Planning for long-term care while trying to protect your assets can feel overwhelming—but a Medicaid Asset Protection Trust (MAPT) may offer a powerful solution. This type of trust helps you preserve your home, savings, and legacy while positioning you to qualify for Medicaid benefits when you need them most.

In this guide, you’ll learn exactly how a MAPT works, who it’s right for, and how it fits into a smart, future-focused estate plan. Whether you’re preparing for retirement or helping a loved one plan ahead, this article will give you the clarity and confidence to make informed decisions.

What you’ll learn:

- What Is a Medicaid Asset Protection Trust (MAPT)?

- Why You Might Need a Medicaid Asset Protection Trust

- How a MAPT Helps You Qualify for Medicaid

- Understanding the 5-Year Look-Back Rule

- What Assets Can and Cannot Be Protected in a MAPT

- How to Set Up a Medicaid Asset Protection Trust with Trust Guru

- Pros and Cons of Using a MAPT

- Common Myths and FAQs About MAPTs

What Is a Medicaid Asset Protection Trust (MAPT)?

A Medicaid Asset Protection Trust (MAPT) is a specialized type of irrevocable trust designed to help individuals protect their assets—like a home, savings, or investments—while still qualifying for Medicaid to cover long-term care costs.

Medicaid Asset Protection Trust (MAPT) is a specialized type of irrevocable trust designed to help individuals protect their assets—like a home, savings, or investments—while still qualifying for Medicaid to cover long-term care costs.

When structured properly, a MAPT allows you to preserve your wealth for your loved ones instead of spending it down on nursing home or assisted living expenses.

Think of a MAPT as a legal “safe” for your assets. Once you place assets into the trust, they are no longer counted as yours when Medicaid evaluates your eligibility. This strategy is especially valuable for seniors who want to avoid losing their home or life savings to long-term care costs but also don’t want to risk leaving their family unprotected.

A key characteristic of a MAPT is that it is irrevocable—meaning once it’s set up and funded, the terms can’t be easily changed and the assets cannot be taken back at will. This is different from a revocable trust, where the person creating the trust (called the grantor) retains control and can modify or dissolve it at any time.

Because of this, assets in a revocable trust are still considered part of your estate for Medicaid purposes, and therefore don’t offer the same level of protection.

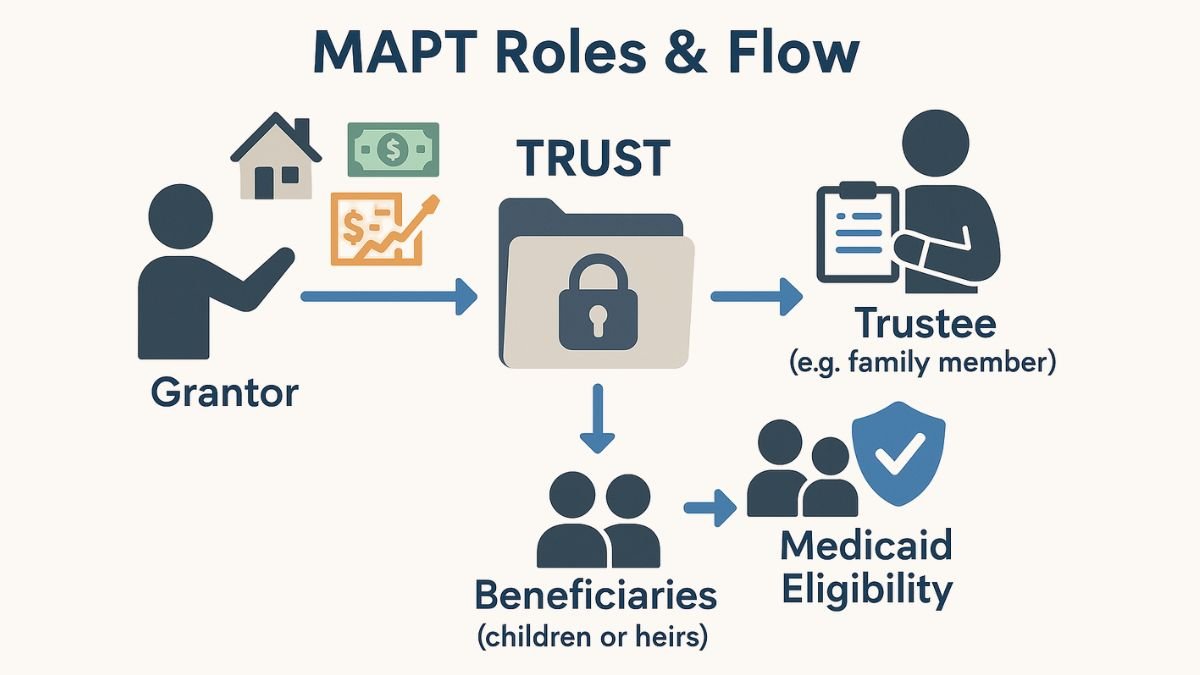

In a MAPT, several key roles are involved:

- The grantor: The person who creates the trust and transfers their assets into it.

