When it comes to protecting your assets and securing your family’s future, understanding living trust benefits is essential. A living trust offers more than just peace of mind—it can help you avoid probate, streamline the distribution of your estate, and ensure your wishes are honored with minimal legal hassle.

In this guide, we’ll break down the most important advantages of a living trust in simple, practical terms. Whether you’re planning for retirement, safeguarding your legacy, or just exploring your estate planning options, this article will help you make informed decisions with confidence.

What you’ll learn:

- What Is a Living Trust?

- Why Consider a Living Trust?

- 7 Key Benefits of a Living Trust

- Who Should Consider a Living Trust?

- Common Misconceptions About Living Trusts

- How to Set Up a Living Trust the Right Way

- Living Trust vs Will: Which Is Right for You?

- Final Thoughts: Secure Your Legacy with Confidence

What Is a Living Trust?

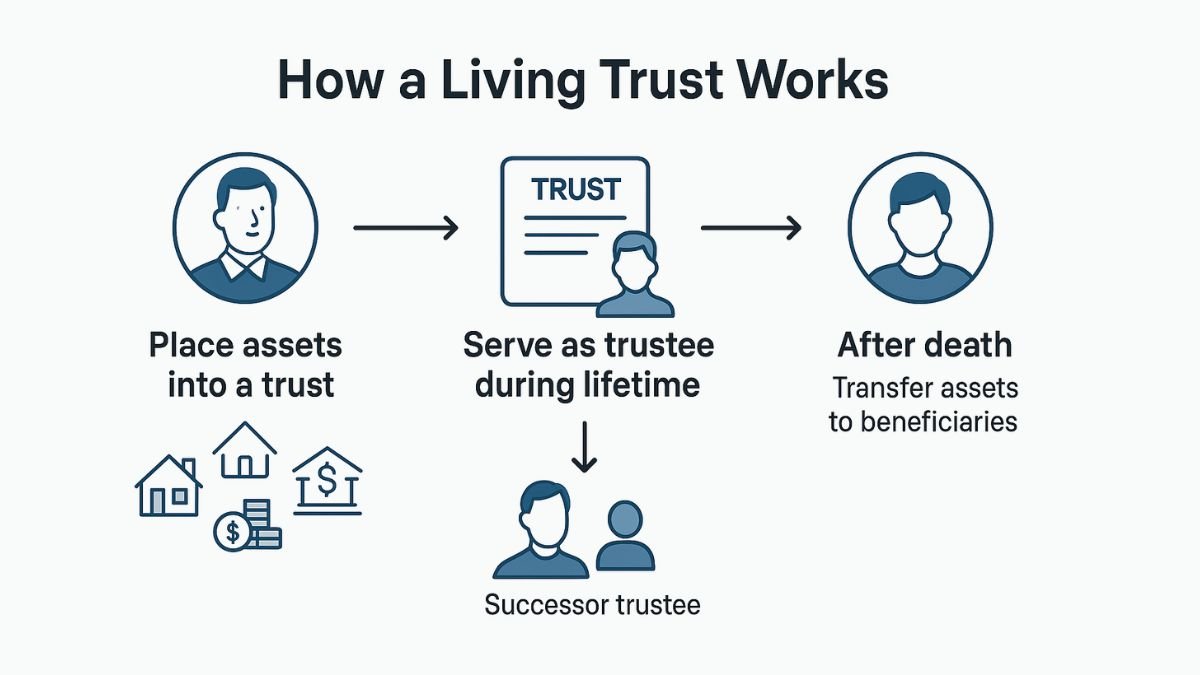

A living trust is a legal document that allows you to place your assets—such as your home, bank accounts, or investments—into a trust during your lifetime, and then transfer those assets to your chosen beneficiaries after you pass away.

Unlike a will, which only takes effect after death, a living trust goes into effect while you’re still alive, giving you greater control over how your estate is managed both now and in the future. To learn more about the structure and purpose of these documents, visit this overview on living trusts.

