What is asset protection, and why is it becoming a priority for so many Americans? Whether you’re a homeowner, business owner, or planning for retirement, understanding how to shield your assets from lawsuits, creditors, and unexpected life events is essential for long-term financial security.

In this guide, we’ll break down what asset protection really means, why it matters, and how you can use smart, legal strategies to safeguard your wealth. From trusts to LLCs and beyond, you’ll learn how to take proactive steps—without the legal jargon or complexity. Let’s get started.

In this article you’ll learn:

- What Is Asset Protection?

- Common Risks That Asset Protection Can Help Avoid

- How Asset Protection Works

- Common Asset Protection Tools and Strategies

- What Asset Protection Can and Cannot Do

- Choosing the Right Asset Protection Strategy for You

- Why Work with Trust Guru for Asset Protection?

What Is Asset Protection?

Asset protection is a proactive legal strategy designed to preserve your wealth by minimizing your exposure to lawsuits, debts, and other financial liabilities. At its core, it’s about structuring ownership of your personal and business assets in a way that shields them from unexpected claims—whether from creditors, divorcing spouses, or legal judgments—while staying fully compliant with the law.

Rather than waiting for a financial threat to arise, asset protection helps you prepare in advance, using tools like trusts, limited liability companies (LLCs), and exemptions to separate and safeguard assets. It’s not about hiding wealth—it’s about creating legal distance between you and your assets to ensure they remain intact when challenges come your way. For a broader look at how asset protection fits into overall financial planning, see this guide by Elder Advisors Law.

Why Asset Protection Matters Today

In today’s increasingly litigious society, even responsible individuals can find themselves facing legal and financial threats. A single lawsuit, divorce, or business failure can put years of hard-earned assets at risk. Without a protective structure in place, your personal assets—like your home, savings, or investment accounts—could be seized to satisfy a judgment or claim.

This is especially important for professionals in high-risk fields, business owners, and anyone with significant personal or real estate assets. As healthcare costs rise, debt increases, and financial pressures grow, asset protection isn’t just for the ultra-wealthy—it’s a smart move for anyone who wants peace of mind and long-term financial security. LegalZoom outlines 11 steps to consider for responsible estate planning that may include asset protection strategies.

Who Needs Asset Protection?

Asset protection isn’t just for millionaires. If you own a home, operate a business, have a retirement fund, or support a family, you likely have something worth protecting. Individuals and businesses alike benefit from setting up a legal buffer that keeps their assets safe from potential threats.

Some of the people who most often seek asset protection include:

- Professionals (like doctors, lawyers, and real estate investors) exposed to litigation risks

- Small business owners who could face business-related liabilities

- Retirees looking to protect their nest egg for their heirs

- Divorced or remarried individuals navigating complex family dynamics and asset transfers

If your goal is to ensure your personal assets are not easily accessible in the event of a claim, divorce, or lawsuit, asset protection is a wise and essential step toward securing your financial future.

Common Risks That Asset Protection Can Help Avoid

Many people don’t think about protecting their assets—until it’s too late. Life is unpredictable, and without a clear asset protection strategy, your wealth could be vulnerable to a wide range of legal and financial threats. Below are some of the most common risks where asset protection can serve as a critical safeguard.

Lawsuits and Liability Exposure

Lawsuits are one of the most common and damaging threats to personal and business assets. Whether it’s a professional malpractice claim, a personal injury lawsuit, or a dispute with a former client, legal claims can arise unexpectedly—and the financial consequences can be severe.

Without legal protections in place, your assets may be seized to satisfy a judgment. That means your savings, investment accounts, or even your home could be on the line. Business owners are particularly liable if they haven’t separated their business and personal assets through proper legal structures like LLCs or trusts.

Example:

Sarah, a small business owner in California, operated her consulting firm as a sole proprietorship. After a client sued her over a contract dispute, Sarah lost the case—and with no asset protection in place, the court ordered repayment using her personal savings and a lien against her family’s home. Had she used an LLC and established an asset protection trust, her personal assets could have remained untouched.

Divorce and Marital Disputes

Divorce doesn’t just impact your personal life—it can significantly impact your finances, too. In the absence of proper asset protection, a spouse may be entitled to claim a substantial portion of your assets, even those you acquired prior to the marriage. Here’s a helpful breakdown from RBC Wealth Management on wills vs. trusts that touches on asset distribution after major life events.

Prenuptial/postnuptial trusts or irrevocable trusts can help ensure that your divorce settlement doesn’t derail your financial future or affect intended inheritances for children from a prior marriage.