- The trustee: The person (or institution) responsible for managing the trust’s assets according to its rules. This is typically someone other than the grantor.

- The beneficiaries: The individuals who will eventually inherit the trust assets—often children or other family members.

What Makes a MAPT Different from a Living Trust?

While both are estate planning tools, a living trust is typically revocable and used to avoid probateliving trust is typically revocable and used to avoid probate. It doesn’t protect assets from Medicaid because the grantor retains control.

A MAPT, on the other hand, is irrevocable and specifically designed for Medicaid planning and long-term care protection. [link to cluster: What Is a Living Trust?]

Who Is Typically Involved in a MAPT Structure?

In most MAPTs:

- You (the grantor) transfer ownership of your assets to the trust.

- A trusted family member or professional acts as the trustee.

- Your children, spouse, or heirs are named as beneficiaries. This setup helps you stay eligible for Medicaid while ensuring your assets eventually pass to your loved ones.

Key Takeaway: A Medicaid Asset Protection Trust is a proactive legal tool that helps you qualify for Medicaid without sacrificing your home or savings. By understanding how it works—and who needs to be involved—you can take a confident step toward protecting your legacy.

Why You Might Need a Medicaid Asset Protection Trust

Many people spend their lives building financial security—buying a home, saving for retirement, and setting aside something to pass on to their children. But without proper planning, the high cost of long-term care can quickly drain those assets.

A Medicaid Asset Protection Trust (MAPT) offers a proactive way to protect what you’ve worked hard for while preparing for the possibility of needing nursing home or assisted living care.

The High Cost of Long-Term Care

Long-term care isn’t just expensive—it’s one of the biggest financial risks in retirement. According to Genworth’s Cost of Care Survey, the median annual cost of a private room in a nursing home exceeds $100,000 in many states. Medicare doesn’t cover extended stays, and if you don’t have long-term care insurance, those expenses often come out of pocket—unless you qualify for Medicaidlong-term care insurance, those expenses often come out of pocket—unless you qualify for Medicaid.

Explore the latest national and state long-term care cost data

But here’s the challenge: Medicaid eligibility comes with strict income and asset limits. For example, in many states, a single applicant must have less than $2,000 in countable assets to qualify. That means your home, savings, retirement accounts, or even a modest investment portfolio could disqualify you—unless those assets are legally protected.

This is where a MAPT becomes invaluable.

Protect Your Home, Savings, and Legacy

By placing your primary residence, bank accounts, or other non-retirement assets into a MAPT, you effectively remove them from your personal ownership for Medicaid purposes—without giving them away or losing all control. This allows you to:

- Protect your assets from being spent on long-term care

- Preserve your children’s inheritance

- Maintain eligibility for vital Medicaid benefits when care is needed

MAPTs are especially helpful if you want to remain in your home while preparing for future care needs. In most cases, you can continue living in your home even after transferring it into the trust.

Who Benefits Most from a MAPT?

A MAPT is ideal for:

- Adults aged 55+ who are planning for future long-term care needs

- Individuals or couples who own a home or other non-retirement assets they wish to pass down

- Those without long-term care insurance or with limited coverage

- Families looking to avoid last-minute “Medicaid spend-down” scenarios

If you’ve accumulated assets but worry about the potential financial burden of aging or illness, a MAPT helps you plan ahead with peace of mind.

What Types of Assets Are at Risk Without One?

Without a MAPT or similar protection strategy, the following assets may be vulnerable:

- Your primary residence (in some states, Medicaid can recover costs from your estate after death)

- Savings and checking accounts

- Non-retirement investments (e.g., stocks, bonds, brokerage accounts)

- Life insurance with cash value

If these assets remain in your name when you apply for Medicaid, you may be required to spend them down to meet eligibility requirements—or risk losing them to estate recovery after you pass.

Key Takeaway: If you’re planning for the future and want to avoid depleting your life savings to pay for long-term care, a Medicaid Asset Protection Trust can help you protect your assets, qualify for Medicaid, and ensure your legacy is preserved for those you love.

How a MAPT Helps You Qualify for Medicaid

Qualifying for Medicaid can be challenging if you own a home, have savings, or hold other assets meant for your family. That’s because Medicaid—unlike Medicare—has strict income and asset limits, and exceeding them can disqualify you from receiving benefits to help cover long-term care costs.

A Medicaid Asset Protection Trust (MAPT) is a proven strategy that allows you to transfer assets out of your name in a way that still complies with Medicaid rules—making it easier to qualify without losing what you’ve worked hard to build.

