Funding a living trust is a crucial—but often overlooked—step in effective estate planning. If you’ve already set up your trust, you might be wondering how to fund a living trust and ensure your assets are properly transferred to avoid probate and protect your beneficiaries.

In this step-by-step guide, you’ll learn exactly what it means to fund your trust, why it matters, and how to move different types of assets—from real estate to retirement accounts—into it.

We’ll break it all down in simple terms, so you feel confident and in control of your estate plan.

What you’ll learn:

- Why Funding a Living Trust Matters

- What Does It Mean to “Fund” a Trust?

- General Steps to Fund a Living Trust

- How to Fund Different Types of Assets

- Common Mistakes to Avoid When Funding Your Trust

- When to Get Help from a Trust Professional

- FAQs About Funding a Living Trust

First, let’s look at why funding a living trust is so important.

Why Funding a Living Trust Matters

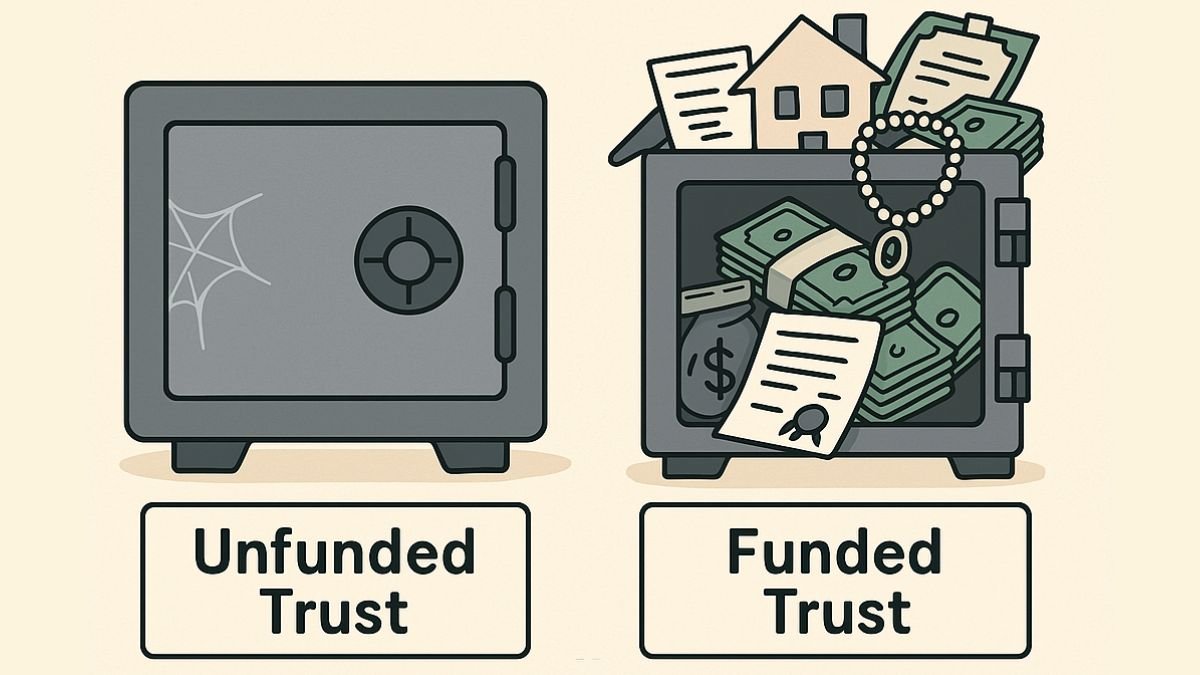

Setting up a living trust is a powerful move in estate planning—but it’s only the first step. To truly protect your assets and avoid probate, you must fund the trust, which means transferring ownership of your assets into it. Without this step, your trust exists only on paper and doesn’t actually control anything.

Here’s why this matters: An unfunded trust won’t do what you created it to do. If your assets are still titled in your name when you pass away, those assets will likely go through probate—the very legal process many people create trusts to avoid. This can delay inheritance, add court costs, and create unnecessary stress for your loved ones.

Unfortunately, this is a common oversight. Many people assume that once their trust document is signed and notarized, their work is done. In reality, that document is like an empty safe—it only works when you put something in it.

Let’s look at a quick example:

Imagine you create a living trust and plan for your house, bank accounts, and investment portfolio to pass smoothly to your children. But you never update the deed on your home or retitle your accounts to the trust. When you pass away, those assets are still legally in your name—and now must go through probate, despite the existence of the trust.

