Creating a living trust is one of the smartest ways to protect your legacy—but it’s also easy to get wrong. From not funding the trust to naming the wrong trustee, there are several mistakes to avoid with a living trust that could lead to probate, family conflict, or unintended asset distribution.

In this article, we’ll break down the 13 most common missteps people make when setting up a living trust—and show you how to avoid them with expert-backed advice.

Whether you’re drafting your first trust or revisiting an old one, this guide will help you safeguard your assets and give your loved ones peace of mind.

What you’ll learn:

- Why Avoiding Mistakes Matters

- 1. Not Funding the Trust

- 2. Forgetting to Update the Trust

- 3. Naming the Wrong Trustee

- 4. Failing to Include All Assets

- 5. Not Coordinating with a Will

- 6. Leaving Out a Successor Trustee

- 7. Poorly Drafted Trust Documents

- 8. DIY Living Trust Errors

- 9. Not Understanding Revocable vs. Irrevocable

- 10. Ignoring Tax Implications

- 11. Not Communicating with Beneficiaries

- 12. Failing to Update Beneficiary Designations

- 13. Overlooking State-Specific Laws

- Final Thoughts – Set Your Trust Up Right from the Start

- Frequently Asked Questions (FAQs)

Let’s start by looking at one of the biggest pitfalls: not funding the trust.

Why Avoiding Mistakes Matters

A living trust is a legal tool that helps you manage and distribute your assets—such as your home, investments, and bank accounts—without the delays, costs, or stress of probate.

But here’s the catch: even the best intentions can fall short if the trust isn’t set up or maintained correctly. Simple oversights—like forgetting to fund the trust or not naming a backup trustee—can unravel your plan and create financial headaches for your loved ones. In many cases, assets you thought were protected could still wind up in probate, defeating the very purpose of creating a trust in the first place.

In fact, industry experts estimate that more than 60% of DIY trusts are flawed—mainly due to mistakes like not funding the trust properly or failing to keep documents updated.

The problem isn’t always carelessness. It’s often a lack of clarity. Many people are unsure about what actually goes into a trust, what needs updating over time, or how state laws may affect the structure they’ve set up.

For retirees passing down real estate, small business owners with complex assets, or families with blended dynamics, these seemingly small errors can have significant consequences—from legal disputes among heirs to tax liabilities and delays in asset distribution.

That’s where a trusted guide like Trust Guru makes all the difference. With years of experience helping clients across all 50 states, we’ve seen the pitfalls firsthand—and know exactly how to prevent them. Our mission is to simplify estate planning and help you build a trust that works as intended, now and in the future.

Here’s the good news: most mistakes can be avoided with a little expert insight and ongoing attention.

Let’s dive into the most common mistakes people make when creating a living trust—and how you can avoid them.

1. Not Funding the Trust

One of the most common—and most costly—mistakes people make is failing to fund the trust. In simple terms, “funding” a trust means transferring ownership of your assets into the trust’s name. It’s the critical step that makes the trust effective. Without it, your trust is just an empty shell—legally valid on paper, but practically useless when it matters most.

What Does Funding Look Like?

Funding involves retitling assets so that the trust becomes the legal owner. This may include:

- Deeding your home and other real estate into the trust

- Changing the title on bank or brokerage accounts

- Assigning ownership of business interests

- Updating life insurance policies or retirement account beneficiaries (in coordination with your estate plan)

Each type of asset has a slightly different process, but the goal is the same: make sure the trust controls those assets while you’re alive and after you pass.

What Happens If You Skip This Step?

If you don’t fund your trust properly:

- Your assets may still go through probate, delaying distribution and increasing legal costs.

- The trust’s instructions may not apply to assets left out, causing confusion or disputes.

- Your beneficiaries could face avoidable taxes, fees, or even lawsuits.

Here’s a real-world example: Sarah created a living trust for her home and investments but never updated the property title. When she passed away, the home was still in her name—not the trust’s. As a result, her family had to go through probate, paying thousands in court fees and waiting over a year to gain access to the property.

Pro Tip: Don’t Just Create—Fund

Once your trust is drafted, don’t stop there. Take time to work through your asset list and transfer titles properly. Many estate planning services—including Trust Guru—guide you through the process step-by-step or offer funding support so nothing falls through the cracks.

Takeaway: A living trust can only protect what’s inside it. If you don’t fund it, your estate plan may fail when your family needs it most.