Creditor Claims and Debt Collection

Unpaid debts or financial obligations can open the door for creditor claims, which may result in your assets being garnished, levied, or liquidated. Whether it’s medical bills, business debts, or personal loans, creditors can pursue repayment by targeting your bank accounts, real estate, or other valuable property.

With the right tools—like a well-structured trust or creditor protection solutions—you can protect assets from creditors and ensure your financial foundation isn’t wiped out by a single repayment demand. The goal is not to evade debt, but to responsibly shield your core assets from aggressive collection tactics.

By proactively addressing these risks, asset protection helps you stay in control—even when life takes an unexpected turn. It’s not just a luxury—it’s a strategic necessity for anyone serious about securing their financial future.

How Asset Protection Works

Asset protection isn’t about secrecy or deception—it’s about legally managing risk before it becomes a problem. At its core, asset protection is a set of ethical legal strategies that help you structure ownership of your wealth in ways that make it more difficult for outside parties to reach.

When properly implemented, these strategies create a legal buffer between your assets and potential threats. The goal is simple: to help you maintain control over your financial future while staying fully compliant with the law.

Legal Ownership vs. Equitable Interest

One of the most important concepts in asset protection is the difference between legal ownership and equitable interest.

- Legal ownership means your name is on the title or deed. This makes the asset visible and accessible in lawsuits or creditor actions.

- Equitable interest, on the other hand, refers to your right to benefit from an asset, even if you don’t technically “own” it on paper.

For example, if you place assets into an irrevocable trust, the trust—not you—legally owns the assets, even though you or your beneficiaries may still receive the benefits. This legal separation helps shield your wealth from being directly targeted, making it harder for creditors or claimants to pursue those assets in court.

Understanding how to shift ownership without giving up access is key to building a resilient asset protection strategy.

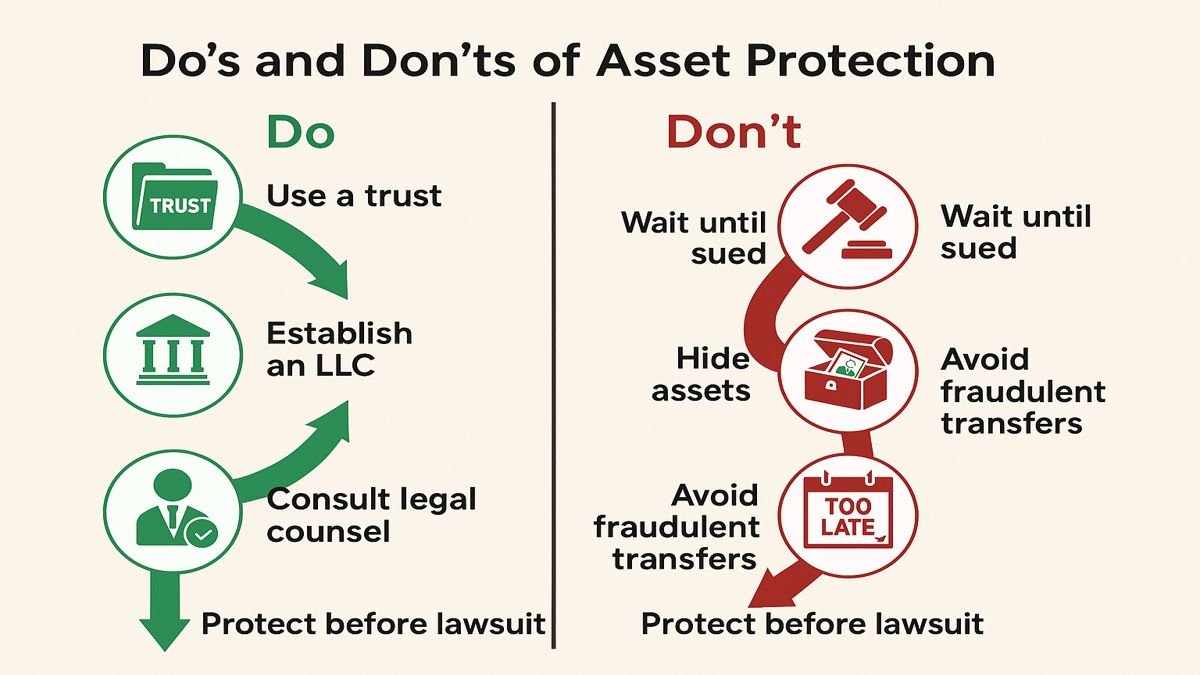

Timing Matters: Pre-Planning vs. Crisis Planning

When it comes to protecting your assets, timing is everything. Pre-planning—putting protections in place before a threat arises—is always more effective and legally sound than reacting after the fact.

