Choosing the right type of trust can feel overwhelming—especially when you’re planning for a loved one with special needs. If you’re weighing a special needs trust vs living trust, it’s important to understand how each one works and which offers the right protections for your family’s unique situation.

This article breaks down the key differences between these two trusts in simple, practical terms—so you can make confident estate planning decisions without the legal guesswork.

What You’ll Learn:

- What Is a Special Needs Trust?

- What Is a Living Trust?

- Key Differences Between Special Needs Trusts and Living Trusts

- Which Trust Is Best for a Disabled Child?

- Can You Use Both Trusts Together?

- Talk to an Expert About the Right Trust for Your Family

- Frequently Asked Questions

Let’s start by looking at what a special needs trust actually is.

What Is a Special Needs Trust?

A special needs trust is a specific type of legal arrangement designed to protect the financial future of individuals with physical or cognitive disabilities—without jeopardizing their eligibility for essential government benefits such as Supplemental Security Income (SSI) or Medicaid.

Unlike a standard trust, the special needs trust is carefully structured so that assets held within it do not count toward the beneficiary’s personal resource limits.

This is crucial because many public assistance programs impose strict financial thresholds, and even a modest inheritance or gift could disqualify someone from receiving vital support. The special needs trust offers a way to supplement, not replace, these benefits. Learn more about Medicaid eligibility policies and resource limits directly from the source.

Key Features

A well-crafted special needs trust includes the following core features:

- Preserves government benefit eligibility

The trust is legally recognized as a separate entity, which allows funds to be used for the beneficiary’s supplemental needs—such as education, therapies, recreation, or out-of-pocket medical expenses—without interfering with SSI or Medicaid. This is especially useful when combined with Medicaid asset protection planning. For a detailed breakdown of what’s considered appropriate, refer to this guide on what a special needs trust can pay for. - Managed by a trustee

A designated trustee oversees how the trust funds are used, ensuring that spending aligns with program guidelines. This protects the beneficiary while providing peace of mind to the family. Families may also benefit from trustee support services to help navigate this responsibility. - Tailored to long-term support

Special needs trusts are typically designed to last the lifetime of the beneficiary, providing consistent financial assistance and oversight throughout their adult years.

Who It’s For

This type of trust is best suited for individuals who:

- Have a diagnosed disability that qualifies them for means-tested government programs

- May not have the capacity to manage finances independently

- Need structured, long-term financial support beyond what public assistance provides

Real-Life Example:

Consider the story of Mark and Lisa, parents of a 27-year-old son named Ryan, who has autism and receives SSI and Medicaid. Rather than leaving assets directly to Ryan—which could disqualify him from these programs—they chose to set up a special needs trust. Now, Ryan has access to funds for life enrichment services, dental care, and transportation, while still maintaining his vital government benefits.

Takeaway:

A special needs trust offers a powerful, compassionate solution for families who want to secure their loved one’s future while preserving access to essential public assistance programs.

What Is a Living Trust?

A living trust, often called a revocable living trust, is a popular estate planning tool that allows you to manage and distribute your assets both during your lifetime and after your death—without the need for probate court proceedings. Unlike a will, which only takes effect after you pass away, a living trust is active while you’re still alive and fully amendable at any time. You can find a more technical breakdown of these trusts in this overview from Nolo.

This flexibility makes it especially valuable for individuals or families looking to maintain control over their estate, simplify the transfer of assets, and reduce the stress on heirs during an already emotional time.

Key Features

A revocable living trust offers several important benefits:

- Avoids probate

When assets are placed in a living trust, they pass directly to beneficiaries without going through probate. This can save time, legal fees, and preserve privacy for the family—a major reason many clients seek trust funding assistance. If you’re exploring options, it’s helpful to understand the cost to set up a living trust, as it can vary depending on your estate’s complexity. - Flexibility during your lifetime

As the grantor (creator of the trust), you retain full control. You can change beneficiaries, add or remove assets, or dissolve the trust entirely if your circumstances or wishes change. - Continuity in case of incapacity

If you become unable to manage your affairs, your successor trustee can step in seamlessly to manage the trust on your behalf—avoiding the need for a court-appointed guardian or conservator. This is an important benefit when paired with proper healthcare directives and powers of attorney.

When It’s Typically Used

A living trust is commonly used when:

- You want to avoid probate for your family after your passing

- You own real estate in multiple states—especially if considering real estate protection strategies

- You desire more privacy and control over how and when your assets are distributed

- You’re planning for incapacity and want to simplify future transitions

Takeaway:

A living trust is a versatile and powerful option for managing your estate—providing flexibility while you’re alive and streamlining the process for your loved ones after you’re gone.