2. Forgetting to Update the Trust

Creating a living trust isn’t a “set it and forget it” task. Life changes—and so should your trust. One of the biggest mistakes people make is failing to update their trust after major life events, which can lead to unintended consequences that derail your estate plan.

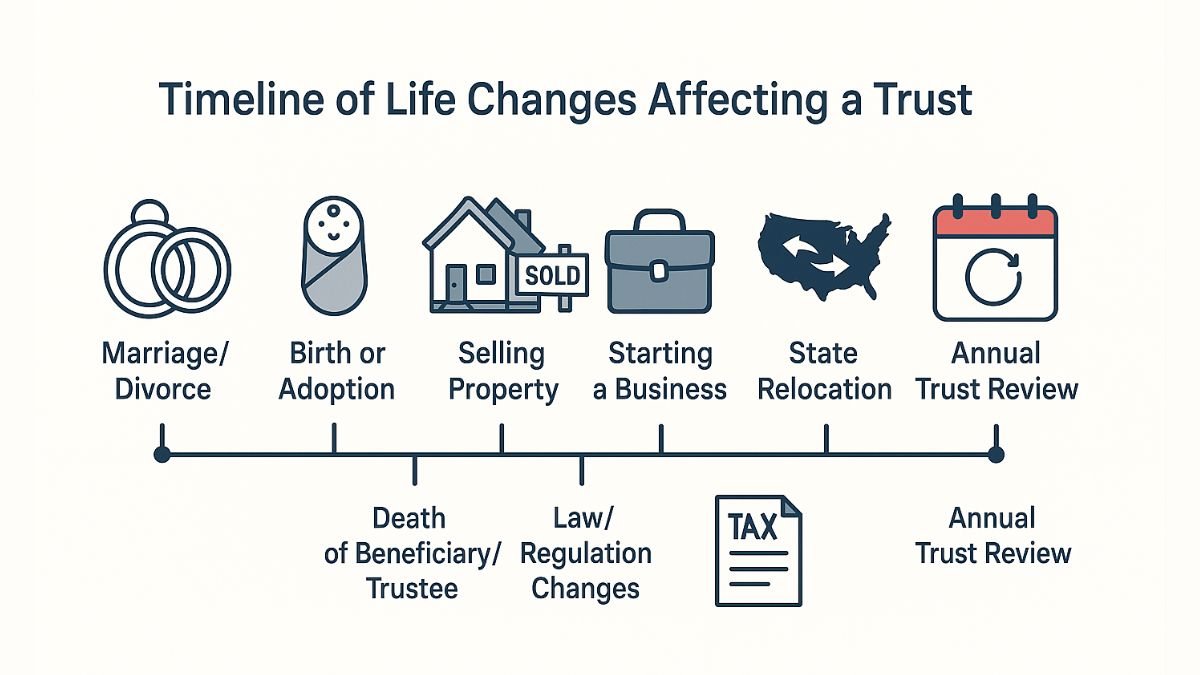

When Should You Update a Living Trust?

Your trust should reflect your current life, relationships, and financial situation. Be sure to review and update it whenever the following occurs:

- Marriage or divorce

- Birth or adoption of a child or grandchild

- Death of a beneficiary or trustee

- A significant change in assets (e.g., selling a home, starting a business)

- Relocation to a different state

- Changes in tax laws or estate planning regulations

Even if no major changes happen, it’s wise to review your trust annually—just as you would with your insurance or investment portfolio.

What Can Go Wrong?

Outdated trusts can cause:

- Assets to go to the wrong people, such as an ex-spouse or a deceased relative

- Missed opportunities for tax savings or protection

- Legal battles among family members due to unclear or obsolete instructions

- Invalid trustee appointments, especially if the named individual is no longer able or willing to serve

For instance, imagine Mark created a trust before the birth of his second child but never added the new child as a beneficiary. After Mark’s passing, only the first child was legally entitled to inherit the trust assets—causing tension and a potential court battle the family never saw coming.

Pro Tip: Build in Regular Checkpoints

To stay on top of things, schedule a trust review at least once a year. If working with a provider like Trust Guru, you may have access to trustee support services or reminders to keep your documents current and compliant with state laws.

Takeaway: An outdated trust is just as risky as not having one. Regular updates ensure your wishes stay aligned with your life—and protect the people you care about most.

3. Naming the Wrong Trustee

Choosing the right trustee is just as important as creating the trust itself. The trustee is the person or institution responsible for managing your assets according to the terms of the trust—both while you’re alive (if needed) and after you pass away. Unfortunately, naming the wrong trustee is a common and often overlooked mistake.

