When it comes to setting up a living trust, one of the first questions people ask is: should I do it online or hire an attorney? The choice between an online vs attorney living trust can significantly affect the cost, complexity, and legal security of your estate plan—especially if you’re trying to protect assets like real estate or retirement accounts.

This article will break down the pros, cons, and best-fit scenarios for each option, so you can confidently decide what’s right for your unique situation. Whether your estate is straightforward or more complex, we’ll help you understand how each route works and where the real value lies.

What you’ll learn:

- Why Choosing the Right Trust Setup Method Matters

- Overview – Online Services vs. Attorneys: What’s the Difference?

- Pros and Cons of Online Living Trust Services

- Pros and Cons of Working with an Estate Attorney

- When Is DIY Trust Setup a Good Option?

- When You Should Hire an Attorney Instead

- Hybrid Options: Getting the Best of Both Worlds

- Frequently Asked Questions

First, let’s understand why choosing the right trust setup method really matters.

Why Choosing the Right Trust Setup Method Matters

Creating a living trust is one of the most important steps you can take to protect your assets and ensure your loved ones are cared for when you’re no longer here. But how you set up that trust—whether through an online service or with the help of an estate attorney—can make a big difference in both the effectiveness of your plan and your overall peace of mind.

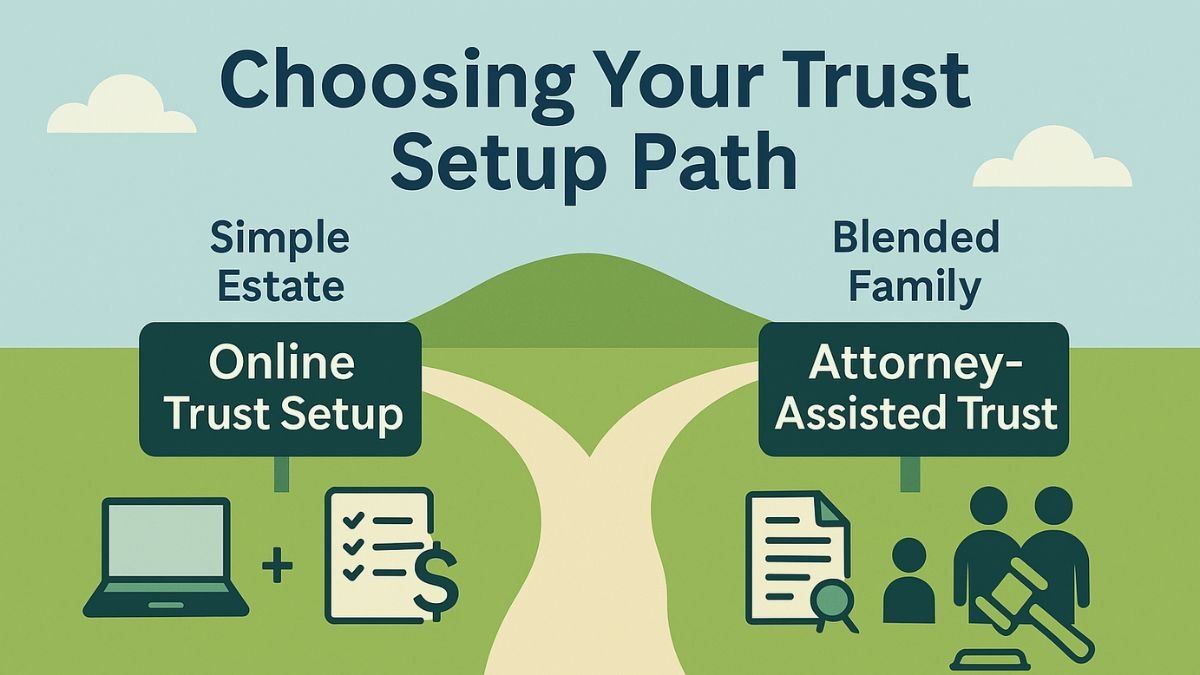

This decision isn’t just about cost. It’s about choosing a process that matches the complexity of your estate, your comfort level with legal documents, and how much hands-on guidance you want. For some, a streamlined digital service might be all that’s needed. For others, especially those with blended families or multiple properties, the expertise of a professional attorney can prevent future disputes and costly mistakes.