The Role of Asset Transfers in Medicaid Eligibility

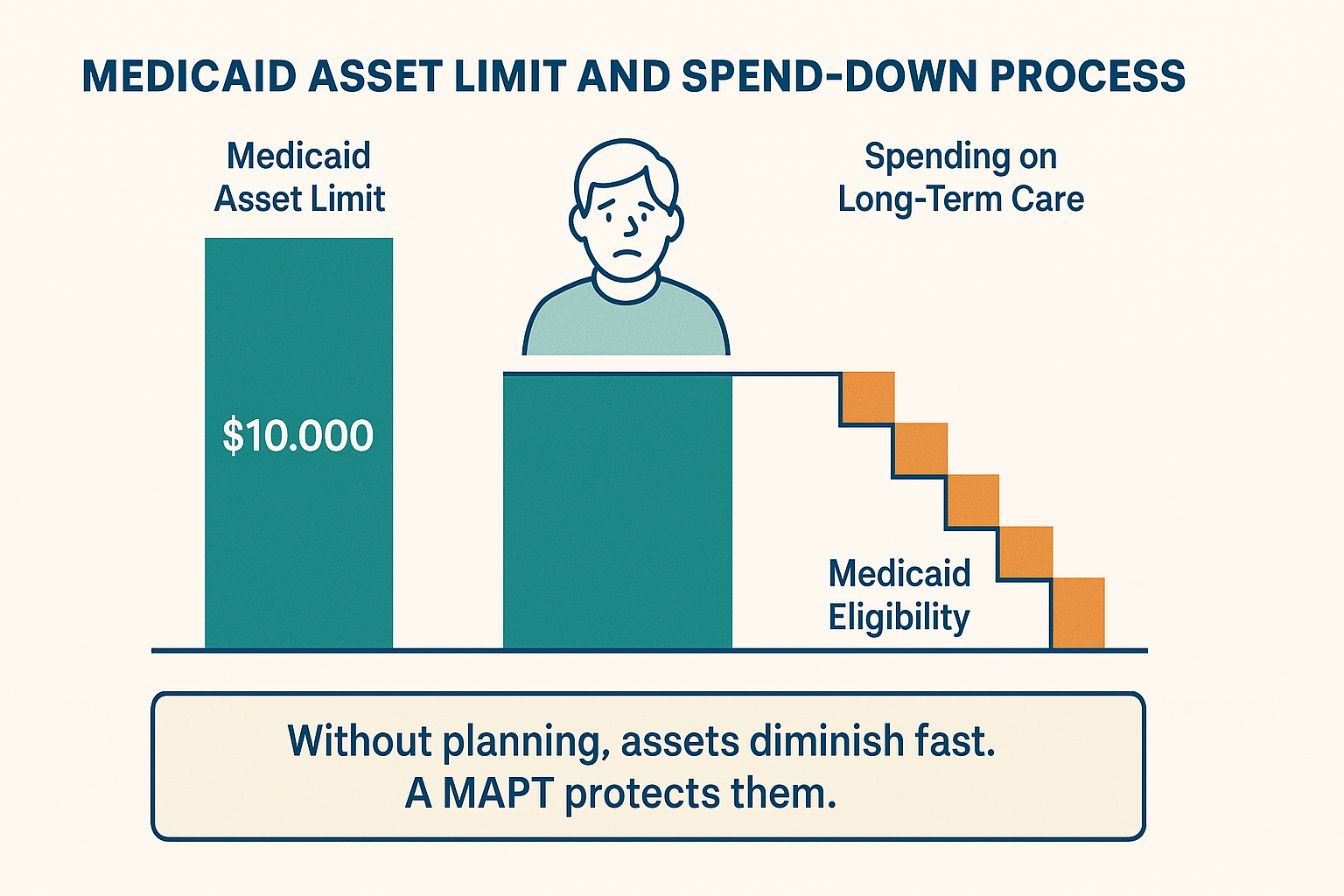

Medicaid considers both your monthly income and total countable assets when determining eligibility. If your assets exceed the allowable threshold, you’ll be required to spend down those assets—often on nursing home care—before Medicaid steps in. That’s where a MAPT makes a major difference.

By transferring certain assets—like your home, savings, or investments—into a MAPT well in advance of applying, they are no longer considered part of your personal estate.

This keeps them protected and out of reach from spend-down requirements or Medicaid estate recovery later on.

This kind of irrevocable trust must be created and funded properly, and timing is crucial. Medicaid looks back five years from the date you apply to see if any assets were transferred out of your name—known as the five-year look-back rule (we’ll cover this more in the next section).

What Are the Medicaid Income and Asset Limits?

Medicaid limits vary slightly by state, but here’s a general snapshot:

- Income limit (single applicant): Around $2,742/month (as of 2024, varies by state)

- Asset limit (single applicant): $2,000 in countable assets

- Countable assets include bank accounts, stocks, second homes, and cash-value life insurance

- Non-countable assets may include personal belongings, a car, and certain retirement accounts (state-dependent)

If you’re over these limits, you either won’t qualify or will be expected to “spend down” the excess before receiving any Medicaid benefits.

What Does It Mean to “Spend Down” Assets?

“Spending down” means using your personal funds—often savings or investments—to pay for care until you reach the Medicaid limit. For example, if you have $100,000 in a bank account, you may be expected to pay for nursing home care out of pocket until your balance drops below the allowed $2,000.

Without planning, this process can leave little or nothing behind for your loved ones.

By placing those assets into a Medicaid trust ahead of time, you can protect them from spend-down rules. However, timing and proper structure are critical—improper transfers can trigger penalties and delay eligibility.

