When it comes to estate planning, one of the biggest questions people face is how to set up their living trust. With so many living trust setup options available today—ranging from hiring an attorney to using online platforms or going the DIY route—it can be tough to know which path is right for you.

This guide breaks down each method in plain language, comparing the pros, cons, and real-life costs so you can choose the approach that fits your needs, budget, and comfort level. Whether you’re planning ahead for retirement or protecting your family’s future, you’ll walk away with the clarity to move forward confidently.

What you’ll learn:

- Why Choosing the Right Trust Setup Method Matters

- Option 1 – Setting Up a Trust with an Attorney

- Option 2 – Online Trust Services

- Option 3 – DIY Trust Kits

- Comparison Table: Attorney vs. Online vs. DIY

- How to Choose the Right Method for You

- Real-World Examples and Cost Scenarios

- Final Thoughts

- Frequently Asked Questions (FAQs)

First, let’s understand why choosing the right trust setup method really matters.

Why Choosing the Right Trust Setup Method Matters

Setting up a living trust is one of the most important steps you can take to protect your assets and ensure your loved ones are cared for when you’re no longer around. But while deciding what type of trust you need is crucial, how you set up that trust is just as impactful—both in terms of cost and long-term effectiveness.

Many people don’t realize that the method they choose to create their trust can directly influence whether their estate plan is airtight or full of unintended gaps. Whether you go with an attorney, an online platform, or a DIY kit, each option comes with its own trade-offs in complexity, legal validity, cost, and peace of mind.

Here’s why that matters:

- Cost can vary significantly—from under $100 for a DIY option to several thousand dollars for full legal representation. Choosing the wrong method could mean overpaying for your needs—or worse, cutting corners that lead to costly legal issues later. To better understand the financial differences between setup options, check out this breakdown of how much it costs to set up a living trust.

- Complexity plays a role—some estates are simple enough to handle with a digital service, while others (like blended families, special needs planning, or large portfolios) may require customized legal support.

- Legal protection is not guaranteed with every option—attorney-led trusts are usually airtight, while DIY templates may lack the legal nuance or state-specific requirements to hold up in court.

- Your peace of mind matters—estate planning isn’t just about documents. It’s about knowing that what you leave behind will be handled exactly as you intended.

Let’s say you’re a retiree with $1 million in assets and adult children from two marriages. A generic DIY kit might not account for the complexity of your family dynamic, increasing the risk of disputes or missteps.

On the other hand, someone with a modest estate and no dependents might not need a full legal package and could be better served with an online platform that offers some attorney oversight.

Throughout this article, we’ll explore the three most common trust setup options—working with an attorney, using an online trust service, and doing it yourself—so you can determine which route best fits your unique situation.

Option 1 – Setting Up a Trust with an Attorney

Working with an estate planning attorney is the most traditional and comprehensive way to set up a living trust. For individuals with complex financial situations or unique family dynamics, this option provides peace of mind that every legal detail is carefully handled.

While it often comes with a higher price tag, the level of customization and legal oversight can make it well worth the investment.

Pros of Using an Attorney

Choosing an attorney-led approach offers several key benefits:

- Tailored guidance for complex situations: An experienced estate attorney can help you navigate scenarios that off-the-shelf solutions might overlook—like managing trusts for minor children, incorporating special needs provisions, or minimizing estate taxes.

- Confidence in legal accuracy: Attorneys are trained to draft trusts that comply with state laws, reduce the risk of future disputes, and ensure your documents stand up in court.

- Risk mitigation and long-term planning: Beyond setting up your trust, an attorney can help you think through broader estate planning strategies—like funding your trust, updating your will, or naming the right successor trustee.

- Peace of mind: With an attorney at your side, you’re less likely to worry about missing a step, misunderstanding legal language, or making costly mistakes.

Cons of Using an Attorney

Despite its advantages, working with an attorney isn’t for everyone:

- Higher upfront costs: Legal fees typically range from $1,500 to $5,000+, depending on the complexity of your estate and where you live.