If you have a blended family, navigating asset distribution can be tricky. Be sure to understand estate planning pitfalls and solutions for blended families to avoid leaving loved ones unprotected.

Let’s break it down:

Here’s what’s at stake when choosing your trust setup method:

- Probate avoidance: A poorly structured or incomplete trust might not keep your estate out of probate, defeating one of its core purposes.

- Legal compliance: Estate laws vary by state. The right method ensures your trust is enforceable where you live.

- Complexity handling: Some estates require special provisions for minor children, business assets, or unique family dynamics.

- Error prevention: DIY solutions can lead to missed steps or misworded clauses, which may not be discovered until it’s too late.

- Ongoing support: Do you need help adjusting your trust over time, or want expert advice as your situation changes?

For example, if you’re a single homeowner with no dependents and a few financial accounts, an online service may be perfectly suitable. But if you’re a small business owner with remarriage considerations and multiple heirs, professional legal guidance could save your family from future legal complications.

Takeaway: The method you choose to set up your living trust isn’t a one-size-fits-all decision—it should reflect your financial situation, family dynamics, and how much support you want throughout the process.

Overview – Online Services vs. Attorneys: What’s the Difference?

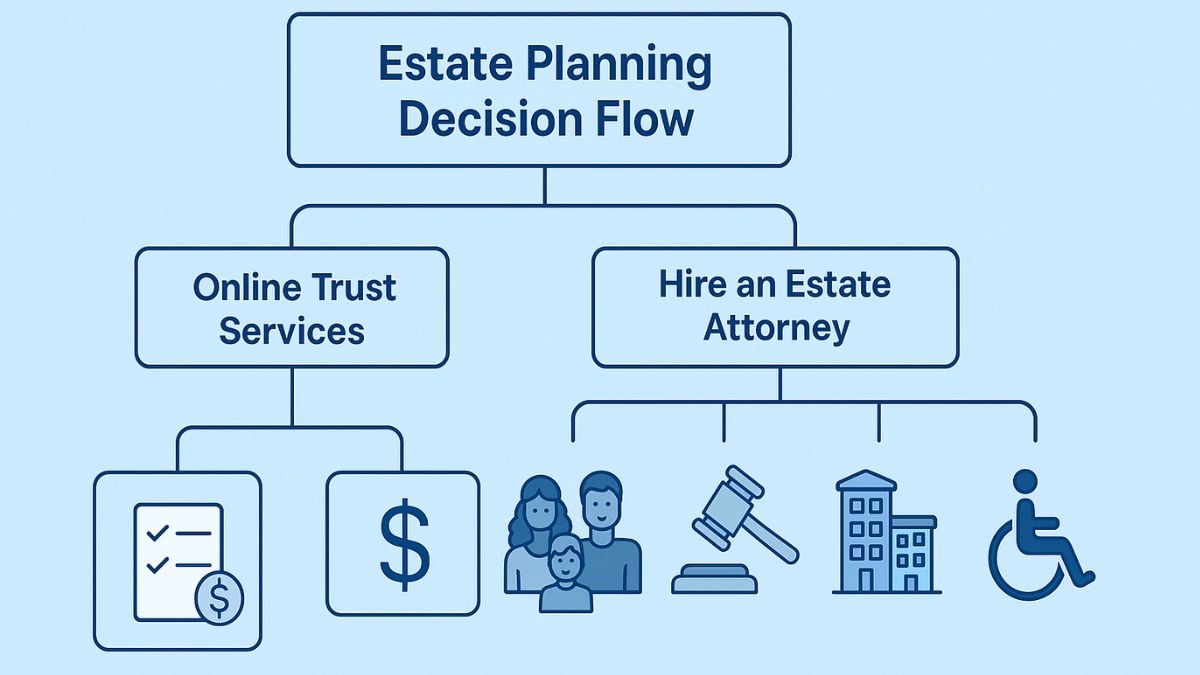

When it comes to setting up a living trust, you have two main paths: using an online living trust service or working with an estate planning attorney. While both aim to help you protect your assets and avoid probate, the experience, cost, and level of support can vary dramatically.