With a living trust, you typically serve as the trustee (the person who manages the trust) while you’re alive, and you name a successor trustee to step in when you’re no longer able to manage things yourself—due to illness, incapacity, or death.

This structure helps your family avoid the delays and costs of probate, while ensuring your wishes are carried out smoothly and privately. To learn more about the structure and purpose of these documents, visit this overview on living trusts.

Revocable vs. Irrevocable Trusts

There are two main types of living trusts: revocable and irrevocable.

- Revocable Living Trust: This is the most common option for comprehensive estate planning. It allows you to retain full control over your assets—you can change beneficiaries, add or remove assets, or dissolve the trust entirely if your circumstances change.

- Irrevocable Living Trust: Once established, this type of trust cannot be changed without the approval of the beneficiaries. It’s often used for advanced tax strategies or asset protection trusts, particularly in cases involving high-value estates or potential legal exposure. You can read more about this in this explanation of revocable vs. irrevocable trusts.

For most individuals and families, a revocable living trust offers the flexibility and peace of mind needed for day-to-day estate planning.

How a Living Trust Differs from a Will

A common question is whether a living trust replaces the need for a will. The answer is: not entirely—but they serve different purposes.

| Feature | Living Trust | Will |

| Takes Effect When? | While you’re alive and after death | Only after death |

| Goes Through Probate? | No | Yes |

| Public Record? | No (keeps your affairs private) | Yes (wills become public record) |

| Covers Incapacity? | Yes (names someone to manage assets) | No (only handles matters after death) |

| Ease of Asset Transfer | Faster, avoids court delays | Slower, must go through probate |

A well-rounded estate plan often includes both a living trust and will drafting services, especially for naming guardians for minor children or covering assets not titled in the trust.To further compare these documents, see this helpful breakdown of a living trust vs. will.

Key takeaway: A living trust gives you greater control, privacy, and efficiency over your estate, both during your life and after. It’s a flexible solution designed to protect what you’ve built and make life easier for those you love.

Why Consider a Living Trust?

Creating a living trust isn’t just about managing wealth—it’s about removing unnecessary burdens from your loved ones and ensuring your wishes are carried out efficiently.

For many families, a living trust becomes one of the most valuable tools in their estate planning toolkit, offering protection not just for assets, but for relationships and peace of mind.

Let’s explore why more individuals are turning to living trusts as a smarter, more secure way to plan for the future.