- Time and scheduling commitments: The process often involves multiple in-person meetings, paperwork reviews, and follow-ups, which can be time-consuming.

- Not ideal for simple estates: If your estate is straightforward, these services might offer more legal power than you actually need—making them less cost-effective for smaller situations.

Ideal For…

You’ll likely benefit most from an attorney-led trust if:

- You have significant assets or property in multiple states

- Your family structure is blended, complex, or legally sensitive

- You’re including elements like a special needs trust or charitable trust

- You want maximum legal protection and a hands-off, expert-led process

For Example: Jane, 55, a small business owner with $750K in assets and children from a previous marriage, chose an estate attorney to ensure everything was handled carefully. For her, the extra investment meant greater confidence that her wishes would be carried out without conflict or confusion.

If your estate involves more than just checking a few boxes, working with an attorney offers the most thorough and personalized path to building a trust that truly protects your legacy.

Option 2 – Online Trust Services

Online trust platforms have surged in popularity over the past decade, offering a modern, tech-enabled alternative to traditional estate planning. These services aim to make trust creation faster, more affordable, and accessible from the comfort of your home—without sacrificing legal compliance.

For many individuals with relatively straightforward needs, online services strike a smart balance between professional support and cost-effectiveness.

Pros of Online Trust Platforms

Here’s why more people are turning to digital estate planning tools:

- Affordability without cutting corners: Most online services fall in the $300–$800 range, offering substantial savings compared to hiring a private attorney.

- Speed and convenience: You can start and complete the process on your own schedule—often in just a few days. No office visits, no drawn-out back-and-forth.

- Legally compliant in most states: Reputable platforms build their documents to comply with the legal standards of all 50 states, and many include options for electronic signatures and online notarization.

- Guided setup with optional attorney review: Some services offer hybrid models where you can have your documents reviewed by a licensed attorney—giving you added assurance without the full cost of private legal counsel.

Trust Guru offers expert-reviewed digital trusts tailored for your needs—without the traditional law firm price tag. Their service combines the ease of online tools with attorney-backed legal oversight, helping clients navigate estate planning with confidence and clarity.

Cons of Online Trust Platforms

While these platforms are a great fit for many, they’re not perfect for everyone:

- Limited customization for complex needs: If your estate involves advanced tax planning, multiple properties, or intricate family dynamics, you may find the templated approach restrictive.

- Less hands-on support: Although some services offer customer help desks, you won’t get the same level of personal consultation or deep strategic guidance as you would with an attorney.

Ideal For…

Online trust services work best for:

- Tech-comfortable users who prefer a self-service approach with optional help

- Simple to moderately complex estates—like single-family homes, retirement accounts, and a handful of beneficiaries

- Busy professionals or retirees who want fast, cost-effective solutions without navigating legal red tape

Comparison Snapshot: Online Trust Services

| Platform | Estimated Cost | Legal Review Available? | Turnaround Time |

| Trust Guru | $400–$750 | ✅ Included | 3–5 business days |

| Trust & Will | $399+ | ✅ Optional | 1–3 days |

| LegalZoom | $279+ | ✅ Optional | Varies (2–7 days) |

| Quicken WillMaker | $99 (desktop) | ❌ None | Instant (DIY) |

Note: Prices and features are examples only. Always confirm with the provider for up-to-date details.

Online trust platforms offer an ideal middle ground for individuals seeking efficiency, affordability, and legal compliance—without the overwhelm or expense of hiring a private attorney.

Option 3 – DIY Trust Kits

Do-it-yourself (DIY) trust kits are the most budget-friendly option for setting up a living trust. These tools—often available as downloadable templates, fillable PDFs, or even printed booklets—give you full control over the process.

For legally confident individuals with simple estates, DIY kits can seem like an attractive, low-cost way to get started with estate planning. But as with most things, convenience and cost savings come with trade-offs.