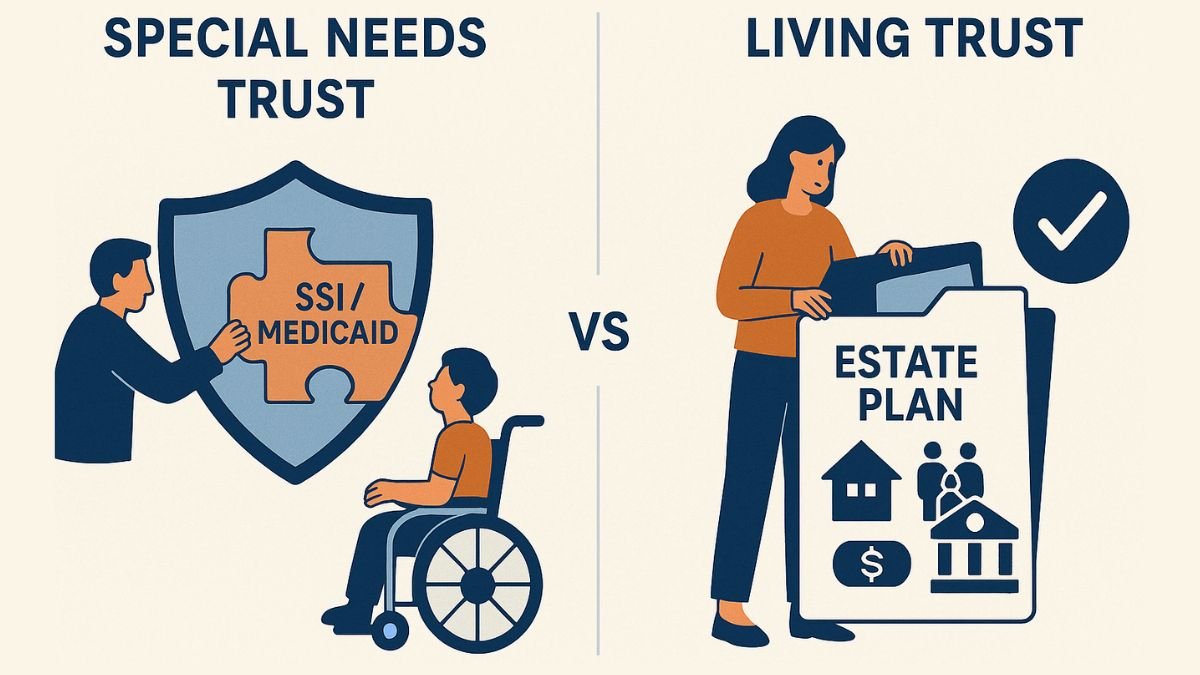

Key Differences Between Special Needs Trusts and Living Trusts

While both special needs trusts and living trusts serve important roles in estate planning, they are built for very different purposes. Understanding these differences is essential for choosing the right solution—especially when planning for a loved one with a disability.

This comparison makes it clear: a special needs trust is tailored to protect a vulnerable loved one’s access to essential benefits, while a living trust offers flexibility and simplicity for more traditional estate planning needs.

Below is a side-by-side comparison to help you quickly see how each trust functions and when one might be more appropriate than the other:

Comparison Table

| Feature | Special Needs Trust | Living Trust |

| Beneficiary Purpose | Designed for individuals with disabilities who need lifelong financial support | Designed for general beneficiaries such as spouses, children, or heirs |

| Medicaid Eligibility | Preserves eligibility for SSI and Medicaid by not counting trust assets as personal funds | Assets in the trust may disqualify a disabled beneficiary from public benefits |

| Revocability | Typically irrevocable (cannot be changed once funded) | Revocable (can be changed, amended, or dissolved by the grantor at any time) |

| Control | Managed by a trustee with strict rules on distributions | Managed by the grantor during their lifetime, then by a successor trustee |

| Use Cases | Ideal for parents or guardians of individuals with special needs | Ideal for general estate planning and probate avoidance |

This comparison makes it clear: a special needs trust is tailored to protect a vulnerable loved one’s access to essential benefits, while a living trust offers flexibility and simplicity for more traditional estate planning needs.

Takeaway:

Choosing between these two trusts comes down to your goals—whether you’re protecting a loved one’s public benefits or simply streamlining your estate. In some cases, using both together may offer the most complete solution.