If you attempt to transfer or hide assets after a claim occurs or legal action has been filed, it could be considered fraudulent or unethical—and courts are quick to reverse such moves. This is often referred to as a “fraudulent conveyance,” and it can not only undo the protection but also expose you to additional penalties.

That’s why the most effective asset protection plans are proactive. When done well and early, they stand up to legal scrutiny and help you avoid the perception—or reality—of trying to game the system.

In short, asset protection works best when it’s approached as part of your comprehensive estate planning—not as a last-minute move to avoid liability. This article by Commerce Trust Company reinforces the importance of early estate and asset planning as a long-term wealth strategy.

Common Asset Protection Tools and Strategies

When it comes to safeguarding your wealth, there’s no one-size-fits-all solution. Asset protection is built around a customized set of legal tools and strategies—each designed to reduce risk while keeping you in control. Below are some of the most commonly used structures, explained in simple terms so you can better understand your options.

Revocable vs. Irrevocable Trusts

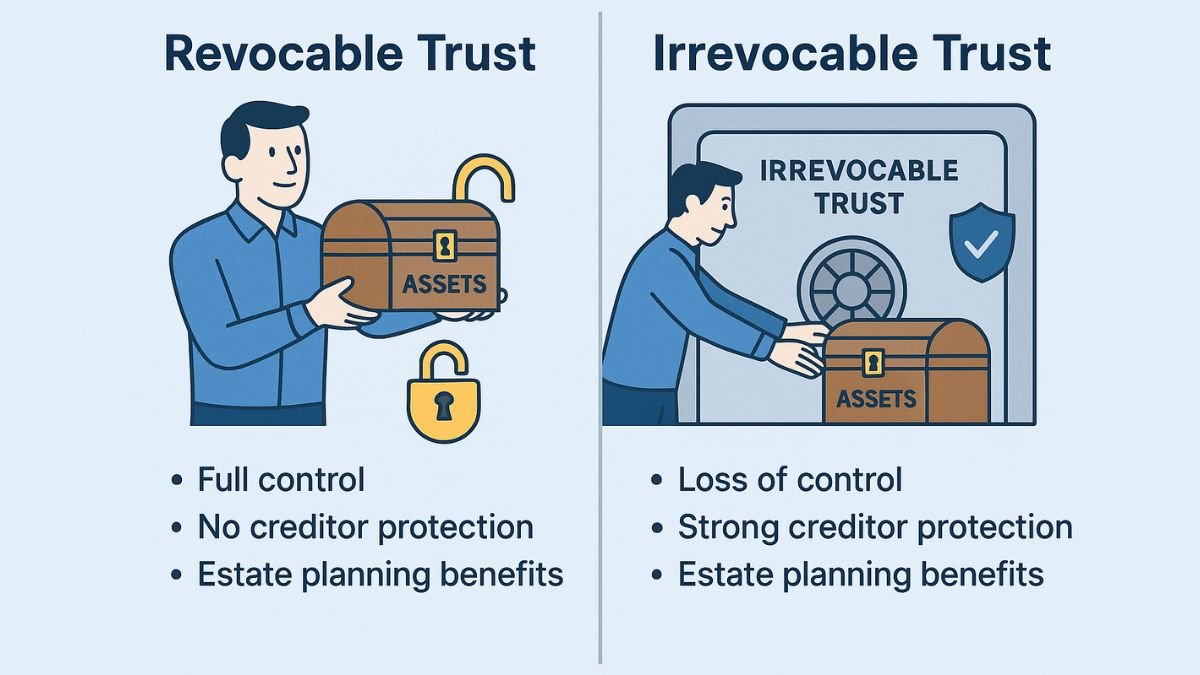

Trusts are foundational tools in asset protection planning, but not all trusts offer the same level of security.

- A revocable trust allows you, the settlor, to maintain full control over the assets and make changes at any time. While this is helpful for estate planning and avoiding probate, it doesn’t offer strong protection from creditors or lawsuits.

- An irrevocable trust, on the other hand, involves permanently transferring ownership of the assets to the trust. Once placed in an irrevocable trust, you no longer legally own the assets—which significantly limits their vulnerability to outside claims.

Asset Protection Trusts (APTs): Domestic vs. Offshore

Asset protection trusts are specifically designed to shield wealth from lawsuits and creditor claims. These trusts are highly structured and offer powerful legal safeguards—especially when combined with early planning.

- A domestic APT is established within certain U.S. states that have favorable trust laws, such as Nevada or South Dakota. These trusts can be highly effective, but their success may depend on state-specific rules and court interpretations.