Pros of DIY Trusts

There are a few clear reasons why some individuals choose the DIY route:

- Extremely low cost: Many DIY kits cost under $100, and some basic templates can even be found for free. This makes it the most affordable option by far.

- Total control: You complete the process on your own terms—no meetings, no phone calls, and no third-party involvement.

- Quick setup: If you know what you’re doing, you can draft and sign documents in a matter of hours.

Cons of DIY Trusts

Despite the simplicity, there are serious risks to consider:

- High legal risk: Estate law is complex and varies by state. Without professional guidance, it’s easy to make small errors that could render your trust invalid or unenforceable. The IRS FAQs on gift and inheritance tax offer clarity on some overlooked aspects of estate transfers.

- No expert review: There’s no one checking your work. You won’t have a legal expert flag missing steps, vague clauses, or outdated state-specific language.

- Potential for long-term consequences: Mistakes in your DIY trust may not surface until after your death—when it’s too late to fix them. This could lead to probate disputes, delays in asset distribution, or unintended beneficiaries.

Ideal For…

DIY trust kits might work if:

- You have a very simple estate (e.g., one home, one bank account, no dependents)

- You’re legally savvy and confident in your understanding of estate planning documents

- You need a temporary solution while exploring more comprehensive options

For Example: Mike, 40, a single professional with limited assets, used a DIY template to draft a basic trust. It worked well initially, but after getting engaged and purchasing a home, he upgraded to an online trust platform for added legal protection and flexibility.

DIY trust kits offer maximum savings and autonomy, but they carry significant legal risks. They’re best suited for straightforward situations—or as a starting point before transitioning to a more robust solution.

