When planning for the future, one of the most important decisions you’ll make is how to protect and pass on your assets. If you’re weighing a living trust vs will, you’re not alone—many individuals reach this stage in their estate planning journey unsure which option is best for their needs.

This article will guide you through the key differences, benefits, and limitations of each, helping you make a confident, informed choice. Whether you’re focused on avoiding probate, maintaining privacy, or simplifying inheritance for your family, understanding these tools is essential.

What you’ll learn:

- What Is a Will?

- What Is a Living Trust?

- Key Differences Between a Living Trust and a Will

- Pros and Cons of Each Estate Planning Tool

- Will or Trust: Which Is Better for You?

- Special Considerations: Pour-Over Wills & Simple Wills

- Next Steps: Creating Your Estate Plan with Confidence

- Frequently Asked Questions

First, let’s understand what a will actually does—and when it comes into effect.

What Is a Will?

A will, formally known as a last will and testament, is a legal document that outlines how you want your assets distributed after your death. It allows you to name beneficiaries for your property, appoint guardians for minor children, and designate an executor—someone you trust to carry out your wishes.

Think of a will as your written voice after death. It gives instructions for what happens to your possessions, who should care for your dependents, and even how you want certain personal matters handled. Without one, state laws will determine how your estate is divided—which may not reflect your intentions.

For a breakdown of average probate durations by state, visit this probate timeline overview.

Key Features of a Will

Here are some of the most important characteristics of a will:

- Designates beneficiaries: You can name individuals or organizations to inherit specific assets or portions of your estate.

- Names a guardian for minor children: If you have dependent children, a will allows you to appoint a legal guardian, rather than leaving that decision to the court.

- Appoints an executor: This person is responsible for managing your estate after death—paying debts, filing taxes, and distributing property according to your will.

- Requires probate: A will typically goes through a court-supervised process called probate, which validates the document and oversees the administration of your estate.

- Amendable during your lifetime: You can revise or revoke your will as long as you’re mentally competent.

When a Will Becomes Effective

A will only takes effect upon your death. It has no legal authority while you’re alive. This means it doesn’t help if you become incapacitated due to illness or injury; in such cases, a power of attorney or living trust would be needed to manage your affairs.

Example:

Imagine you’re a parent with two young children and a home in your name. By creating a will, you can specify who should raise your children if something happens to you, and ensure your home goes to your chosen beneficiaries—rather than being divided by default rules set by the state.

Takeaway

A will is a foundational estate planning tool that ensures your final wishes are respected—but it only comes into play after death and does not help manage assets or decisions during your lifetime.

What Is a Living Trust?

A living trust is a legal arrangement that allows you to transfer ownership of your assets into a trust during your lifetime, with instructions on how those assets should be managed and distributed after your death—or even while you’re still alive. Unlike a will, a living trust takes effect as soon as it’s created and funded, providing greater flexibility and control over your estate while you’re still living.

Living trusts are especially useful for those who want to avoid probate, maintain privacy, or ensure someone can manage their affairs in case of incapacity.

For an explanation of how probate charges can impact estate planning, see this legal guide on probate fees.

Revocable vs. Irrevocable Trusts

There are two main types of living trusts:

- Revocable Living Trust:

The most common type, this trust allows you (the grantor) to maintain control of your assets. You can modify, add to, or revoke the trust at any time. It’s ideal if you want flexibility while planning for future needs. - Irrevocable Living Trust:

Once created, this trust generally cannot be changed or dissolved. You relinquish control over the assets placed into it, which can provide asset protection and potential tax benefits—but at the cost of flexibility.

For most individuals exploring living trust vs will comparisons, the revocable trust is the relevant option. To dive deeper into the differences and when each trust type makes sense, check out this guide on Revocable vs. Irrevocable Trusts.

When a Living Trust Becomes Effective

A major difference between a living trust and a will is timing. A living trust becomes effective immediately upon creation and funding. This means:

- You can manage assets within the trust during your lifetime.

- If you become incapacitated, your chosen successor trustee can step in and manage everything seamlessly—without court involvement.

- Upon your death, the trust’s terms direct how assets are distributed, bypassing probate entirely.