Which Trust Is Best for a Disabled Child?

When planning for a child with a disability, your choice of trust carries more than just financial weight—it impacts their future quality of life, access to essential benefits, and long-term stability.

Many parents wonder: Is a special needs trust or a living trust the better option for my child? The answer depends on your goals, but in most cases, a special needs trust is the better fit when protecting eligibility for government programs is a priority.

Why a Special Needs Trust Is Often the Right Choice

A special needs trust (SNT) is specifically designed to support individuals with disabilities without disqualifying them from programs like SSI or Medicaid. Here’s why it’s often the preferred option:

- Protects access to public benefits

Funds in an SNT are not considered the beneficiary’s personal assets, so they won’t interfere with benefit eligibility. - Provides ongoing support

The trust can pay for a wide range of services and needs—education, therapies, transportation, recreation—enhancing the child’s quality of life without affecting their benefits. - Managed with oversight

A trustee is responsible for making decisions in the child’s best interest, providing structure, accountability, and peace of mind for the family.

Example: Imagine a parent, Emily, setting up a special needs trust for her daughter Lily, who has Down syndrome and receives Medicaid. With this trust, Emily ensures Lily can enjoy enrichment activities, personal care assistance, and occasional travel—without ever risking her access to healthcare or SSI.

When a Living Trust Might Still Be Useful

Although a special needs trust is essential for protecting benefits, a living trust can still play an important role in the overall estate plan:

- Asset funneling tool

A living trust can direct specific assets into a special needs trust upon your passing, ensuring seamless transition and proper funding. For step-by-step guidance, visit our article on how to set up a living trust. - Broader estate planning

If you’re planning for multiple heirs—including a disabled child—your living trust can manage assets for the entire estate while designating the SNT as one of the beneficiaries. Learn more about our full range of services to support complex family planning needs.

Quick Decision-Making Checklist

Use this guide to assess which trust is appropriate for your situation:

- Does your child receive SSI or Medicaid?

→ Use a special needs trust to preserve benefits. - Do you need flexibility to change your plan over time?

→ Use a living trust as part of a broader strategy. - Are you planning for multiple children, including one with special needs?

→ Consider using both types of trusts together.

Takeaway:

If your child relies on government assistance, a special needs trust is often essential. However, pairing it with a living trust can provide greater flexibility and control over your full estate—offering the best of both worlds.

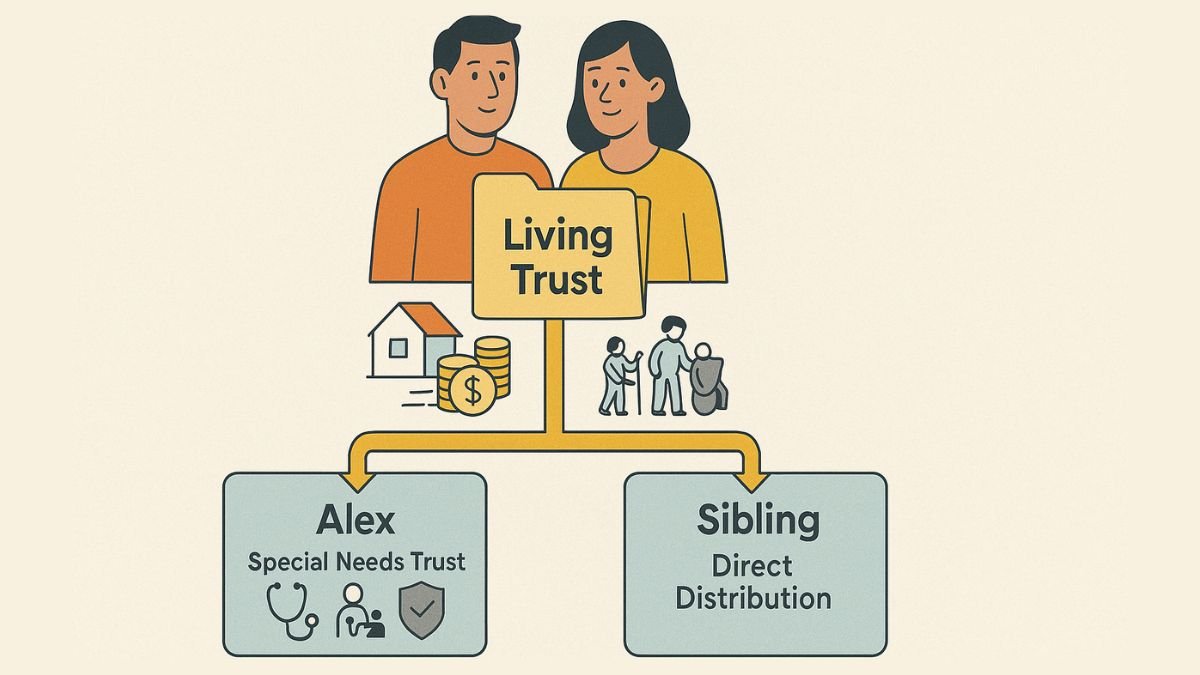

Can You Use Both Trusts Together?