Key Takeaway: A MAPT helps you qualify for Medicaid by shielding your countable assets from eligibility calculations—allowing you to access critical care benefits without losing your financial legacy.

When created early and correctly, this type of trust is one of the most effective tools for balancing Medicaid planning with long-term security for your familyMedicaid planning with long-term security for your family.

Understanding the 5-Year Look-Back Rule

One of the most important—and often misunderstood—parts of Medicaid planning is the 5-year look-back rule. This rule determines whether the asset transfers you’ve made, including those to a Medicaid Asset Protection Trust (MAPT), will impact your eligibility for Medicaid coverage.

Understanding how this rule works—and planning accordingly—can make the difference between qualifying for benefits and facing significant delays or penalties.

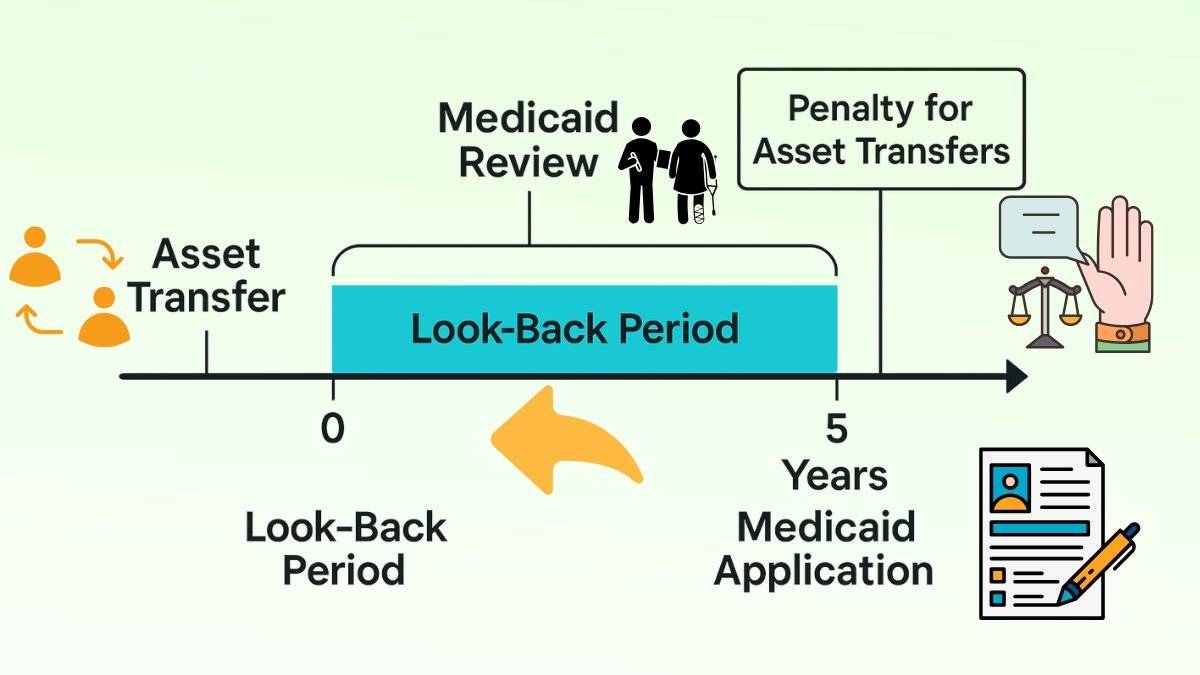

What Is the Medicaid 5-Year Look-Back Rule?

When you apply for Medicaid to cover long-term care costs, the state will review your financial history going back five years from your application date. This is known as the look-back period.

During this time, Medicaid checks for any transfers of assets that were made for less than fair market value. This includes gifts to family, donations, or placing assets into an irrevocable trust like a MAPT. Learn how Medicaid’s five-year look-back rule affects eligibility.

If such transfers are found, Medicaid assumes they were made to reduce your assets in order to qualify for benefits—and a penalty period may be imposed.

What Happens If You Transfer Assets Within the Look-Back Period?

Transferring assets during the five-year look-back window doesn’t automatically disqualify you from Medicaid, but it does trigger a penalty period. During this time, you’re considered ineligible for Medicaid—even if you meet all other requirements.

Here’s how it works:

- The state calculates the value of the transferred assets

- That amount is divided by the average monthly cost of care in your state

- The result is the number of months you’ll be ineligible for Medicaid coverage

Example:

If you transferred $60,000 into a trust and the average monthly nursing home cost in your state is $6,000, you would be ineligible for 10 months from the date you apply.

This is why early planning is so important. If you establish and fund a MAPT more than five years before applying, the assets in the trust are fully protected from both the look-back rule and Medicaid estate recovery after death.

Can You Undo or Reverse a Transfer?

With some types of gifts or revocable trusts, you may be able to reverse or “cure” a transfer by taking the asset back or having the recipient return it. However, with a MAPT, which is an irrevocable trust, this is rarely possible.

Once assets are transferred into the trust, they are no longer in your control—and that’s part of what makes them effective for Medicaid protection.