Want a deeper breakdown of what you might spend? Learn how much it really costs to set up a living trust depending on the method you choose.

Below, we’ll walk through how each option works, what they typically include, and what kind of support you can expect from each.

What Is an Online Living Trust Service?

An online living trust service offers a do-it-yourself approach to estate planning. These platforms guide users through a digital questionnaire that collects information about your assets, beneficiaries, and wishes. Based on your responses, the system generates legal documents that you can download, sign, and in some cases, have notarized.

Popular platforms in this space include:

- LegalZoom

- Trust & Will

- Quicken WillMaker & Trust

- Fabric by Gerber Life

These services are typically:

- Affordable: Often a fraction of the cost of hiring an attorney

- Convenient: Complete the process from home, on your own time

- Designed for simplicity: Ideal for straightforward estates with few complications

However, they usually do not include legal advice, and their documents are based on standardized templates, not personalized legal reviews. This means you’re responsible for understanding how the trust works and ensuring it’s set up correctly for your specific situation.

Still unsure which path to take? This comparison of living trust setup options outlines when to choose online platforms, attorneys, or hybrid services—based on your goals and estate complexity.

What Does an Estate Attorney Provide?

An estate attorney, on the other hand, offers a customized, hands-on experience. They take the time to understand the full picture of your financial and family life and use that information to draft a trust tailored to your specific needs and goals.

With an attorney, you can expect:

- Personalized legal advice based on your life circumstances

- State-specific expertise, ensuring your trust aligns with local laws

- Help with complex scenarios, like second marriages, minor children, or business ownership

- In-person or virtual consultations for real-time guidance

- Ongoing support for updates or questions after the trust is created

While this path is more expensive and time-intensive than using an online tool, it provides peace of mind for those with more to protect or more complex wishes.

Key Differences at a Glance:

| Feature | Online Service | Estate Attorney |

| Cost | Low | Higher investment |

| Speed | Fast (hours to days) | Moderate (days to weeks) |

| Personal Legal Advice | ❌ Not included | ✅ Yes |

| Customization Level | Basic templates | Fully personalized |

| Ideal For | Simple estates | Complex estates |

| Ongoing Support | Limited | Often included |

| Legal Compliance by State | General coverage | State-specific, detailed |

Takeaway: Online trust services and estate attorneys serve the same goal—but offer very different journeys. Choosing the right one comes down to how much complexity you’re managing and how much personal guidance you need.

Pros and Cons of Online Living Trust Services

Online living trust services have gained popularity for their affordability and convenience—but they’re not right for everyone. If you’re considering going the digital route, it’s important to weigh the benefits against the potential risks to ensure it aligns with your specific estate planning needs.

Pros of Online Living Trust Services

Lower Cost

One of the biggest advantages of online trust platforms is the significantly lower price tag compared to hiring an attorney. While attorney-prepared trusts can cost thousands, online options often range from $100 to $600, depending on the platform and level of service.

Convenience and Speed

These services are designed for maximum efficiency. You can typically complete the entire process from your home—on your schedule—without the need for phone calls, appointments, or physical paperwork. Most users can generate their documents in just a few hours.

Good for Simple Estates

If your estate is straightforward (think: one property, no dependents, and clear beneficiary designations), an online trust may be all you need. Many platforms offer basic templates that work well for single individuals or married couples with uncomplicated finances.

Case Example:

Karen and David, a retired couple in their 60s, own a home, have no dependents, and hold a few retirement accounts. They want to avoid probate and ensure their assets go directly to their nieces and nephews. For them, an online living trust offers an affordable, no-fuss solution that checks all the boxes.

Cons of Online Living Trust Services

Limited Customization

Most online services rely on standard templates and decision trees. If your situation doesn’t fit neatly into their options, you could miss key protections—or end up with a trust that doesn’t reflect your true intentions.

Higher Risk of Errors

Without legal review, you’re relying on your own understanding to complete complex legal documents. A small mistake or oversight—like forgetting to fund the trust—can render it ineffective and send your estate to probate anyway.