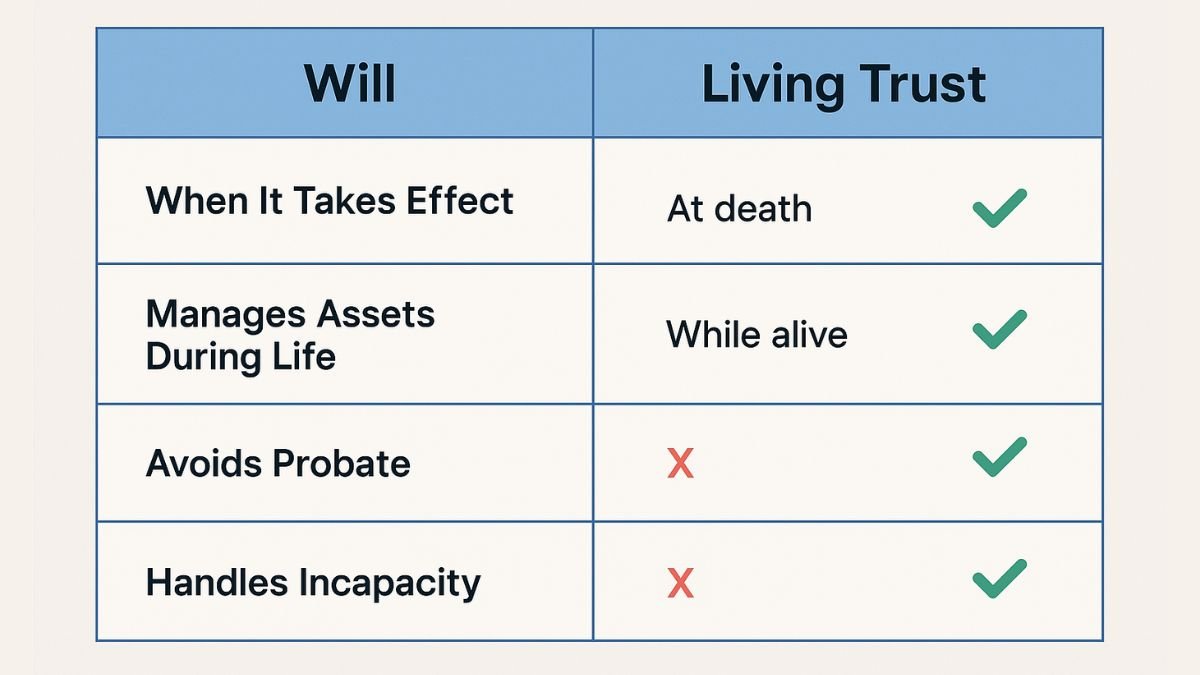

Visual Timeline Concept (suggested visual):

| Action/Event | Will | Living Trust |

| Created | While alive | While alive |

| Takes legal effect | At death | Immediately after funding |

| Manages assets during life | No | Yes (if assets are in the trust) |

| Avoids probate | No | Yes |

| Handles incapacity | No | Yes |

Real-World Example

Suppose you own real estate, have investment accounts, and are concerned about who would manage your finances if you became ill or disabled. With a living trust, you can appoint a successor trustee who will immediately take over managing those assets—ensuring continuity and avoiding court delays or public proceedings.

Takeaway

A living trust offers proactive control and protection for your assets both during your lifetime and after, making it a powerful option for those seeking to avoid probate, maintain privacy, and plan for incapacity.

Key Differences Between a Living Trust and a Will

While both a living trust and a will are foundational tools for estate planning, they serve different functions and offer distinct advantages depending on your goals. This section outlines the most critical differences so you can decide which option—or combination—best aligns with your needs.

Probate Process

- Will:

A will must go through probate, the court-supervised process of validating the will and distributing assets. Probate can be time-consuming, public, and costly, sometimes taking several months to over a year to finalize. - Living Trust:

A living trust avoids probate entirely for assets placed in the trust. This allows for a faster, private transfer of property to beneficiaries without court involvement.

Privacy Considerations

- Will:

Once submitted to probate, a will becomes part of the public record, meaning anyone can view its contents, including who inherits what. - Living Trust:

Trusts remain private documents. Only the involved parties (trustee and beneficiaries) know the terms, which appeals to those who value discretion.

Timing and Control

- Will:

A will only becomes effective after your death. It does not provide any support or authority during your lifetime—especially if you become incapacitated. - Living Trust:

A living trust is active as soon as it’s funded. It allows for ongoing control and management during your lifetime, and a successor trustee can step in immediately if you’re unable to manage your affairs.

