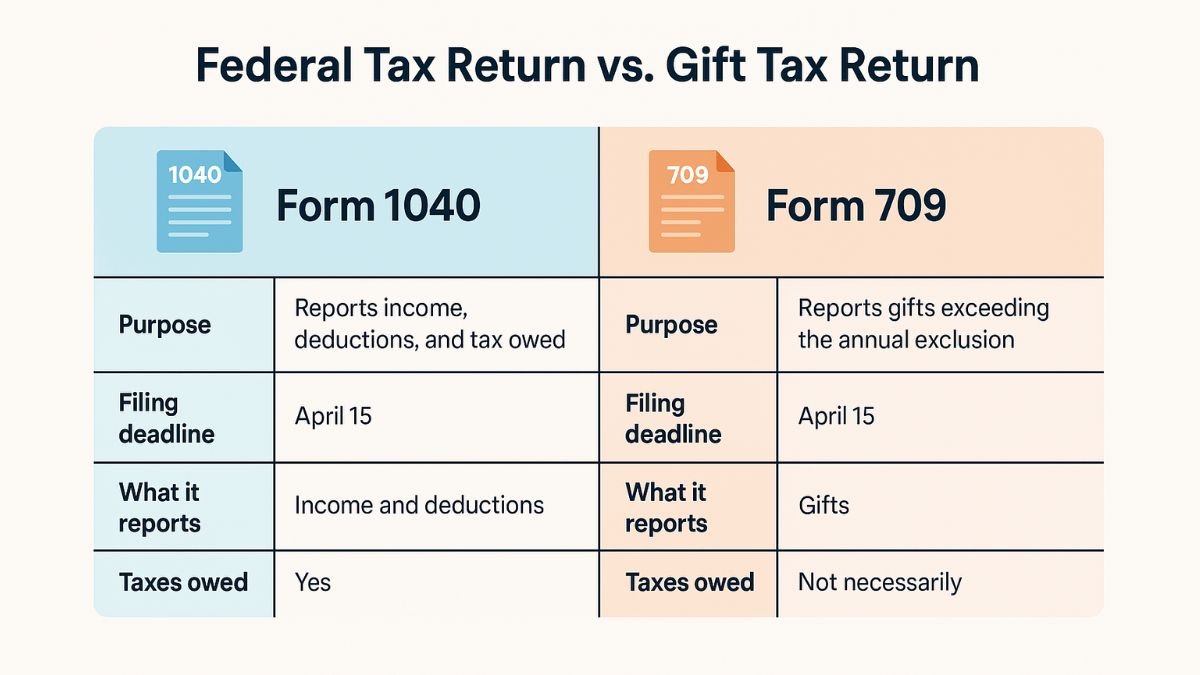

Federal Tax Return vs. Gift Tax Return

Although both are filed annually, Form 709 is separate from your federal income tax return (Form 1040). The gift tax return reports eligible gifts that exceed the annual exclusion. It is required even if you do not owe income tax or if you are not otherwise required to file a tax return.

| Form | Purpose |

| Form 1040 | Reports income, deductions, and tax owed |

| Form 709 | Reports gifts exceeding the annual exclusion |

Can a Tax Professional Help You File?

Yes. A certified public accountant (CPA), tax advisor, or estate planning attorney can assist with:

- Determining if your gifts require filing

- Calculating fair market values and exclusions

- Preparing the required forms and documentation

- Coordinating gift reporting with your long-term estate strategy

Professional guidance is especially helpful when gifting complex assets, splitting gifts with a spouse, or nearing the lifetime exemption limit.

Gift Tax Filing Checklist

Use this list to stay organized and ensure nothing is missed:

- Details of each gift over $19,000 per recipient

- Documentation for non-cash gifts (e.g., appraisals)

- Names and relationships of recipients

- Record of lifetime exemption used to date

- Supporting trust or legal documents (if applicable)

- Completed Form 709 and signed copy

Key Takeaway: Filing IRS Form 709 is often a procedural step—not a financial burden. As long as you report qualifying gifts accurately and on time, you’ll avoid penalties and keep your estate plan in good standing. If you’re unsure whether you need to file or how to complete the form, Trust Guru can connect you with experienced professionals who understand the nuances of gift tax compliance.

Final Thoughts + Key Takeaways

Understanding how the gift tax works is essential for anyone looking to protect assets, reduce tax burdens, and pass on wealth efficiently. In 2025, the IRS allows individuals to gift up to $19,000 per recipient annually without triggering gift tax reporting requirements.

In addition, the lifetime gift and estate tax exemption stands at a historically high $13.99 million per individual, presenting a rare opportunity for strategic wealth transfer.

By planning your gifts thoughtfully—whether through annual giving, family support, or setting up a living trust—you can reduce your future estate tax exposure and avoid probate complications. And with the scheduled reduction of the lifetime exemption in 2026, acting now can lock in significant tax advantages that may not be available in the near future.

Whether you’re gifting cash, property, or business interests, staying informed and filing correctly is key to long-term success. If you’re uncertain about your situation, it’s wise to seek an expert for tax questions, especially when the implications stretch beyond a single year.

Need help protecting your assets and minimizing taxes? Let Trust Guru guide your next step. Our team simplifies the estate planning process with personalized, legally sound solutions—so you can give confidently and plan for the future with peace of mind.

Frequently Asked Questions (FAQ)

In 2025, you can gift up to $19,000 per recipient without paying gift tax or filing a gift tax return. This is known as the annual gift tax exclusion. You can give this amount to as many individuals as you like in a single year without it counting against your lifetime gift tax exemption. Married couples can double this exclusion to $38,000 per recipient by splitting gifts.

Yes. If you give more than $19,000 to any one person in 2025, you’re required to file IRS Form 709 to report the excess. However, filing does not mean you’ll owe tax unless you’ve already used up your lifetime exemption of $13.99 million. The IRS uses the return to keep track of how much of your lifetime limit you’ve used.

The gift tax applies to transfers made during your lifetime, while the estate tax applies to the transfer of assets after your death. Both draw from the same lifetime exemption limit, meaning the more you give during your life, the less exemption remains for your estate. Strategic gifting can help reduce the overall size of your estate, potentially lowering or eliminating estate tax exposure.

You can give your child $50,000, but only $19,000 is exempt under the annual exclusion. The remaining $31,000 must be reported on Form 709 and will count against your lifetime gift tax exemption. Unless you’ve already used your full exemption, you won’t owe taxes on the gift. If you’re married and choose to split the gift, the full $50,000 could fall under the $38,000 joint exclusion, further reducing or eliminating your reportable amount.

The IRS requires you to file a gift tax return (Form 709) for any gifts over the annual exclusion or those that fall into special categories, such as future interest gifts or split gifts. Once filed, the IRS keeps a record of your taxable gift amounts and tracks how much of your lifetime exemption remains. If no return is filed, there’s no official record, which can complicate matters later—especially during estate settlement. Accurate reporting helps protect your financial legacy.