Avoiding Probate and Legal Delays

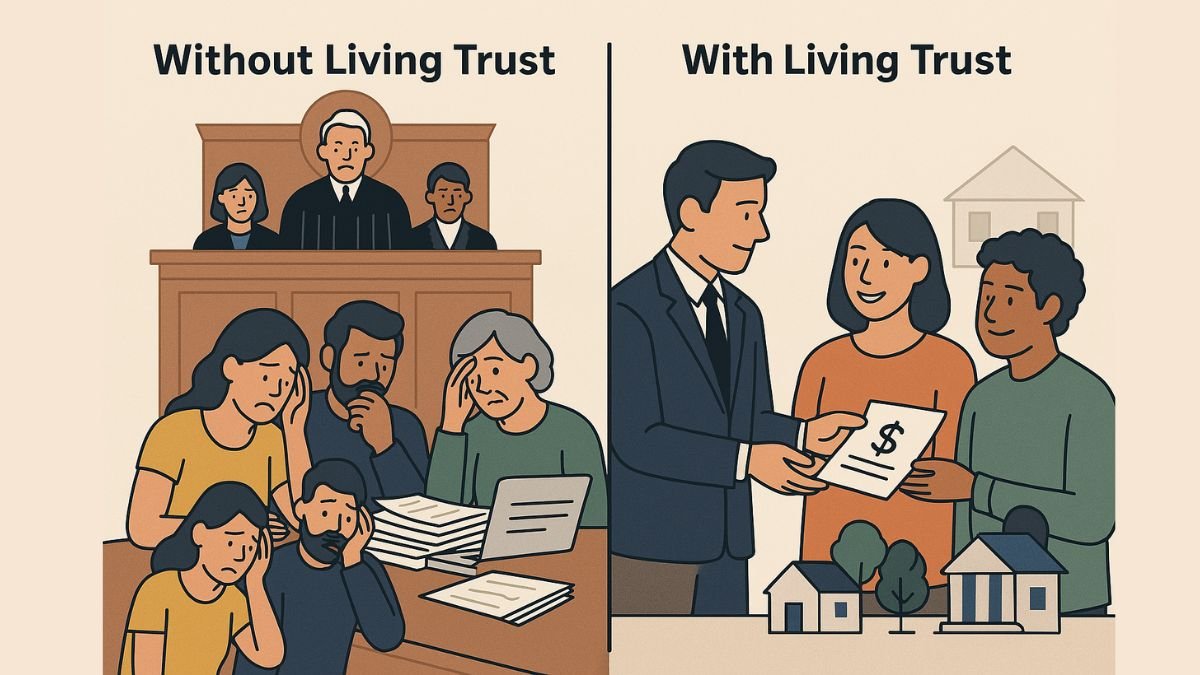

One of the most compelling reasons to create a living trust is to avoid probate, the court-supervised process of distributing your assets after death. Probate can be time-consuming, expensive, and emotionally taxing for your heirs—often taking months or even years to resolve. Here’s how the probate process works.

With a living trust, your assets are already assigned to beneficiaries and managed by a successor trustee, which means there’s no need for court intervention. The transition happens privately and efficiently, often within weeks—not months. This means your loved ones can access what they need without unnecessary legal hurdles or delays.

Real-world example: Imagine your spouse needing access to joint savings or your children needing funds for immediate expenses. With a living trust, they won’t be stuck waiting for probate approval.

Reducing Stress on Heirs (emotional benefit)

Losing a loved one is hard enough. The last thing families want during a time of grief is to deal with legal complexity, court appointments, or uncertainty about “who gets what.”

A living trust helps eliminate confusion and conflict by clearly outlining your wishes. Your appointed trustee is legally obligated to follow your instructions, helping prevent disagreements between family members. This structure promotes harmony and reduces the emotional weight placed on your heirs during an already difficult time.

Benefit highlight: Heirs can focus on healing and honoring your legacy—not sorting through paperwork or contesting decisions.

Keeping Your Estate Private

Unlike wills, which become public record once filed in probate court, living trusts are completely private. That means the details of your estate—what you own, who gets what, and how much—is kept confidential.

This privacy not only protects your beneficiaries but also reduces the risk of disputes or opportunistic claims from outsiders. It’s a powerful benefit for anyone who values discretion, especially families with complex dynamics or high-value estates.

Bonus: A private trust can help protect your family’s financial security and shield them from unwanted attention through real estate protection strategies.

Key takeaway: A living trust allows you to bypass court delays, preserve family harmony, and protect your privacy—all while ensuring your estate is managed exactly the way you intend. It’s a proactive step that simplifies the future for everyone you care about.

7 Key Benefits of a Living Trust

A living trust isn’t just a legal document—it’s a strategic tool designed to protect your assets, reduce stress for your family, and preserve your legacy. Below are seven core benefits that make living trusts a smart choice for many individuals and families.

Avoiding Probate

Perhaps the most well-known benefit, a living trust allows your estate to bypass the probate process, which can be lengthy, costly, and public. Assets held in a trust can be transferred directly to your beneficiaries without court involvement, saving your loved ones time, legal fees, and emotional strain.

Quick tip: Probate can take months—or even years—in some states. A living trust can reduce this process to just weeks.