Asset Types and Ownership

- Will:

Covers only assets in your name alone at the time of death. Assets jointly owned or with beneficiary designations (like life insurance) may not be governed by your will. - Living Trust:

Requires you to transfer ownership of assets into the trust. It can include real estate, bank accounts, investments, and more—ensuring all included assets are distributed according to your instructions without delay.

Comparison Table: Living Trust vs. Will

| Feature | Will | Living Trust |

| Goes Through Probate | Yes | No |

| Becomes Effective | At death | Immediately upon funding |

| Handles Incapacity | No | Yes (via successor trustee) |

| Privacy Level | Public (after death) | Private |

| Asset Coverage | Solely owned assets | Assets titled in the trust |

| Ease of Updates | Simple updates via codicil | Updates require formal trust amendment |

| Cost to Set Up | Typically lower upfront | Higher initial setup, but saves long-term probate fees |

| Control While Living | No | Yes |

Takeaway

Understanding the key differences between a living trust and a will can clarify which option provides the right balance of control, privacy, and long-term efficiency based on your estate and personal goals. Each tool offers unique advantages depending on how and when you want your assets managed and distributed.

Pros and Cons of Each Estate Planning Tool

Choosing between a will and a living trust depends on your goals, the complexity of your estate, and how much control you want during your lifetime. Below is an objective breakdown of the pros and cons of each option, helping you weigh what matters most in your estate planning process.

Pros and Cons of a Will

Pros:

- Simple to create: Wills are generally easier and quicker to draft than living trusts.

- Low upfront cost: They typically involve fewer legal fees and setup requirements.

- Names guardians for minor children: A will is the only document where you can legally appoint a guardian.

- Flexible and easy to update: Minor changes can be made through an amendment (codicil).

Cons:

- Goes through probate: The estate must be validated by the court, which can delay distributions and incur additional costs.

- Public record: Once probated, the will’s contents and beneficiaries become accessible to the public.

- No asset management during incapacity: A will offers no authority to manage your affairs if you’re still alive but incapacitated.

- May not cover all assets: Joint accounts, retirement funds, and life insurance may pass outside the will unless properly coordinated.

Pros and Cons of a Living Trust

Pros:

- Avoids probate: Assets held in the trust pass directly to beneficiaries without court delays.

- Maintains privacy: Trust details remain confidential and do not enter public record.

- Effective during lifetime and after death: The trust is active immediately, allowing for smooth management of assets during incapacity.

- Greater control over asset management: You can outline detailed instructions for asset management, including conditions for distribution.

Cons:

- More complex to set up: Creating a living trust requires retitling assets and legal documentation.

- Higher initial cost: Typically more expensive to establish than a will due to the time and legal guidance required.

- Ongoing maintenance: Trusts must be properly managed and updated if your assets or intentions change.

- May require a pour-over will: For any assets not titled in the trust, a backup will is recommended to ensure full coverage.

Takeaway

Both wills and living trusts offer valuable benefits—but they also come with trade-offs. Understanding these pros and cons helps you decide which tool (or combination) fits your financial situation, family dynamics, and long-term estate goals.

Will or Trust: Which Is Better for You?

There’s no one-size-fits-all answer when it comes to estate planning. Whether a will or living trust is better for you depends on your specific financial situation, family dynamics, and long-term goals. This section helps you weigh key factors and offers real-world scenarios to guide your decision.

Factors to Consider

Use these questions to determine which option aligns best with your needs:

- Do you want to avoid probate?

A living trust can help your heirs bypass the lengthy and public probate process. - Do you own property in multiple states?

A living trust can prevent your estate from going through probate in each state—a common issue with just a will. - Are you concerned about incapacity?

A living trust allows someone you choose to manage your affairs if you become unable to do so, without court intervention. - Do you have minor children?

A will is necessary to appoint a legal guardian for your children. - Is simplicity and low upfront cost a priority?

A will is typically less expensive and easier to establish than a living trust. - Is privacy important to you?

Trusts keep your estate details private, while wills become public record. - Do you expect family conflict or disputes?

A living trust offers clearer, court-free asset transfers that may reduce friction among heirs.