Because of this, it’s critical to work with an experienced professional and have a well-thought-out Medicaid planning strategy before initiating any transfers.

Key Takeaway:

The 5-year look-back rule is a cornerstone of Medicaid eligibility—and a major reason why early action matters. By setting up a Medicaid Asset Protection Trust well in advance, you can transfer assets strategically, avoid costly penalties, and ensure your legacy is protected when you or a loved one needs long-term care support.

What Assets Can and Cannot Be Protected in a MAPT

One of the biggest reasons people explore a Medicaid Asset Protection Trust (MAPT) is to preserve the assets they’ve worked hard to build—like their home, savings, or investment accounts.

But not all assets are treated the same when it comes to Medicaid planning, and understanding what a MAPT can and cannot protect is key to making informed decisions.

Let’s break down how it works.

Countable vs. Non-Countable Assets

Medicaid divides assets into two main categories:

- Countable assets: These are considered available to pay for long-term care and are factored into Medicaid eligibility. They include cash, checking and savings accounts, brokerage accounts, vacation homes, and life insurance policies with cash value.

- Non-countable assets: These may be exempt from Medicaid calculations, such as one primary residence (up to a certain equity limit), personal belongings, a single vehicle, and certain pre-paid funeral plans.

A MAPT helps convert certain countable assets into non-countable ones by legally removing them from your personal ownership—making them exempt from spend-down rules and Medicaid estate recovery.

Can You Protect Your Home with a MAPT?

Yes—your primary residence is one of the most valuable assets you can protect using a MAPT.

When you transfer your home into the trust:

- You can continue living in it for the rest of your life

- It will no longer count against you for Medicaid eligibility (as long as the transfer was made outside the five-year look-back period)

- It will be shielded from Medicaid estate recovery after your death

This allows your family to inherit the home without having to sell it to pay off care costs.

Important Note: If you don’t take action before needing care, Medicaid may place a lien on your home to recover expenses after you pass. A MAPT helps you avoid that outcome. Understand how Medicaid estate recovery works and who it affects.

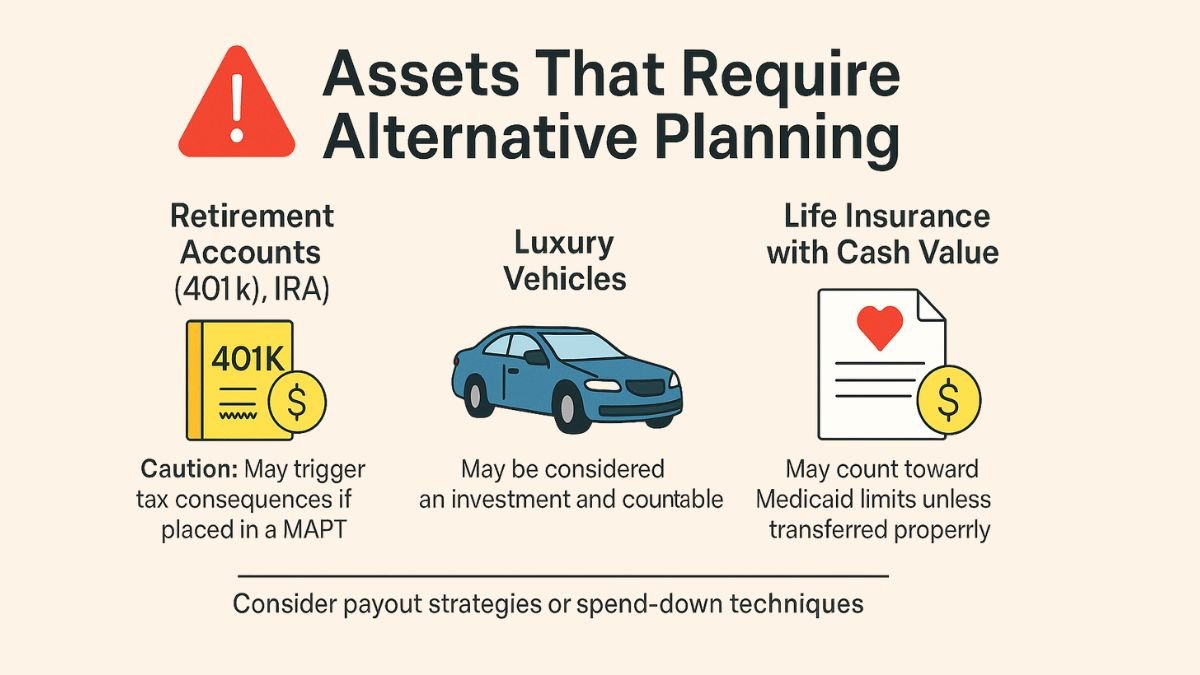

What About Retirement Accounts or Vehicles?

This is where things get a bit more nuanced:

- Retirement accounts like IRAs or 401(k)s are generally treated as countable assets unless they’re in payout status. However, these accounts are not typically placed into a MAPT because doing so could trigger tax consequences. Instead, Medicaid planning strategies may involve adjusting distributions or using spend-down techniques.