Protecting Your Privacy

Unlike wills, which become public record, a living trust remains entirely private. That means the details of your estate, including who inherits what and how much, stay confidential. This privacy is especially valuable for high-net-worth individuals, blended families, or anyone who values discretion.

Privacy matters: A living trust shields your family from potential disputes and protects your estate from outside scrutiny.

Ensuring Faster Distribution of Assets

With a living trust, your successor trustee can step in immediately after your passing and begin distributing assets according to your instructions—no court delays required. This means your family can access funds, property, or accounts when they need them most.

Real-life example: Your family won’t have to wait months for a court to release funds to cover mortgage payments or daily expenses.

Minimizing Legal Complications

Because your living trust outlines your wishes clearly and names a successor trustee, it reduces the chance of legal disputes or challenges to your estate. This clarity can help prevent confusion, delays, and potential lawsuits among heirs or other interested parties.

For added protection, many individuals also consider legal compliance and risk oversight services to further mitigate risks.

Benefit highlight: A clear, legally binding trust can help your family avoid costly disagreements or misunderstandings.

Supporting Incapacity Planning

A living trust isn’t just useful after death—it also provides protection during your lifetime. If you become ill or incapacitated, your successor trustee can manage your assets on your behalf without court intervention. This ensures seamless financial continuity without the need for a court-appointed guardian or conservator.

This ties closely with establishing healthcare directives and powers of attorney to ensure your medical and financial decisions are also accounted for.

Peace of mind: You stay in control while you’re able, and your loved ones are protected if you can’t manage things yourself.

Reducing Family Conflicts

Unclear estate plans often lead to tension, resentment, or even legal battles between family members. A well-structured living trust provides transparency and eliminates ambiguity, helping reduce the potential for arguments or confusion during a sensitive time.

Emotional benefit: Your family can focus on healing—not fighting over your wishes.

Multi-Generational Wealth Protection

Living trusts can be designed to protect and preserve wealth across generations. You can establish timelines, conditions, or age-based distributions to ensure your assets are used wisely. Some trusts also include creditor protections for beneficiaries, helping safeguard your legacy long after you’re gone.

In more complex family or wealth scenarios, you may also want to consider beneficiary education resources to help prepare future generations to manage their inheritance wisely.

Legacy-focused: With the right structure, your living trust can support not just your children—but your grandchildren and beyond.

Key takeaway: A living trust offers more than legal protection—it provides clarity, control, and peace of mind for you and your loved ones. These seven benefits make it a powerful tool for anyone serious about protecting their estate and ensuring a smooth transition of wealth.

Who Should Consider a Living Trust?

While living trusts are commonly associated with wealthy families or large estates, the truth is—they can benefit a wide range of individuals. If you own property, have investments, or simply want more control over your estate, a living trust can be a practical and protective choice.

Here are a few scenarios where setting up a living trust makes particular sense:

Planning for Retirement

As you approach retirement, it’s important to ensure your assets are structured for long-term security and a smooth transfer to your heirs. A living trust allows you to plan proactively—so that your spouse, children, or other loved ones won’t face delays or legal stress if something happens to you.

This planning can include Medicaid asset protection planning to ensure long-term care eligibility doesn’t jeopardize your estate.

Why it matters: Retirees often shift their focus from growing wealth to preserving and distributing it wisely. A living trust offers clarity and control for that transition.

Blended or Large Families

In blended families, estate planning can be especially sensitive. You may want to ensure children from a previous marriage are provided for, while also protecting your current spouse’s financial future. For marital asset protection, you might explore prenuptial and postnuptial trusts to add clarity and legal strength.

A living trust allows you to customize how your estate is distributed, minimizing the risk of disputes and ensuring that everyone is treated according to your wishes.

Emotional benefit: It reduces potential conflict by making your intentions crystal clear—something that’s especially valuable in complex family structures.

High-Value Assets or Multiple Properties

If you own multiple homes, rental properties, or significant investments, a living trust makes it easier to manage and transfer those assets. Without a trust, each property might require separate probate proceedings, especially if they’re located in different states.