This is why funding isn’t optional—it’s essential.

Top reasons funding your trust is crucial:

- Avoids probate for included assets, saving time and legal fees

- Ensures privacy, since probate is a public process

- Gives your successor trustee immediate authority to manage your estate

- Prevents disputes among heirs or delays in inheritance

- Makes your trust legally functional, not just symbolic

Takeaway: A living trust only protects your legacy when it holds your assets—funding the trust is what turns good intentions into real-world impact.

What Does It Mean to “Fund” a Trust?

When we talk about “funding” a trust, we’re referring to the process of transferring ownership of your assets into the trust’s name. It’s the step that makes your trust legally functional and capable of doing what it was designed to do—manage, protect, and distribute your assets according to your wishes.

Think of it like this: Setting up a trust is like opening a new bank account. You can go through the paperwork, sign everything, and walk away with a shiny new account number. But if you never deposit any money into that account, it doesn’t serve a purpose. It just sits there—technically created, but practically empty.

Funding your trust is the act of “depositing” your assets into that legal container. This means retitling property, updating account ownership, changing beneficiary designations, or drafting assignment documents depending on the type of asset. Once assets are inside the trust, your successor trustee can manage or distribute them without going through probate if something happens to you.

Here’s how that works in practice:

- For real estate, you’d typically transfer the deed into the name of the trust.

- For bank or brokerage accounts, you’d change the account title to reflect trust ownership.

- For items like jewelry, collectibles, or personal property, you might list them in an assignment of property.

It’s important to note that just having a list of your assets in your trust documents is not enough. Legal ownership must be formally changed—or for certain assets, beneficiary designations must be updated to direct them into the trust upon your passing.

Note: If you’re wondering whether notarized documents expire, they do not lose their validity over time unless laws change or the document is otherwise challenged. Learn more in this NotaryCam article.

Takeaway: Funding a trust means legally moving your assets into the trust’s name—without that step, your trust is a hollow shell that can’t carry out your estate plan.

General Steps to Fund a Living Trust

Before diving into how to transfer each type of asset into your trust, it’s helpful to understand the general process. While the specifics vary depending on the asset, the overall steps remain the same. This high-level overview will help you approach funding your trust with clarity and confidence.

Step 1: Review Your Trust Documents

Start by reviewing your trust agreement. Make sure it’s signed, notarized, and legally valid. Look over:

- The full legal name of your trust (you’ll need this for retitling)

- The name of your trustee (typically yourself if it’s a revocable living trust)

- Instructions on how your assets should be managed or distributed

If your trust was prepared with an estate planning service like Trust Guru, these documents should be clear and complete. If not, consider a legal review to ensure everything is in order before moving forward.

Curious about the cost to set up a living trust? This detailed guide breaks down common fees and what to expect.

Step 2: Create an Inventory of Assets

Next, make a comprehensive list of the assets you want your trust to hold. This might include:

- Real estate

- Bank accounts

- Investment portfolios

- Retirement accounts

- Vehicles

- Business interests

- Personal property (like jewelry or collectibles)

- Digital assets (e.g., cryptocurrency, domain names)

A detailed inventory helps you stay organized and ensures nothing gets left out. It’s also helpful to group assets by category, as each will follow a slightly different process for transfer.

Step 3: Transfer Ownership or Assign Beneficiaries

Once your inventory is ready, begin transferring ownership of each asset to your trust. The method depends on the asset type:

- Title transfer: For property like homes, vehicles, or financial accounts, you’ll typically need to update the title or account registration to the trust’s name.

- Assignment of interest: For personal property without a title (like household items), you may create a document assigning ownership to the trust.

- Beneficiary designation: For retirement accounts or life insurance policies, you may not transfer ownership but instead name the trust as the beneficiary.

This is where attention to detail matters—using the exact legal name of your trust on all documents helps avoid complications later.

Step 4: Update Records and Notify Institutions

After assets are transferred, update any related records and notify relevant institutions:

- Banks, investment firms, insurance companies, or pension administrators

- County clerk or recorder’s office for property deeds

- Your estate planner or attorney for documentation

Keep copies of all documents and communications. Having a dedicated file—physical or digital—makes it easier for your trustee to manage things in the future.

Takeaway: Funding your living trust starts with reviewing your documents, organizing your assets, and taking targeted action to transfer ownership or update beneficiaries. Following these four steps sets the foundation for a legally sound and effective estate plan.

Pro Tip: Use a checklist to track each asset’s funding status—one small oversight could send an item to probate.