- Vehicles are usually exempt if you own one. There’s generally no need to place a car into a MAPT unless it’s a luxury vehicle that could be considered an investment.

- Life insurance policies with significant cash value may be transferred into the MAPT to avoid being counted. Term life insurance, which has no cash value, typically doesn’t count against eligibility.

Key Takeaway:

A MAPT can protect many of your most important assets—especially your home, savings, and non-retirement investments—so they aren’t lost to long-term care costs. But some assets, like retirement accounts or vehicles, may need alternative planning strategies.

The right approach depends on your financial picture, so working with an expert ensures your Medicaid planning is both effective and legally sound.

How to Set Up a Medicaid Asset Protection Trust with Trust Guru

Setting up a Medicaid Asset Protection Trust (MAPT) might sound complex—but with Trust Guru, it’s a clear, guided process designed to take the stress and confusion out of estate planning.

Whether you’re planning for your own care or helping a loved one prepare, we make it easy to protect your assets and take the next step toward Medicaid eligibility.

Our process is 100% remote, legally sound, and customized to your needs—so you can move forward confidently, without the hassle of traditional law firm visits or dense legal paperwork.

Step-by-Step: How It Works with Trust Guru

- Start with a Free Consultation

Connect with a Trust Guru advisor to assess your needs and see if a MAPT is the right fit. We’ll walk you through the basics and answer any questions about Medicaid eligibility, asset protection, or your estate plan. - Provide Key Information

Through our secure online platform, you’ll share essential details like your assets, beneficiaries, and long-term care concerns. This helps us create a trust that aligns with your goals and family structure. - We Draft Your Custom MAPT

Our legal team prepares your irrevocable trust documents, tailored to your unique situation and compliant with your state’s laws (we support all 50 U.S. states). - Review and Sign

You’ll review the final documents with our expert guidance. We explain everything in plain language—no confusing legalese. Once approved, you’ll sign and notarize your MAPT. - Fund the Trust

This crucial step involves transferring selected assets—such as your primary residence or savings—into the trust. We provide step-by-step instructions and support throughout the process. - Ongoing Support

Even after setup, we’re here for you. Need to update your trust or ask a question? Our client-first approach means you’ll always have expert help when you need it.

How Long Does It Take to Set Up?

Most MAPTs through Trust Guru can be completed within 2 to 4 weeks, depending on your responsiveness and the complexity of your estate. Because our platform is built for efficiency, many clients complete the process faster than they would with a traditional law firm—without sacrificing quality or legal protection.

What Documents or Information Do You Need?

To get started, you’ll typically need:

- A list of assets you’d like to protect (e.g., your home, savings accounts, investment portfolios)

- Basic identification and contact info

- Names of your chosen trustee(s) and beneficiaries

- Any relevant estate planning documents you’ve already created (if applicable)

Don’t worry—we’ll walk you through every step, and you don’t need to have everything figured out before you begin.

Pros and Cons of Using a MAPT

A Medicaid Asset Protection Trust (MAPT) can be a powerful tool for protecting your assets and qualifying for long-term care benefits—but it’s not the right solution for everyone. Like any legal and financial strategy, it comes with trade-offs that should align with your personal goals, health outlook, and financial priorities.

Here’s a clear breakdown of the key advantages and limitations to help you make an informed decision.

Pros of Using a MAPT

- Protects Key Assets from Long-Term Care Costs

Once assets like your home or savings are placed in a MAPT, they’re no longer counted for Medicaid eligibility and are typically safe from nursing home care costs or estate recovery after you pass away. - Helps You Qualify for Medicaid

By reducing your countable assets, a MAPT increases your chances of becoming eligible for Medicaid without going through a painful or rushed spend-down process. - Preserves Your Legacy

Assets in a MAPT can be passed on to your beneficiaries according to your wishes, rather than being consumed by rising care expenses. - Customizable and Legally Sound

A properly structured irrevocable trust allows you to outline who manages the trust (trustee) and who inherits from it, giving you control over the “who” and “how”—even if you no longer legally own the assets. - Avoids Probate

Assets in the trust bypass probate, meaning they’re transferred to your heirs more quickly and privately.

Cons of Using a MAPT

- Loss of Direct Control Over Assets

Because the trust is irrevocable, once you transfer assets into it, you generally can’t take them back or change the terms. This is a major reason why it’s important to plan ahead and feel confident in your decisions. - Not Ideal for Immediate Medicaid Needs

MAPTs are best suited for proactive planning. If you need care urgently and haven’t yet funded the trust, the five-year look-back period could delay your eligibility. - Limited Access to Trust Assets

You can’t use trust assets for your own benefit after the transfer—only the beneficiaries can access them, unless your trust is structured with limited exceptions. - Doesn’t Cover All Asset Types

Certain assets, like retirement accounts or long-term care insurance policies, typically aren’t transferred into a MAPT. These may require separate planning.

What Are the Risks of Creating an Irrevocable Trust?