No Personalized Legal Advice

Online platforms aren’t designed to answer nuanced questions or offer legal interpretations. If you need help deciding how to handle blended families, business ownership, or guardianship issues, you’ll be on your own—or may need to consult a lawyer anyway.

Takeaway:

Online living trust services are best for simple, low-risk estates and budget-conscious individuals who are comfortable managing the process on their own. But if you have even a hint of complexity or uncertainty, it’s worth exploring other options.

Pros and Cons of Working with an Estate Attorney

Choosing to work with an estate planning attorney offers a personalized, high-touch approach to setting up your living trust. While it’s a bigger investment in both time and money, it can be well worth it—especially if your financial or family situation is more complex than average. Below, we explore the advantages and potential drawbacks of this route to help you decide if it’s the right fit for you.

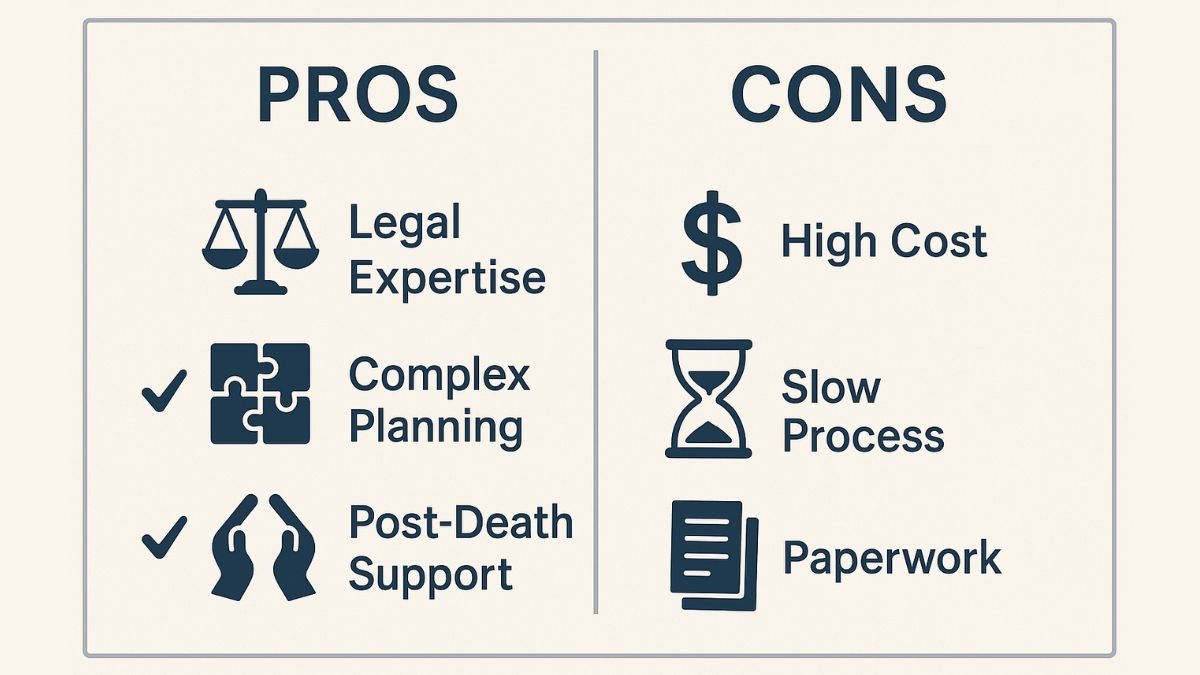

Pros of Hiring an Estate Attorney

Legal Expertise and Comprehensive Review

Attorneys are trained to navigate the legal complexities of estate planning. They go beyond basic templates to create a trust that fully aligns with your personal goals, financial picture, and applicable state laws. They also help ensure all documents are correctly executed and funded—critical steps that are often missed in DIY setups.

Suited for Complex Family or Financial Situations

If your estate involves business interests, blended families, multiple properties, or concerns about future disputes among heirs, an attorney is often the safest route. They can craft detailed provisions and contingency plans that protect your legacy and minimize the chance of conflict or probate challenges.