How to Fund Different Types of Assets

Now that you understand the general process of funding a living trust, it’s time to get specific. Each type of asset has its own method of transfer—and knowing the right approach for each one ensures your trust is properly funded and legally secure. Below is a breakdown of the most common asset categories and how to move them into your trust.

Real Estate

To transfer real estate into your trust, you’ll need to retitle the property deed so the trust becomes the legal owner. This process typically involves:

- Drafting and signing a new deed (such as a quitclaim or warranty deed)

- Recording the deed with your county recorder’s office

- Updating property insurance and tax records to reflect the trust

Scenario: If you own a second home in Florida, you’d create a new deed transferring ownership from your name to the name of your trust (e.g., “John A. Smith, Trustee of the Smith Living Trust dated January 1, 2025”). You’d then file this with the appropriate Florida county office.

Tip: Involving a title company or real estate attorney can help ensure everything is compliant with local and state regulations.

Bank and Investment Accounts

For checking, savings, and brokerage accounts, you can either:

- Retitle the account in the name of your trust, or

- Open new accounts under the trust and transfer funds into them

Steps include:

- Contacting the financial institution

- Providing a certificate of trust (a summary of your trust’s terms)

- Completing any required forms

With revocable trusts, you can remain the account holder while naming your trust as the owner. Irrevocable trusts may require more formal arrangements and legal guidance due to stricter rules on control and access.

Want to better understand how revocable and irrevocable trusts differ—and which one suits your situation? This article breaks it down in simple terms.

Retirement Accounts (401(k), IRA)

You typically don’t retitle retirement accounts into your trust due to IRS regulations and potential tax penalties. Instead, you update the beneficiary designation to name your trust (or specific individuals) as the primary or contingent beneficiary.

Key considerations:

- Naming your trust can be useful if you want to control how distributions are handled for minor or special needs beneficiaries

- Required Minimum Distributions (RMDs) and tax implications should be reviewed with a trust tax compliance professional

Vehicles

Transferring a car or other vehicle into your trust depends on your state’s DMV rules. In general:

- Complete a title transfer form

- Visit your DMV or submit paperwork by mail

- Update your vehicle registration and insurance policy

In some cases, vehicles may not need to be included in your trust, especially if:

- They’re low in value and covered by a “pour-over” will

- You have other estate planning tools in place for quick transfer

Tip: Check with your insurance provider to ensure coverage continues uninterrupted after retitling.

Personal Property & Valuables

Items like furniture, art, collectibles, and household goods don’t have official titles. To fund these into your trust, create an assignment of personal property. This is a simple legal document that transfers ownership of untitled items.

You can also:

- Make a detailed list of high-value or sentimental items

- Store the list with your trust documents for easy reference

Business Interests

If you own a business, consult with experts in business asset protection or succession planning to avoid disruptions or legal issues during transfer, funding these interests into your trust may require:

- Amending operating agreements or shareholder contracts

- Executing an assignment of interest

- Notifying partners or board members, depending on structure

Since business ownership is often complex, it’s wise to work with an attorney to avoid disrupting operations or violating internal agreements.

Digital Assets

Digital assets can include:

- Cryptocurrency (e.g., Bitcoin, Ethereum)

- Domain names

- Online financial accounts

- Cloud storage, email, and social media

To fund these into your trust:

- Create a detailed inventory of all digital assets

- Include account credentials, where appropriate (or use a secure password manager)

- Draft instructions for access and control in your trust document

Follow best practices in digital asset trust planning to ensure secure management and handoff. Some platforms also allow you to designate a “legacy contact” or digital heir—be sure to align these with your trust instructions.

Takeaway: Each asset type has its own funding process, and overlooking even one could lead to complications down the road. With care, documentation, and occasionally professional guidance, you can ensure your trust is fully equipped to protect your legacy.

Common Mistakes to Avoid When Funding Your Trust

Even with the best intentions, it’s easy to make missteps during the trust funding process. Unfortunately, small oversights can lead to major consequences—like assets ending up in probate or your wishes not being carried out as planned. Below are some of the most common mistakes people make when funding their living trust, and how you can avoid them.

1. Leaving Out Major Assets

One of the most frequent (and costly) mistakes is forgetting to transfer significant assets into the trust. Real estate, bank accounts, investment portfolios, and even business interests should all be reviewed carefully.

Example: You may have added your primary home to your trust but forgot to retitle a vacation property or rental unit. If it’s still in your personal name at the time of death, that property will likely go through probate.