The biggest risk is inflexibility. If your financial or health situation changes after funding the trust, you won’t be able to access the assets to cover unexpected expenses. That’s why working with a trusted advisor is essential—you need a strategy that reflects your long-term goals and anticipates life’s curveballs.

Other risks include:

- Poor trust design or legal errors if not handled by professionals

- Choosing the wrong trustee, which can lead to mismanagement

- Triggering penalties if the trust is funded too close to needing Medicaid

When Might a MAPT Not Be the Best Choice?

A MAPT might not be the right fit if:

- You’re under age 55 and not focused on long-term care planning yet

- You want to retain full control over your assets for the foreseeable future

- You have sufficient long-term care insurance or wealth to self-fund care

- You’re already within the 5-year look-back period and need Medicaid coverage soon

In these situations, other estate planning tools—like revocable living trusts or targeted spend-down strategies—may be more appropriate.

Key Takeaway:

A MAPT offers significant benefits for Medicaid planning and asset protection, but it requires careful timing, trust in your chosen trustee, and comfort with relinquishing control. If your goal is to preserve wealth, qualify for care benefits, and leave a legacy, it may be the smart, strategic move—but it’s best made with expert guidance and a long-term perspective.

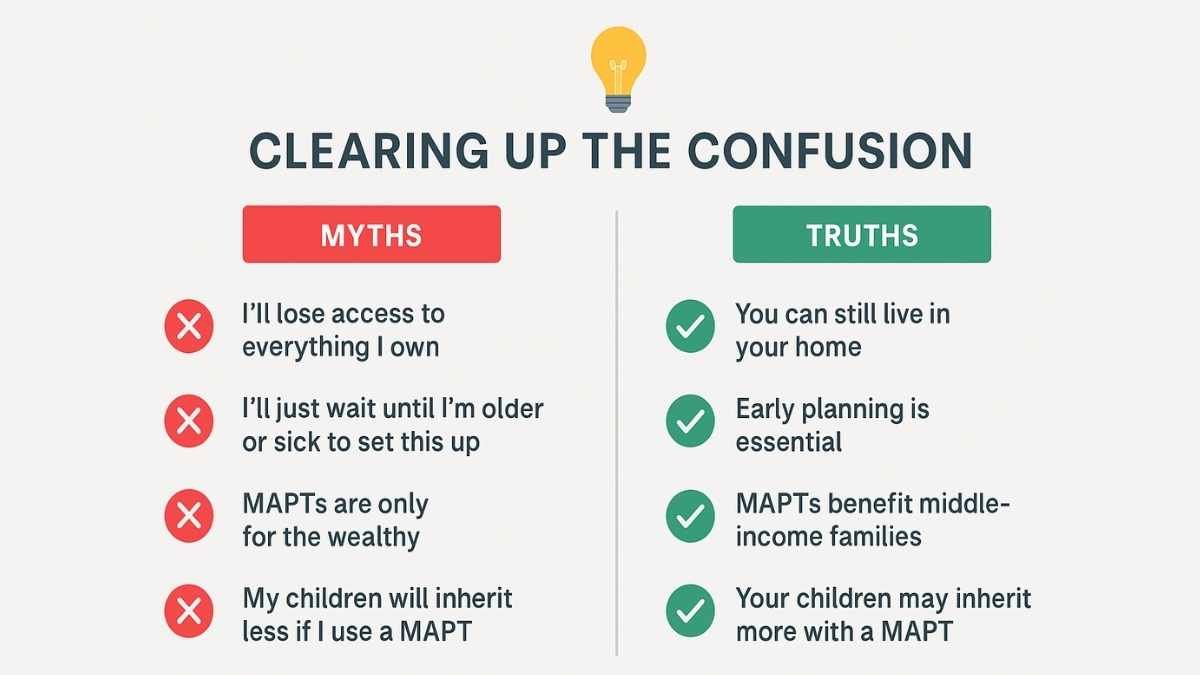

Common Myths and FAQs About MAPTs

When it comes to Medicaid Asset Protection Trusts (MAPTs), there’s no shortage of confusion. Many people assume these trusts are only for the wealthy—or that using one means losing everything. In reality, MAPTs are practical, flexible tools for middle- to upper-income families who want to preserve their legacy and plan for long-term care.

Let’s clear up some of the most common myths and answer questions that often come up during the estate planning process.

Myth #1: “If I use a MAPT, I’ll lose access to everything I own.”

Truth: While it’s true that a MAPT requires you to give up legal ownership of certain assets, that doesn’t mean you lose all connection or benefit. For example, if you place your home into a MAPT, you can still live there for the rest of your life.

You also choose your trustee, set the rules for how the trust operates, and designate your beneficiaries.

What you’re giving up is the ability to sell or spend those assets at will—but that’s precisely what makes them protected from Medicaid and nursing home costs.

Myth #2: “I’ll just wait until I’m older or sick to set this up.”

Truth: Waiting too long is one of the biggest mistakes people make. Because of Medicaid’s five-year look-back rule, any transfers made too close to applying can trigger penalties. That’s why early Medicaid planning is essential.