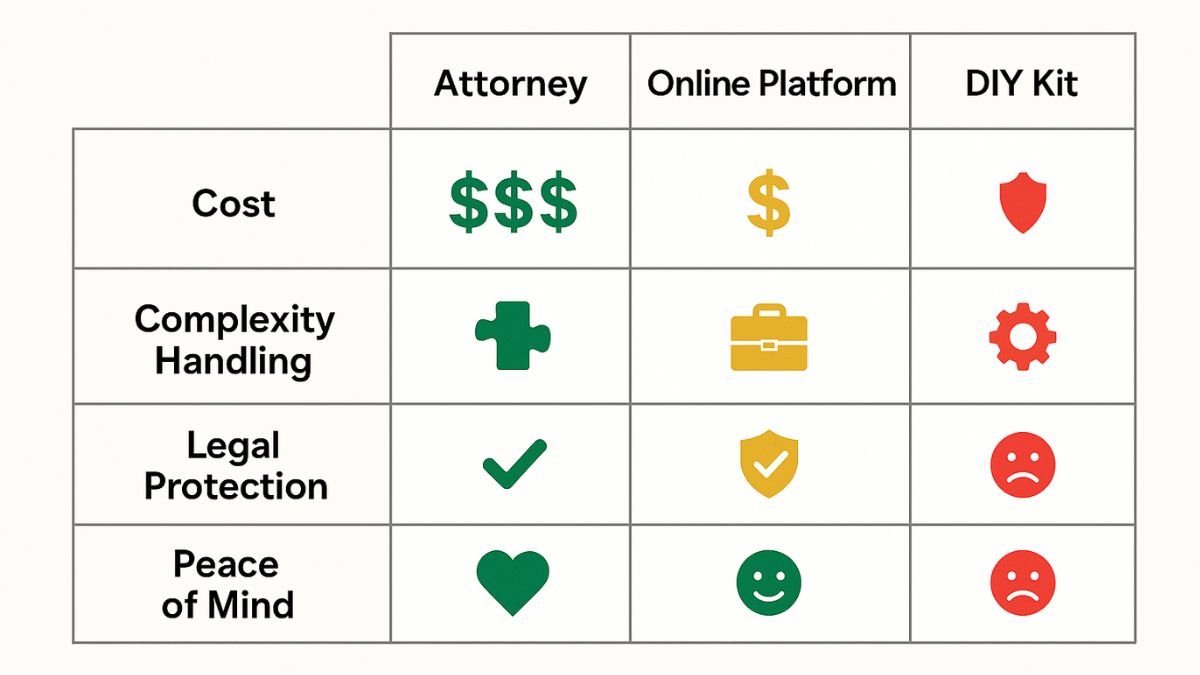

Comparison Table: Attorney vs. Online vs. DIY Trust Setup

Now that we’ve explored each trust setup method in detail, let’s bring everything together with a side-by-side comparison. This table highlights the core differences—so you can quickly evaluate which approach best fits your needs, budget, and level of complexity.

| Setup Method | Estimated Cost | Complexity to Set Up | Legal Risk | Best For | Time Required |

| Attorney | $$$$ ($1,500–$5,000+) | Low – Full-service guidance | Minimal – Professionally drafted | Complex estates, blended families, high-net-worth individuals | Weeks (due to appointments and document prep) |

| Online | $$ ($300–$800) | Medium – Guided digital process | Low to Medium – Some attorney review | Typical families, professionals, moderate estates | Days (fast, self-paced with support) |

| DIY | $ (Under $100 or free) | High – Fully self-directed | High – No legal validation | Very simple cases, legally savvy individuals | Varies (hours to days, depending on prep) |

How to Use This Table

- Prioritize legal protection? An attorney might be the safest route.

- Looking for efficiency and affordability? Online platforms offer a strong middle-ground.

- Confident in legal DIY? A low-cost template may work—for now.

This comparison isn’t about right or wrong—it’s about aligning your trust setup method with your unique financial and family situation. A smart choice now can prevent costly issues later.

How to Choose the Right Method for You

With several living trust setup options available, the best choice ultimately depends on your specific situation. The method you choose should reflect the complexity of your estate, your comfort level with legal documents, and how much hands-on support you prefer throughout the process.

To help guide your decision, consider the following key questions:

1. How complex is your estate?

- Do you own multiple properties, run a business, or plan for Medicaid eligibility?

- Are there special considerations such as a family business, blended family, minor children, or a beneficiary with special needs?

- Are you planning for multigenerational wealth or charitable donations?

If you answered yes to any of these, it may be wise to work with an attorney or use a platform that includes professional legal review.

2. Are you comfortable handling legal documents?

- Do you understand how to draft healthcare directives and POA correctly?

- Are you familiar with state-specific estate planning laws and terminology?

If not, an online service with guided support—or a consultation with an attorney—can reduce the risk of costly errors or oversights.

3. Do you need fast turnaround or personalized legal advice?

- Are you on a tight timeline due to an upcoming move, life event, or health consideration?

- Would it help to speak to someone about amending or restating a trust down the line?

Online platforms can offer speed and convenience, while attorneys provide tailored, in-depth guidance.

Start Small, Upgrade When Needed

One advantage of today’s estate planning tools is that you’re not locked into a single approach. Many individuals begin with a more basic option—such as a DIY template or an online service—and upgrade later as their estate grows or their life circumstances change.

For example, getting married, purchasing property, or starting a family may warrant a more customized plan down the road. Selecting the right trust setup method is a strategic choice, not just a financial one.

Think about what will give you the right level of support and protection based on where you are today—and know that you can evolve your plan as your needs change.

Real-World Examples and Cost Scenarios

To help you see how different trust setup methods work in practice, here are a few real-world scenarios based on common user profiles. These examples illustrate how estate complexity, budget, and personal preferences all play a role in choosing the right approach.

- From DIY to online platforms

- From online to attorney-led services as complexity increases

- Adding layers like asset protection, business succession, or income distribution management

Case Study 1: Retired Couple in Florida Chooses Online + Attorney Review

Profile: Linda and Robert, both in their early 70s, are retired and living in Florida. They have a home valued at $600,000, an investment portfolio, and two adult children.

Goals: Avoid probate, ensure smooth asset transfer, and include clear instructions for healthcare decisions.