To take it a step further, our team also supports trust funding assistance to ensure all assets are correctly titled within your trust—an essential but often overlooked step.

Efficiency tip: A living trust can consolidate and streamline the process, saving your heirs time and thousands in legal fees.

Business Owners & Entrepreneurs

If you own a small business or hold an ownership stake in a company, a living trust can be vital to your succession plan. Pair it with business succession planning to ensure seamless continuity of leadership and operations. In addition, business asset protection strategies can help shield those holdings from future liability.

Scenario: Imagine a local business owner passes unexpectedly. Without a living trust, their family could face months of probate and uncertainty about who can access accounts or make decisions. With a trust in place, their successor trustee can step in immediately, keeping the business running and protected.

Bonus: This is especially important if your business is family-run or tied closely to your personal identity and income.

Key takeaway: A living trust isn’t just for the wealthy—it’s for anyone who wants to reduce stress, avoid probate, and protect what they’ve worked hard to build. Whether you’re entering retirement, managing a blended family, or running a business, a living trust offers the flexibility and peace of mind your situation deserves.

Common Misconceptions About Living Trusts

Despite their many advantages, living trusts are often misunderstood. These misconceptions can prevent individuals from taking advantage of one of the most effective estate planning tools available. Let’s clear up some of the most common myths—so you can make informed decisions with confidence and clarity.

“Isn’t a Will Enough?”

It’s a fair question. A will does allow you to name beneficiaries and outline your final wishes. But unlike a living trust, a will must go through probate, the court-supervised process that can delay asset distribution and create added stress for your family.

A living trust bypasses probate entirely, offering faster, private, and more efficient asset transfer. And while you may still need a simple “pour-over will” to cover any assets not titled in the trust, relying on a will alone often means leaving your loved ones with more legal red tape than necessary.

Clarification: A will is important—but it’s not enough if you want to avoid probate and keep your estate affairs private.

“Trusts Are Only for the Rich”

This is one of the biggest myths in estate planning. In reality, anyone who owns property, savings, or investments can benefit from a living trust—regardless of net worth.

Middle-income families, small business owners, and retirees use living trusts every day to simplify the transfer of assets and protect their legacy. Many also explore charitable trust solutions to extend their impact beyond family. The cost of probate (which a trust helps avoid) can far exceed the cost of setting up a trust, making it a smart financial move for many.

Reassurance: Living trusts aren’t about how much you own—they’re about making sure what you do own is protected and passed on efficiently.

“It’s Too Complicated”

Legal terms like “trustee” and “beneficiary” can sound intimidating, but the actual process of creating a living trust can be surprisingly simple—especially with a guided service like Trust Guru homepage.

Our process walks you through each step in plain language. You don’t need to be a lawyer or financial expert to get it done. In fact, many of our clients are relieved at how easy and stress-free it is to set up a legally sound, personalized trust.

Helpful note: When done right, a living trust simplifies your life—not complicates it.

Key takeaway: Don’t let outdated myths hold you back. Living trusts are not just for the wealthy, they’re not overly complex, and they offer benefits that a will alone simply can’t match. With the right guidance, setting one up is easier—and more worthwhile—than you might think.

How to Set Up a Living Trust the Right Way

Creating a living trust might sound like a complex legal task—but with the right support, it can be a smooth, straightforward experience. At Trust Guru, we’ve simplified the process to make estate planning easy, efficient, and fully customized to your needs.