May Include Post-Death Support for Heirs

Many estate attorneys offer post-death support for heirs, which can be invaluable when it comes time to administer the trust, especially if your loved ones are unfamiliar with the legal process. This can be invaluable when it comes time to administer the trust, especially if your loved ones are unfamiliar with the legal process.

Cons of Hiring an Estate Attorney

Higher Cost

One of the biggest barriers for many people is the price. Attorney-prepared living trusts typically cost anywhere from $1,500 to $5,000 or more, depending on the complexity of the estate and your location. While this cost often reflects the level of detail and support provided, it may not be feasible for everyone.

Slower Turnaround Time

Unlike online platforms, which can generate documents within a day or two, the attorney route involves consultations, document drafts, reviews, and revisions. This process can take several weeks—sometimes longer if additional estate planning elements are involved.

Requires Appointments and Paperwork

The traditional nature of legal services means scheduling meetings, gathering documents, and possibly visiting an office in person. While some attorneys now offer virtual consultations, the process is still more involved than digital DIY options.

If you want to ensure all your key estate planning documents are in order, review this estate planning checklist that highlights essential components like living trusts, wills, and healthcare directives.

Case Example:

James and Maria, a married couple in their early 50s, own several rental properties, co-manage a small business, and have children from previous marriages. They want to ensure each child is fairly treated and that their business can continue operating smoothly if one of them passes. In this case, working with an estate attorney gives them the customized legal framework and guidance they need to protect both their family and financial future.

Takeaway:

Hiring an estate attorney is ideal for those with more at stake—whether in terms of assets, family structure, or legal concerns. It offers peace of mind through expert advice and thorough customization, but it comes at a higher cost and requires more time and involvement.

When Is DIY Trust Setup a Good Option?

While a living trust is a legal document with lasting consequences, not every estate requires a lawyer’s touch. In some cases, a do-it-yourself (DIY) trust created through a reputable online service can be a perfectly safe and cost-effective solution. The key is knowing whether your situation is simple enough to manage without personalized legal guidance.

DIY is typically a good fit if:

- Your estate is straightforward with no special conditions or complications

- You are comfortable reading and following legal instructions

- You don’t anticipate disputes among heirs or beneficiaries

- You understand how to properly fund the trust and maintain it over time

In short, DIY is best for people who want to avoid probate and streamline their estate, but don’t need custom legal strategies or complex family provisions.

Is DIY Right for You?

Use the checklist below to assess whether a DIY approach might be suitable:

DIY Living Trust May Be a Good Fit If You:

- Are the sole owner of your assets

- Have no dependents or minor children

- Have never been married before, or are in a first marriage with shared children

- Own a primary residence and a few financial accounts

- Do not own a business, rental property, or hold foreign assets

- Have straightforward wishes for asset distribution (e.g., everything goes to one or two people)

- Are not expecting family disputes or legal challenges

- Prefer a low-cost solution and feel confident completing the process on your own

If you check most or all of these boxes, using an online trust service may be a smart and practical option.

Takeaway:

DIY trust setups can be a great choice for individuals with simple estates and clear goals—as long as you’re comfortable handling the legal paperwork and ensuring the trust is properly executed. For anything more complex, it’s wise to seek professional advice.

When You Should Hire an Attorney Instead

While online trust services offer a fast and affordable way to set up a basic estate plan, there are many situations where a licensed estate attorney is not just helpful—it’s essential. Complex family dynamics, high-value or unusual assets, and potential legal conflicts can all introduce risks that a one-size-fits-all template simply can’t address.

Common issues that often lead to disputes over estate plans include vague wording, outdated documents, and misaligned beneficiary designations—many of which can be avoided with the help of an experienced attorney.

If you fall into any of the categories below, hiring an attorney can help you avoid costly mistakes, reduce the likelihood of family disputes, and ensure that your trust is legally sound and customized to your unique needs.

Common Triggers That Call for Legal Help

- Multiple heirs or blended families: If you’re trying to divide assets fairly among biological children, stepchildren, or ex-spouses, professional legal guidance helps prevent future conflicts.

- Special needs beneficiaries: Trusts involving individuals with disabilities or those receiving government benefits require special language to avoid unintentionally disqualifying them from assistance.