Why the Trustee Matters

Your trustee holds a great deal of power and responsibility. They must:

- Manage and distribute assets fairly and accurately

- Follow legal obligations and timelines

- Handle sensitive financial decisions

- Communicate clearly with beneficiaries

That’s a big job—and it’s not one that just anyone can handle well.

Common Trustee Mistakes

Many people feel obligated to name a close family member, like an adult child or sibling. But being close doesn’t always mean being capable. The wrong trustee can lead to:

- Poor financial decisions that reduce the value of your estate

- Conflicts of interest or favoritism between beneficiaries

- Delays or errors in asset distribution

- Family disputes and even legal challenges

For example, Linda chose her eldest son as trustee out of tradition, not skill. He struggled to manage investments, failed to communicate with other heirs, and ultimately had to step down—creating stress and resentment that could have been avoided.

How to Choose the Right Trustee

When selecting a trustee, consider:

- Financial and legal literacy

- Organizational and communication skills

- Emotional neutrality and professionalism

- Willingness and availability to serve

If no one in your circle fits that profile—or if you want to prevent family tension—naming a neutral third party like a professional trustee or trust company may be the better option.

Services like Trust Guru can also guide you through choosing and setting up the right structure, including trustee transition planning.

Takeaway: Don’t just pick someone you trust—pick someone who’s truly capable. The wrong trustee can put your entire estate plan at risk.

4. Failing to Include All Assets

Creating a living trust is a smart move—but its power is limited to the assets you actually place inside it. One of the most common mistakes is failing to include all assets, leaving important property outside the trust’s protection. When this happens, those excluded items may still need to go through probate—precisely what you were trying to avoid.

Commonly Overlooked Assets

Even with the best intentions, it’s easy to forget certain types of property. Assets often left out of trusts include:

- Retirement accounts (IRAs, 401(k)s – which require special handling)

- Life insurance policies (if the beneficiary designations don’t align)

- Digital assets (crypto, online accounts, domain names)

- Vehicles and boats

- Collectibles or family heirlooms

- Business interests or shares in private companies

- Out-of-state property

Each of these can have legal or tax implications if not properly titled or addressed in your trust documentation.

Why It Matters

When you fail to include an asset in the trust:

- That item may still go through probate, delaying distribution and increasing costs.

- Your trustee may have limited authority to manage or transfer it.

- The asset could default to intestate succession laws, meaning the state decides who inherits it.

- Family members could be left arguing over ownership or intent.

For example, Tom placed his home and investment accounts into his trust but forgot to include his small business shares. After his death, the business had to go through probate, putting operations on hold and creating uncertainty for employees and heirs.

Pro Tip: Use an Asset Checklist

To avoid missing anything, create a comprehensive inventory that includes digital assets like online subscriptions, crypto, or domain names. Digital asset trust planning can help ensure these often-overlooked valuables are accounted for. Here’s a basic checklist to start:

Asset Inclusion Checklist:

- Real estate (home, rental, vacation properties)

- Bank and investment accounts

- Retirement accounts (review beneficiary alignment)

- Life insurance policies

- Vehicles, boats, and recreational equipment

- Personal valuables and collectibles

- Business ownership interests

- Digital assets (passwords, crypto, online subscriptions)

Your estate planner or trust provider—like Trust Guru—can help you make sure nothing is overlooked and everything is properly titled.

Takeaway: A trust can only protect what’s in it. Keep a detailed inventory and fund your trust fully to make sure every asset is covered.

5. Not Coordinating with a Will

Many people assume that once they’ve created a living trust, they no longer need a will. But that’s a misconception—and a potentially costly one. Your trust and will should work together as part of a unified estate plan, not operate in isolation.

How Trusts and Wills Complement Each Other

A living trust is primarily used to manage and distribute assets you’ve transferred into it. It helps you avoid probate, maintain privacy, and control how your estate is handled both during your lifetime and after death.

A will, on the other hand, covers any assets not included in the trust and can serve several additional purposes, such as:

- Naming guardians for minor children

- Providing instructions for personal property not in the trust

- Designating who inherits residual or overlooked assets

Most importantly, a “pour-over will” is often used alongside a trust. This document directs any assets accidentally left out of the trust to be transferred into it upon your death. Without it, those forgotten assets may pass through probate and be distributed according to state law—not your wishes.

What Can Go Wrong?