Setting up a MAPT before a health crisis allows your assets to “season” outside the look-back period, ensuring they’re fully protected when the time comes.

Myth #3: “MAPTs are only for wealthy people.”

Truth: Many MAPT users are middle-income individuals who own a primary residence and have modest savings they want to protect. Without a MAPT, even a paid-off home can be vulnerable to estate recovery or forced sale to cover long-term care costs.

These trusts are especially helpful for people who don’t have long-term care insurance or can’t afford to self-fund care indefinitely.

Myth #4: “My children will inherit less if I use a MAPT.”

Truth: Actually, the opposite is often true. By placing assets in a MAPT and avoiding Medicaid estate recovery, your children are more likely to inherit more, not less. Instead of spending your savings or selling your home to cover care, those assets remain protected and pass to your heirs according to your estate plan.

Can I Still Live in My Home After Placing It in a MAPT?

Yes. One of the most common and reassuring features of a MAPT is that you retain the right to live in your home for the rest of your life, even after transferring it into the trust.

You won’t pay rent, and the trust doesn’t affect your ability to stay there—it simply protects the home from being counted as a Medicaid asset or subject to recovery after you pass away.

Will My Children Inherit Less If I Use a MAPT?

No—if anything, they’ll likely inherit more. By using a MAPT to shield your home or savings from long-term care expenses, those assets remain intact and out of reach from Medicaid estate claims.

That means your family receives the full value of what you intended to leave behind, without the risk of those assets being consumed by final medical bills or state recovery programs.

Key Takeaway:

MAPTs are misunderstood but incredibly effective tools for long-term planning. You don’t have to be wealthy, and you don’t have to give up everything to make them work. By separating fact from fiction, you can make confident choices that protect your assets—and bring lasting peace of mind to your family.

Ready to Protect Your Legacy? Here’s How to Get Started

Taking the first step toward securing your legacy doesn’t have to be overwhelming. At Trust Guru, we make it simple to explore your options and get expert guidance—without the legalese, the pressure, or the high price tag of a traditional law firm.

Whether you’re ready to create a Medicaid Asset Protection Trust (MAPT) or just want to understand your options, we’re here to help you every step of the way.

You don’t need to be an expert in estate law—that’s our job. What you do need is a clear plan, professional support, and the peace of mind that comes from knowing your assets and loved ones are protected.

Here’s How to Get Started:

- Schedule a Free Consultation

Book a quick, no-obligation call with one of our trusted advisors. We’ll listen to your goals, answer your questions, and help you understand if a MAPT is right for your situation. - Explore Your Personalized Trust Options

We’ll walk you through the setup process, explain what documents or information we’ll need, and show you how easy it is to move forward—all online, on your schedule. - Start Building Your Estate Plan with Confidence

From custom legal documents to asset protection strategies, Trust Guru delivers expert-crafted solutions that are legally sound, easy to understand, and tailored to your needs.

Secure Your Legacy Today – Start Your Free Consultation

Protect what matters most. Click below to schedule your free, friendly consultation and take control of your future—today.

Frequently Asked Questions About Medicaid Asset Protection Trusts

Here are answers to some of the most common questions people ask when considering a Medicaid Asset Protection Trust (MAPT). Whether you’re new to estate planning or ready to take action, these quick insights can help you feel more confident about your next steps.

A Medicaid Asset Protection Trust (MAPT) is a type of irrevocable trust designed to protect your assets—such as your home or savings—while helping you qualify for Medicaid to cover long-term care costs. Once assets are transferred into the trust, they are no longer counted as part of your estate for Medicaid eligibility. However, they’re still preserved for your beneficiaries, allowing you to safeguard your legacy while securing access to care.

Yes. One of the most valuable uses of a MAPT is to protect your primary residence from being counted toward Medicaid’s asset limits. When your home is placed in a properly structured MAPT more than five years before you apply, it’s not subject to Medicaid’s spend-down rules or estate recovery. Plus, you can continue to live in your home for the rest of your life.

The five-year look-back period is a Medicaid rule that reviews any transfers of assets made within the five years before you apply for long-term care benefits. If you transferred assets during this time—such as moving property into a MAPT—Medicaid may impose a penalty period during which you’re ineligible for coverage. This is why early planning is essential to avoid delays or disqualification.

A variety of assets can be transferred into a Medicaid trust, including:

Your primary residence

Savings and checking accounts

Brokerage accounts

Life insurance policies with cash value Assets like retirement accounts and personal vehicles are generally not included in a MAPT, but may require other planning strategies.

It’s important to work with a professional to determine which assets are best suited for protection through the trust.

A MAPT is a specific type of irrevocable trust designed for Medicaid planning. While all MAPTs are irrevocable, not all irrevocable trusts are MAPTs. What makes a MAPT unique is its structure and purpose—to help you qualify for Medicaid while legally shielding your assets from being counted or recovered. Because it’s irrevocable, you give up direct control of the assets, but gain long-term protection and peace of mind.

Still have questions?

We’re here to help. Book a free consultation with a Trust Guru advisor and get the clarity you need to move forward with confidence.