Yes—you can, and often should, use both a living trust and a special needs trust together. While each serves a distinct purpose, combining them creates a more comprehensive, flexible, and protective estate plan—especially when you’re caring for a loved one with a disability while also planning for other beneficiaries.

This strategy allows you to retain full control of your estate during your lifetime while ensuring your disabled child continues to receive vital support after your passing.

Layered Planning

In many estate plans, the living trust acts as the primary container for your assets. Upon your death, it can be designed to automatically transfer a portion of those assets into a special needs trust for the benefit of your disabled child. This layered approach ensures continuity, clarity, and legal protection.

Example:

John and Maria have two children—one of whom, Alex, has a cognitive disability and receives Medicaid. Through their estate plan, they set up a revocable living trust that manages all their assets while they’re alive. Within that trust, they specify that upon their passing, a portion of their estate will be used to fund a special needs trust for Alex. This setup ensures Alex receives ongoing support—without disrupting his benefits—while the rest of the estate is distributed to his sibling through the same living trust.

This approach simplifies asset distribution and ensures every child is cared for according to their specific needs.

Legal and Financial Considerations

Because these trusts serve different legal functions, professional guidance is essential. Improperly drafted documents or asset transfers could jeopardize benefit eligibility or lead to unintended consequences.

A qualified estate planning attorney or trust specialist can help ensure:

- Your living trust clearly references and coordinates with the special needs trust

- All beneficiary designations align with your estate goals

- Assets are properly titled and funded to avoid probate or legal disputes

- Distributions comply with federal and state benefit rules

Takeaway:

Using a living trust and a special needs trust together offers the strongest combination of flexibility, protection, and peace of mind—especially when your estate plan must meet the needs of both a disabled child and other heirs. A well-crafted, integrated plan ensures nothing is left to chance.

Talk to an Expert About the Right Trust for Your Family

Choosing between a special needs trust and a living trust—or knowing how to use both—can feel overwhelming. But you don’t have to make these decisions alone.

At Trust Guru, we specialize in helping families create customized estate plans that reflect their unique circumstances and long-term goals. Whether you’re caring for a child with disabilities, planning for multiple heirs, or simply want to avoid legal complications down the road, our team offers clear, compassionate guidance every step of the way.

We know how important it is to protect your loved one’s future—without putting their access to essential benefits at risk. That’s why we take the time to understand your needs and build a trust strategy that works for your entire family.

With fast, remote-friendly consultations and a simple process tailored to your life, Trust Guru makes estate planning easier, more affordable, and far less stressful than you might expect.

Takeaway:

When your family’s future is at stake, expert guidance makes all the difference. Schedule a free consultation with Trust Guru today and take the first step toward building a trust that protects what matters most.

Frequently Asked Questions

The key difference lies in purpose and benefit protection. A special needs trust is designed to support a person with disabilities without affecting their eligibility for government programs like SSI or Medicaid. A living trust, on the other hand, is a general estate planning tool that helps avoid probate and manage assets during your lifetime and after death.

Yes. In many estate plans, a living trust includes instructions to fund a special needs trust upon the grantor’s death. This layered approach ensures assets are distributed properly while maintaining your loved one’s benefit eligibility.

If assets from a living trust are distributed directly to your child with special needs, it could impact their eligibility for programs like SSI or Medicaid. To avoid this, it’s best to use the living trust to fund a special needs trust, which keeps those assets separate and protected.

Most special needs trusts are irrevocable, meaning they can’t be changed once established. This is important because it ensures the assets are not considered the beneficiary’s personal property, which helps preserve access to government assistance programs.

The best way to decide is to consider your family’s needs, especially if you’re caring for a loved one with a disability. A special needs trust is usually essential for protecting benefit eligibility, while a living trust can help manage broader estate planning goals. Consulting an estate planning expert can help you choose—or combine—both in a way that works for everyone involved.