- A foreign APT (also known as an offshore trust) is formed outside the U.S. in jurisdictions with stronger privacy protections and more favorable asset protection laws. These trusts are often harder for U.S. courts to penetrate but may involve more complexity and scrutiny.

Whether domestic or offshore, APTs are often used by high-net-worth individuals seeking the strongest possible legal shield for their assets.

LLCs and Limited Partnerships

Business structures like Limited Liability Companies (LLCs) and Limited Partnerships (LPs) are valuable tools for separating personal and business assets.

- An LLC protects your personal wealth by creating a legal barrier between you and your business. If your company is sued, your limited liability status helps ensure your home, savings, and personal investments aren’t on the line.

- A limited partnership offers a similar structure, where one or more partners have limited liability and limited control over the business, reducing exposure to personal loss.

This is particularly important in business asset protection strategies where company and personal assets must remain distinct.

By using LLCs or corporations, individuals can isolate high-risk business assets from their personal holdings—a smart move for entrepreneurs, landlords, and investors.

Homestead Exemption and Other State Tools

Some states offer unique, built-in forms of protection that can be used as part of a broader strategy.

- The homestead exemption is a state-level law that protects a portion (or in some states, all) of your primary residence from creditors in bankruptcy or judgment cases.

- Other tools may include tenancy by the entirety (for married couples), state-specific exemptions for retirement accounts, and protections for life insurance or annuities.

These exempt assets can offer reliable protection when paired with more advanced legal structures like Medicaid asset protection planning can provide layered defense for your estate and long-term care planning.

Used strategically, these tools help create a multi-layered defense that can protect everything from your home and savings to your business and legacy. With expert guidance from Trust Guru, you can build a custom plan that matches your financial goals and risk profile.

What Asset Protection Can and Cannot Do

Asset protection is a smart, strategic way to shield your wealth from potential risks, but it’s important to understand its boundaries. While the right legal structures can significantly reduce your exposure to threats, asset protection is not a magic wand—and misusing it can lead to serious consequences. Let’s break down what it can realistically achieve and where its limits lie.

What It Legally Protects Against

When implemented correctly and proactively, asset protection can help defend against a range of legal and financial threats. The strategy best suited for you will depend on your specific situation, but most plans aim to:

- Shield assets from future lawsuits – including personal injury, malpractice, or contract disputes

- Prevent creditors from seizing your wealth – especially if business or personal debts go unpaid

- Limit exposure in high-risk professions or ventures – such as real estate investing, healthcare, or consulting

- Safeguard assets during divorce – by keeping certain property separate from marital holdings

- Preserve wealth for future generations – by using income distribution management strategies

Using various strategies—like irrevocable trusts, LLCs, and state exemptions—can help ensure that your assets are legally protected while remaining accessible for your intended purposes.

What It Doesn’t Cover (or May Not Work For)

While asset protection is powerful, there are clear drawbacks if it’s used improperly or applied too late. Here’s what it can’t (and shouldn’t) do:

- It won’t protect assets after a claim has already been filed. Once a legal action is underway, transferring or hiding assets could be considered fraudulent and easily reversed by the courts.

- It doesn’t shield you from criminal or unethical behavior. If the intent is to avoid taxes, cover up illegal activity, or deceive the court, your plan will not hold up. Asset protection is not a tool for tax evasion or hiding assets during bankruptcy.

- It may not work retroactively. If you set up a trust or transfer property too close to a lawsuit or creditor claim, it may be seen as a “fraudulent conveyance,” and courts can undo it.

- It won’t guarantee total immunity. Even with the best planning, aggressive creditors or legal challenges may still succeed in limited circumstances—especially if your strategy was poorly implemented or not maintained.

In short, asset protection is most effective when it’s done early, ethically, and with expert guidance. It’s not about avoiding responsibilities—it’s about preparing responsibly so your hard-earned assets don’t disappear when life takes an unexpected turn. This is why timing and legal oversight—such as legal compliance and risk oversight—are critical.

Choosing the Right Asset Protection Strategy for You

The most effective asset protection plans aren’t one-size-fits-all—they’re tailored to your lifestyle, financial picture, and long-term goals. Whether you’re a business owner, retiree, or working professional, the right approach depends on what you’re protecting, the risks you’re facing, and what you want your future to look like.

Here’s how to start evaluating which strategies make the most sense for you.

Personal Assets vs. Business Assets

One of the first distinctions to make is between personal assets and business assets, as each category may require a different approach.

- Personal assets include your home, personal savings, retirement accounts, investment portfolios, and heirlooms—anything held in your name outside of business activities.