Here’s how to set up a living trust the right way, step by step:

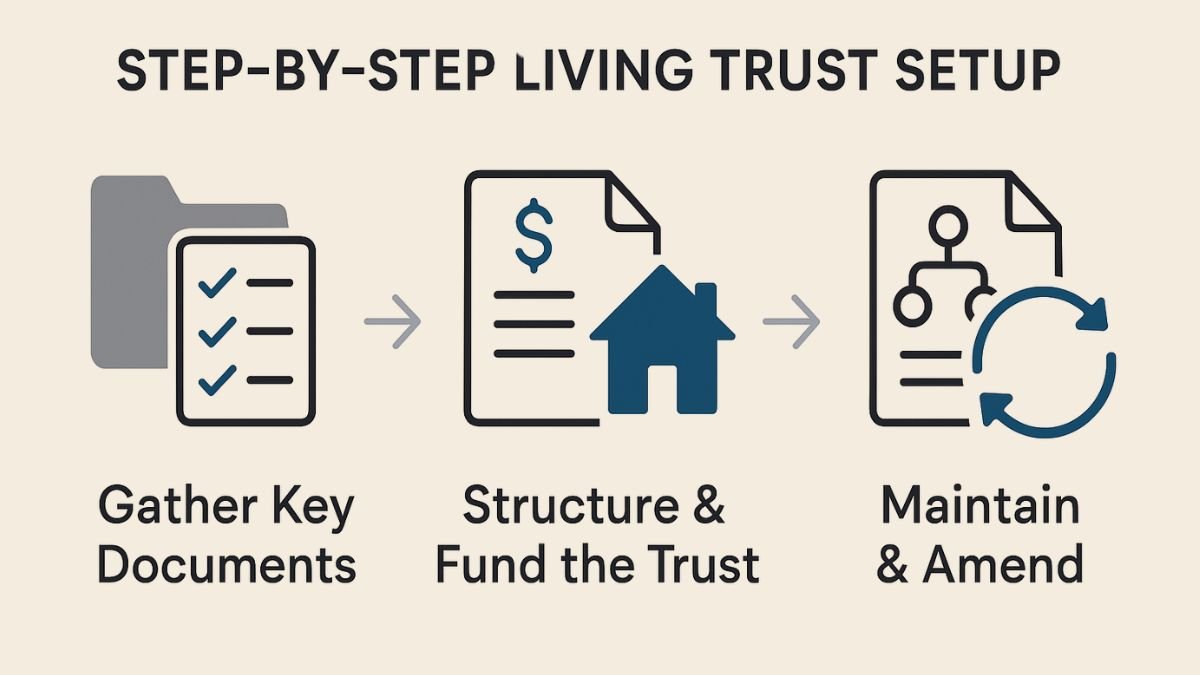

Gathering Key Documents

The first step is collecting the essential information needed to build your trust. This includes:

- A list of your assets (real estate, bank accounts, investments, etc.)

- Names of your beneficiaries

- Selection of a successor trustee—someone you trust to manage the trust when you’re no longer able

- Identification documents and any existing estate planning materials

Trust Guru makes this step easy with a secure, guided questionnaire you can complete from the comfort of your home.

Pro tip: The more organized your documents, the faster and more personalized your trust setup can be.

Structuring and Funding the Trust

Once the details are gathered, the next step is to structure the trust—deciding how your assets will be managed and distributed. This includes drafting the trust document and clearly outlining instructions for your trustee.

Then comes funding the trust, which means legally transferring ownership of your assets into the trust. This might involve updating deeds, account titles, or beneficiary designations. Don’t worry—Trust Guru provides clear guidance and attorney-reviewed documents to ensure everything is handled properly. If you own online assets, digital asset trust planning ensures your online presence and digital holdings are protected too.

Why it matters: A trust that isn’t properly funded won’t work as intended. Trust Guru ensures no detail is overlooked.

Maintaining and Amending as Needed

Life changes—your trust should too. Whether you welcome a new grandchild, buy a new property, or change your mind about a beneficiary, it’s important to keep your trust up to date.

With Trust Guru, you can easily amend or restate your trust to reflect life’s transitions. Our team helps you keep your estate plan current, so your legacy stays protected no matter what the future holds.

Flexibility bonus: A revocable living trust allows you to make changes at any time, offering both control and peace of mind.