Tip: Keep an updated inventory of your assets and double-check that each is properly titled or assigned to your trust.

2. Failing to Update After Major Life Events

Estate plans are not a one-and-done task. After big life changes—such as marriage, divorce, a new child or grandchild, or the sale/purchase of property—you should review your trust and funding documents.

- Did you acquire new assets?

- Did your beneficiary wishes change?

- Has your financial institution changed policies or merged with another?

Regular updates ensure your trust stays aligned with your current life and financial situation.

3. Not Documenting Transfers Properly

Transferring assets into a trust isn’t just a mental note or a sticky note reminder. It requires formal documentation to be legally valid.

- Deeds must be recorded with the county

- Bank accounts need updated registration

- Personal property should be listed in an assignment form

Failing to create or properly store these documents can cause confusion or challenges for your successor trustee later on.

4. Forgetting to Inform Financial Institutions

Even after you’ve transferred an asset into your trust, you’ll need to notify your bank, brokerage, or insurance company. These institutions often require copies of your trust or a certification of trust to update their records. Review your full estate plan regularly and keep documents updated to avoid these errors.

If this step is skipped, your trustee may face hurdles accessing accounts after your passing—defeating the purpose of probate avoidance.

Trustees play a critical role in the months following your passing—managing everything from asset inventory to beneficiary communication. Get a full understanding of their duties in this guide by Nolo.

Takeaway: Avoiding these common mistakes helps ensure your trust performs exactly as intended. A well-funded and properly maintained trust gives you peace of mind—and makes things far easier for your loved ones when the time comes.

When to Get Help from a Trust Professional

While it’s possible to fund a trust on your own, there are times when professional guidance is not just helpful—it’s essential. Estate planning involves a lot of moving parts, and even small errors in the funding process can lead to legal headaches, delays, or assets slipping through the cracks.

Sometimes, the best way to ensure every step is handled properly is to contact our team for guidance.

Want a deeper dive into the fundamentals of revocable trusts, their benefits, and limitations? The American Bar Association offers this in-depth overview.

Benefits of Professional Oversight

Working with a trust professional ensures that:

- Your assets are properly titled or assigned to your trust according to state-specific laws

- Nothing gets overlooked, especially high-value or complex assets like real estate, business interests, or digital property

- Beneficiary designations are coordinated to avoid conflicts or inconsistencies

- Required documents are created, filed, and stored correctly—from deeds and transfer forms to assignment letters and certifications of trust

- You’re protected against unintended tax consequences, particularly with retirement accounts and irrevocable trusts

A professional can also help you navigate updates over time—such as funding new assets or adjusting for life changes—without starting from scratch.

Simplicity, Convenience, and Peace of Mind

The right support doesn’t add complexity—it removes it. At Trust Guru, we make the process simple and secure. Whether you need help transferring your home, assigning your personal property, or updating investment accounts, our team ensures every step is handled with care.

Ready to make your trust truly work for you? Book a free consultation with a Trust Guru expert and feel confident your legacy is fully protected.

FAQs About Funding a Living Trust

Still have questions? You’re not alone. Funding a living trust can feel complex, especially when you’re navigating it for the first time. Below are answers to some of the most frequently asked questions to help clear up confusion and guide your next steps with confidence.

If you don’t transfer your assets into your trust, the trust won’t be able to control or distribute those assets. Instead, any unfunded property will likely go through probate, which is the very process a trust is meant to avoid. In effect, your trust becomes an empty shell—legally created but practically ineffective.

Yes, and in fact, funding your trust is an ongoing process. Life changes—new accounts, property purchases, or inherited assets—should prompt you to revisit your trust and make sure new assets are included. It’s a good habit to review your trust funding annually or after any major life event.

Not always. Many people can handle basic transfers—like bank accounts or personal property—on their own with proper guidance. However, professional help is strongly recommended when dealing with:

Real estate transfers (especially in different states)

Business interests

High-value or complex investments

An attorney or estate planning professional ensures everything is done correctly, preventing costly mistakes later.

There’s no official legal deadline, but the sooner you fund your trust, the better. Unfunded assets remain vulnerable to probate, legal disputes, and administrative delays. Delaying the process also increases the chance that something is forgotten or mishandled in a time of crisis.

Usually not. Most funding steps—like retitling assets or assigning property—are handled by the person creating the trust (you) or your legal representative. Beneficiaries may only need to sign documents in specific scenarios, such as when accepting responsibilities or agreeing to certain terms in complex arrangements.