- Business ownership: Passing on a business involves succession planning, valuation, and tax considerations that go beyond what online tools can handle.

- High-value or nontraditional assets: This includes investment properties, foreign accounts, intellectual property, or cryptocurrency.

- Concerns about future disputes: If there’s a chance someone may contest your trust or challenge your wishes, an attorney can help bulletproof your estate plan.

Attorney Help Is Advised If:

- You have children from a previous marriage

- You own or co-own a business

- Your estate includes out-of-state or foreign assets

- You need to plan for a special needs dependent

- You’re worried about family disagreements or legal challenges

- You want to minimize estate taxes or create generation-skipping trusts

- You’ve been divorced, remarried, or are in a nontraditional relationship

- You’re unsure how to properly fund your trust or align it with other estate documents

Takeaway:

If your estate involves legal gray areas, complex relationships, or high-value assets, working with an estate attorney ensures your trust is legally solid and aligned with your intentions. It’s an investment in peace of mind—and a safeguard for your legacy.

Hybrid Options: Getting the Best of Both Worlds

If you’re torn between the convenience of an online trust service and the security of working with an estate attorney, there’s good news—you don’t have to choose just one. Modern estate planning platforms like Trust Guru offer a hybrid solution that combines the best of both approaches: tech-driven convenience with attorney-reviewed accuracy.

How the Hybrid Model Works

With Trust Guru, you start by answering a series of intuitive questions online—just like you would with a traditional DIY platform. But here’s where things diverge: once your information is submitted, experienced estate attorneys review your trust documents for legal soundness, state-specific compliance, and personalized recommendations.

That means you’re not just filling in blanks—you’re creating a plan with real legal backing.

Why This Approach Works for Many

- Affordability: You avoid the high hourly rates of a traditional law firm while still getting legal oversight.

- Customization: Your trust is reviewed and tailored by attorneys, so it reflects your unique circumstances—not just a one-size-fits-all template.

- Ease of Use: You can manage the process from home, on your schedule, with expert support just a call or message away.

- Confidence: Your trust is built to hold up in real-world situations, reducing the risk of probate issues or disputes later.

This blended model is ideal for people who don’t feel 100% confident going fully DIY, but also don’t want to pay top-tier legal fees. It’s especially valuable for those in the “middle ground”—with moderately complex estates, blended families, or just a desire for legal peace of mind without the traditional attorney hassle.

Not sure where you fall? Contact our team to schedule a free consultation and explore your estate planning options today.

Frequently Asked Questions

Yes, in most cases, online living trusts are legally valid if they meet your state’s legal requirements and are properly executed (signed, witnessed, and notarized where required). However, the challenge lies in making sure those requirements are fully met—especially since laws vary by state. That’s why choosing a service that includes state-specific guidance or attorney review is highly recommended.

The biggest risks of DIY trusts include:

Incorrect or incomplete documents

Failure to fund the trust (i.e., transferring assets into it)

Lack of legal language needed to enforce your wishes

Overlooking state-specific legal nuances

Even small mistakes can render a trust ineffective—possibly resulting in probate or family disputes later. For simple estates, the risk may be low, but for anything more complex, professional oversight is safer.

Your estate might be too complex for an online-only service if you:

Have multiple heirs or blended family dynamics

Own a business, rental property, or out-of-state assets

Need to set up special needs or tax-saving trusts

Are concerned about inheritance disputes or disinheriting someone

If any of these apply, it’s wise to consult with an estate attorney or use a hybrid service that offers attorney review and customization.

Absolutely. Many people start with an online trust and later decide to consult a lawyer—especially when their financial situation changes, or they want more tailored planning. Just be aware that an attorney may suggest revising or rewriting your existing documents to ensure full legal compliance and alignment with your current goals.

It depends on the platform. Some budget-friendly services are fully DIY and do not include any legal review. Others—like Trust Guru’s hybrid model—include attorney oversight as part of the process. Always read the fine print and ensure the service provides licensed legal review if you want that added layer of protection.

While online trust services can be a good starting point, the right approach depends on your personal circumstances, estate complexity, and comfort level with legal documents.

When in doubt, seeking expert advice ensures your trust is built to do what it’s meant to—protect your legacy.