- Business assets include real estate used in your business, company-owned vehicles, equipment, intellectual property, and bank accounts tied to business operations.

The assets included in your protection plan will determine which tools are best suited. For example:

- A living trust or irrevocable trust may be ideal for protecting personal wealth and ensuring smooth estate transfers.

- An LLC or limited partnership is typically the best vehicle for shielding business assets from personal liability.

By separating these asset categories and structuring them appropriately, you minimize risk and increase control.

Factors to Consider: Risk Profile, Profession, and Future Plans

Choosing the right asset protection strategy also requires understanding your risk profile—in other words, how likely you are to face claims or liabilities.

Consider these key factors:

- Your profession: Are you in a high-risk field like medicine, law, real estate, or construction? Professions prone to lawsuits require stronger, more proactive strategies.

- Your financial situation: Do you have significant wealth tied up in real estate or investment accounts? If so, trusts and exemptions can be particularly helpful.

- Your family structure: Are you married, divorced, or supporting children from a prior relationship? If yes, you may need specialized structures to protect certain assets during divorce or inheritance.

- Your future plans: Are you planning to retire, sell a business, or transfer wealth in the near future? Knowing this will help guide the level of protection and flexibility you need.

- The potential cost of inaction: Asset protection can seem costly, but the price of doing nothing—losing your assets to lawsuits, creditors, or probate—can be far greater.

With so many moving parts, the best way to determine the right plan is to consult with a professional who understands your goals, assets, and risks.

Need help deciding? Speak with a Trust Guru advisor today for a personalized asset protection strategy that fits your life and future.

Why Work with Trust Guru for Asset Protection?

When it comes to protecting your assets, choosing the right partner is just as important as choosing the right strategy. At Trust Guru, we combine legal expertise with a client-first approach to make asset protection clear, accessible, and effective—without the risk of confusing processes or one-size-fits-all templates.

Here’s what sets Trust Guru apart:

- Attorney-Reviewed Documents: Every trust and legal structure we provide is carefully crafted and reviewed by experienced attorneys. This ensures your plan is not only compliant, but also that you’re legally entitled to the full protection it offers under current laws.

- Nationwide Legal Acceptance: Whether you’re in California, Texas, Florida, or any other state, our estate planning and asset protection services are designed to meet the legal requirements in all 50 states. That means you can move forward with confidence, knowing your plan is fully enforceable wherever you reside.

- Transparent, Streamlined Process: We believe that asset protection should be simple—not stressful. Our process is fully online, guided by experts, and designed to regulate your wealth in a way that’s easy to understand. No in-person appointments, no legal jargon, and no hidden fees—just a clear path to securing your legacy.

At Trust Guru, we don’t just sell documents—we build strategies. And we’re here to guide you every step of the way, from planning to execution, with personalized support tailored to your unique financial goals.

Ready to protect what matters most? Contact our team or explore our full range of services to get started today.

Frequently Asked Questions (FAQs)

Asset protection refers to a set of legal strategies used to shield your wealth—such as real estate, savings, and business holdings—from potential threats like lawsuits, creditors, divorce, or probate. It works by restructuring legal ownership of your assets through tools like trusts, LLCs, and exemptions. When done proactively and ethically, these strategies create a legal buffer that helps preserve your financial security without hiding or illegally transferring assets.

To protect your assets from lawsuits and creditors, you can use legal structures like irrevocable trusts, asset protection trusts (APTs), and LLCs. These tools reduce your personal liability by either removing your name from legal ownership or separating personal and business assets. The key is to act before a claim occurs—last-minute transfers can be considered fraudulent and won’t hold up in court.

A living trust (also called a revocable trust) is typically used for estate planning to avoid probate, but it doesn’t offer strong asset protection because the settlor retains control of the assets. An asset protection trust, on the other hand, is an irrevocable trust specifically designed to shield assets from legal claims and creditor actions. It requires giving up legal ownership while still allowing you to benefit from the assets, depending on how it’s structured.

Yes, asset protection is entirely legal in the U.S.—as long as it’s done proactively and ethically. Courts recognize your right to arrange your assets in a way that minimizes legal exposure. However, trying to transfer assets after a lawsuit or creditor claim has already been filed may be considered fraudulent and reversed. That’s why timing and expert guidance are crucial.

The best time to start asset protection planning is before you need it. Once a legal issue or creditor claim is underway, your options are limited and may not hold up in court. Early planning—especially before launching a business, acquiring property, or entering a high-risk profession—allows you to legally shield your assets and reduce future exposure without the risk of legal complications.