Living Trust vs Will: Which Is Right for You?

When planning your estate, one of the most common questions is whether to create a will, a living trust, or both. While each has its place in a solid estate plan, they serve different purposes—and understanding those differences can help you choose what’s best for your situation.

Let’s take a closer look at when each option makes sense.

When a Will Might Be Enough

A last will and testament is a foundational estate planning document. It allows you to:

- Name guardians for minor children

- Specify who inherits your assets

- Appoint an executor to carry out your wishes

For individuals with minimal assets, no real estate, and straightforward wishes, a will may be sufficient. It’s also essential for covering any personal items or assets not included in a living trust.

Keep in mind: A will must go through probate, which can delay distribution and expose your affairs to the public.

When a Living Trust Makes More Sense

If your goals include avoiding probate, ensuring privacy, or simplifying asset distribution, a living trust is often the better choice. It allows your assets to pass directly to beneficiaries without court involvement, which can save time, money, and stress for your loved ones.

A living trust may be ideal if you:

- Own real estate or multiple properties

- Have significant financial or investment accounts

- Want to avoid family disputes or legal delays

- Are planning for incapacity or long-term care

- Own a business or have complex family dynamics

Bonus: Living trusts also offer greater flexibility, allowing you to make updates as your life circumstances evolve.

Comparison Table: Will vs Living Trust

| Feature | Will | Living Trust |

| Takes effect | After death | Immediately upon signing |

| Requires probate | Yes | No |

| Becomes public record | Yes | No |

| Covers incapacity | No | Yes |

| Distribution of assets | Delayed (via probate) | Faster and more direct |

| Ability to make updates | Yes | Yes (if revocable) |

| Suitable for simple estates | Yes | May not be necessary |

| Best for privacy and flexibility | No | Yes |

Key takeaway: A will is a vital part of your estate plan—but a living trust offers more privacy, flexibility, and efficiency, especially if your financial life or family situation is more complex. For many people, the best strategy includes both tools working together to fully protect their legacy.

Final Thoughts: Secure Your Legacy with Confidence

Planning for the future may feel overwhelming—but it doesn’t have to be. A living trust offers you the clarity, control, and protection you need to make confident decisions about your estate.

From avoiding probate and reducing stress on your loved ones to ensuring your wishes are honored privately and efficiently, the benefits of a living trust are both practical and deeply personal.

Whether you’re preparing for retirement, managing a blended family, or simply want peace of mind knowing your legacy is secure, a living trust empowers you to take charge of your future today. Explore our full range of services or contact our team to get started with a free consultation.

At Trust Guru, we’re here to guide you through every step—without the complexity or pressure. Our expert-reviewed, client-first approach makes estate planning simple, approachable, and tailored to your unique needs.

Ready to protect what matters most?

Book your free consultation with Trust Guru and take the first step toward securing your legacy with confidence.

Frequently Asked Questions About Living Trusts

Yes. Even with a living trust, it’s important to have a “pour-over will” in place. This type of will acts as a safety net to catch any assets not formally transferred into your trust during your lifetime. It ensures that everything you own is ultimately distributed according to your wishes—even if something was unintentionally left out of the trust.

Assets held in a living trust are owned by the trust—not the individual. When the trust creator passes away, the successor trustee can distribute the assets directly to beneficiaries without going through probate court. This speeds up the process, avoids costly legal fees, and keeps your estate matters private.

It depends on your needs. A will is sufficient for simple estates or naming guardians for minor children. A living trust is typically the better choice for those with property, multiple assets, complex family dynamics, or a desire to avoid probate. In many cases, the best estate plan includes both tools working together.

Absolutely. If you create a revocable living trust, you can amend or restate it at any time—as long as you’re mentally competent. Life changes like marriage, divorce, births, or new assets may all require updates to your trust. Trust Guru makes it easy to keep your trust current and legally sound.