Decision: After researching their options, they chose an online trust platform with attorney review. It offered a structured process, lower cost than a traditional law firm, and the ability to include healthcare directives and power of attorney.

Cost: Approximately $650

Reasoning: Their estate was moderately complex, but not enough to warrant full attorney fees. They valued professional oversight without the hassle of multiple appointments.

Case Study 2: Tech Executive in California Starts with Trust Guru

Profile: Jason, 42, is a single tech executive in San Jose. He owns a condo, has $350,000 in retirement assets, and plans to leave his estate to his younger sibling and a charitable foundation.

Goals: Set up a revocable living trust quickly and ensure it includes a pour-over will and durable power of attorney.

Decision: Jason opted for Trust Guru’s online platform, which included guided forms, attorney-reviewed documents, and the ability to update his plan as his assets grow.

Cost: Around $700

Reasoning: He wanted a user-friendly, legally compliant solution with attorney oversight—without the time and cost of traditional legal services.

Case Study 3: Single Dad Transitions from DIY to Professional Support

Profile: Marcus, 40, is a single father with one child. Initially, his estate consisted of a modest savings account and a car.

Goals: Provide for his child in case of an emergency, using a cost-effective trust setup.

Decision: Marcus started with a DIY trust template he found online. It met his basic needs at the time. However, after gaining full custody of his child and buying a home, he upgraded to a professional online service with attorney input.

Cost:

- DIY: Free (initially)

- Online platform later: $500

Reasoning: As Marcus’s responsibilities and assets grew, so did the need for a more secure and legally sound estate plan.

These scenarios show that trust setup isn’t one-size-fits-all. Your life stage, financial situation, and future goals will all shape the best method for you—whether it’s starting small or investing in expert support from the start.

Final Thoughts

When it comes to creating a living trust, there’s no universally “best” method—only the one that aligns with your unique goals, assets, and comfort level.

Whether you prefer the high-touch support of an attorney, the convenience of an online platform, or the independence of a DIY approach, each option has its place depending on your situation.

Here’s a quick recap of what we’ve covered:

- Attorney-led trusts offer maximum customization and legal assurance but come with higher costs and longer timelines.

- Online trust services strike a balance between cost and convenience, ideal for most individuals with simple to moderately complex estates.

- DIY trust kits are the most affordable, but they carry significant legal risks if your estate has any complexity or future changes.

The good news is, your choice doesn’t have to be permanent. Many people start with one approach and upgrade as their life circumstances evolve.

What matters most is taking that first step toward protecting your legacy—and making sure your wishes are clearly documented and legally sound.

Need expert-reviewed, affordable trust setup? Discover how Trust Guru makes estate planning easy or contact our team for personalized help getting started.

Frequently Asked Questions (FAQs)

Yes—most reputable online trust platforms design their documents to comply with the laws in all 50 U.S. states. However, it’s still important to choose a provider that offers state-specific customization and, ideally, attorney review to ensure your trust is enforceable where you live.

Attorney-led trust setups typically range from $1,500 to $5,000 or more, depending on your location and the complexity of your estate. In contrast, online platforms usually cost between $300 and $800, while DIY templates can be free or under $100. The added cost of an attorney comes with in-depth guidance and higher legal assurance.

Yes, it is possible to set up a revocable living trust on your own using a DIY template or guide. However, doing so requires careful attention to detail, as mistakes can affect the trust’s validity. If you’re unfamiliar with legal documents or your estate includes multiple assets, professional support is strongly recommended.

Errors in a DIY trust—such as missing signatures, unclear instructions, or incorrect legal language—can lead to serious consequences. These might include probate delays, disputes among heirs, or parts of your estate being distributed in unintended ways. Unfortunately, many of these issues may not be discovered until after your death, when they are no longer fixable.

Absolutely. Many people start with a DIY trust and later move to an online platform or hire an attorney as their estate grows or their needs change. It’s often advisable to review and update your trust periodically, especially after major life events like marriage, divorce, having children, or buying property.