Decision-Making Matrix

| Personal Situation | Best Fit |

| You want to minimize court involvement | Living Trust |

| You’re on a limited budget for estate planning | Will |

| You need to appoint a guardian for minor children | Will (with or without a trust) |

| You own real estate in multiple states | Living Trust |

| You want your estate plan to stay private | Living Trust |

| You’re planning for incapacity or long-term illness | Living Trust |

| You have a simple estate and few assets | Will |

Takeaway

The choice between a will or a living trust comes down to what matters most to you: privacy, cost, control, simplicity, or peace of mind. For many, the ideal solution may even involve both—a living trust to manage assets and avoid probate, and a will to cover guardianship and any assets not placed in the trust.

Special Considerations: Pour-Over Wills & Simple Wills

While the main focus of estate planning often centers on wills vs. living trusts, there are a couple of important variations worth understanding: pour-over wills and simple wills. These tools are commonly misunderstood, but they can play a critical role—especially when used alongside a living trust.

What Is a Pour-Over Will?

A pour-over will is a type of will designed to work in tandem with a living trust. Its primary purpose is to “catch” any assets that weren’t transferred into the trust during your lifetime and direct them into it upon your death.

Why it matters: Even with a trust in place, people sometimes forget to formally retitle certain assets into it. A pour-over will ensure those loose ends are tied up, so everything ends up governed by the terms of your trust.

Key points:

- Acts as a safety net for unfunded or newly acquired assets.

- Still goes through probate, but ensures all assets are ultimately distributed according to the trust.

- Commonly used by individuals who prioritize using a living trust but want full legal coverage.

Example:

You set up a living trust and transfer your home and investment accounts into it. Later, you buy a vehicle but forget to title it in the name of the trust. A pour-over will ensures that vehicle gets transferred to the trust and distributed as planned.

What Is a Simple Will?

A simple will is a basic, straightforward estate planning document, often appropriate for those with minimal or non-complex estates. It covers the essentials—naming heirs, appointing guardians for minor children, and assigning an executor.

Key points:

- Best suited for smaller estates with limited assets or no complex distribution needs.

- Doesn’t include trusts or advanced tax planning strategies.

- Still requires probate, but can be effective for straightforward situations.

How it compares: A simple will is often a good starting point for those early in the estate planning process. However, as assets grow or family dynamics evolve, many people later opt to incorporate a living trust and a pour-over will for greater flexibility and control.

Takeaway

Pour-over wills and simple wills serve different purposes but can both be useful depending on your estate planning goals. A pour-over will complement a living trust by ensuring nothing is left behind, while a simple will may be enough for individuals with minimal assets or uncomplicated needs. Understanding how these tools fit into your broader estate plan can help you create a more complete and secure legacy.

Next Steps: Creating Your Estate Plan with Confidence

Now that you understand the differences between a living trust and a will, you’re better equipped to make decisions that align with your personal goals, financial situation, and family needs. Whether you’re focused on avoiding probate, protecting your privacy, or ensuring your assets are managed in case of incapacity, the right estate planning tool can provide peace of mind for you and your loved ones.

If you’re leaning toward a living trust and want to understand what it might cost, don’t miss our guide on How Much Does It Cost to Set Up a Living Trust?—it breaks down common expenses and what you can expect.

Still unsure which route is best for your situation? You don’t have to navigate it alone.

Contact our team for a free consultation today. Our estate planning professionals are here to answer your questions, review your goals, and help you build a customized plan that gives you confidence in every stage of life.

Your legacy matters—make sure it’s protected the right way.

Frequently Asked Questions

Here are some of the most common questions people have when comparing a will vs. living trust. These quick answers will help you feel more confident in choosing the right estate planning approach for your situation.

The main difference lies in when each takes effect and how assets are handled. A will only becomes effective after your death and must go through probate. A living trust is active as soon as it’s created and funded, allowing assets to be managed during your lifetime and transferred privately without court involvement.

Yes, many people use both. A living trust handles most assets and helps avoid probate, while a pour-over will serves as a backup to capture any property not included in the trust and appoint guardians for minor children.

Yes. Even with a trust in place, a will is still important for naming guardians, managing assets not placed into the trust, and ensuring nothing is left out of your estate plan. This is where a pour-over will often comes in handy.

While a will is less expensive upfront, it may lead to higher costs later due to probate fees and court delays. A living trust involves more effort and cost to set up but can save money and time for your beneficiaries by avoiding probate.

A properly funded living trust can avoid probate for the assets it holds. However, any assets not titled in the trust may still need to go through probate, which is why it’s critical to keep the trust up to date and consider using a pour-over will as a safety net.