When a trust and will aren’t aligned, it can create:

- Conflicting instructions that confuse trustees or beneficiaries

- Legal disputes between heirs over which document should prevail

- Assets slipping through the cracks, ending up in probate despite the trust

For example, Emily created a living trust but never updated her old will, which named different beneficiaries than the trust. After her passing, the discrepancy led to a court battle between family members—and delayed the distribution of her estate for nearly two years.

Pro Tip: Keep Documents in Sync

Your estate plan should be reviewed as a whole, not in pieces. Make sure:

- Your will doesn’t contradict your trust

- A pour-over will is in place if using a living trust

- Beneficiary designations are consistent across documents

At Trust Guru, we help clients align all elements of their estate plan so nothing is left to chance.

Takeaway: A living trust is powerful, but it’s not a standalone solution. Coordinating your trust and will ensure your wishes are followed smoothly and completely.

6. Leaving Out a Successor Trustee

Appointing a trustee is a key step in setting up a living trust—but the job doesn’t end there. One of the most overlooked mistakes is failing to name a successor trustee, someone who can step in if your primary trustee can no longer serve.

What Is a Successor Trustee?

A successor trustee is the person (or institution) who takes over trust management if the original trustee:

- Passes away

- Becomes incapacitated

- Chooses to resign or is removed

- Is otherwise unable or unwilling to fulfill their duties

This individual plays a critical role in ensuring your trust continues to function smoothly, especially when it’s time to distribute assets or manage affairs after your death.

Why Naming a Successor Matters

Without a successor trustee:

- The court may need to appoint someone, causing delays, added legal fees, and potential family conflict.

- The trust may become temporarily unmanaged, creating confusion for beneficiaries and risking asset mismanagement.

- Your original intentions could be compromised if someone unfamiliar with your wishes takes control.

Imagine this scenario: John named his brother as trustee, but never designated a backup. When his brother suffered a sudden medical emergency, the family had to petition the court to appoint a replacement—delaying key decisions for months during a time of grief and uncertainty.

Pro Tip: Plan for Contingencies

When drafting your trust:

- Always name at least one successor trustee—preferably two or more, in case the first is unavailable.

- Choose someone who is trustworthy, organized, and willing to serve.

- Review your successor list periodically to ensure it still makes sense as your life and relationships evolve.

Professional services like Trust Guru can help you evaluate trustee candidates and build in the right safeguards for long-term coverage. Visit our trustee support services for more.

Takeaway: Life is unpredictable. Naming a successor trustee ensures your trust remains in capable hands—no matter what happens.

7. Poorly Drafted Trust Documents

A living trust is only as effective as the language it’s written in. Poorly drafted trust documents are one of the most dangerous—and unfortunately, most common—mistakes people make when setting up their estate plan. What may seem like a minor wording issue can create major legal and financial consequences for your loved ones down the line.

What Makes a Trust “Poorly Drafted”?

- Vague or ambiguous language that’s open to interpretation

- Missing essential clauses (like incapacity provisions or tax planning tools)

- Outdated legal references or reliance on old laws

- Contradictory instructions within the trust or between other documents

- Failure to comply with state-specific laws and requirements

These errors are especially common when using generic DIY templates or one-size-fits-all trust kits that don’t take into account your personal assets, family structure, or the laws in your state.

Real-World Consequence

Consider this: Lisa used an online trust template to save time and money. The document failed to include a clause addressing what should happen if one of her beneficiaries predeceased her. When that situation occurred, her assets were held up in probate court while the family waited for legal clarification—exactly what she had hoped to avoid.

Why Professional Review Matters

Estate planning isn’t just about checking boxes—it’s about building a legally sound, customized structure that reflects your values, protects your assets, and minimizes confusion. A licensed estate planning attorney or trusted service provider like Trust Guru can help:

- Ensure your trust is legally enforceable

- Add provisions that match your specific needs

- Tailor the language to your state’s current regulations

- Catch inconsistencies or legal blind spots before they become a problem

Pro Tip: Think of Your Trust as a Legal Blueprint

You wouldn’t build a home with a flawed blueprint—and your trust deserves the same level of precision.

Takeaway: Even small drafting mistakes can lead to big legal headaches. Have your trust reviewed by a professional to make sure it’s airtight, accurate, and built to protect everything you’ve worked for.

8. DIY Living Trust Errors

In today’s digital age, it’s tempting to take the do-it-yourself route with estate planning. Countless websites offer fill-in-the-blank living trust templates that promise a fast, affordable solution—but these shortcuts often lead to long-term problems. DIY trusts often overlook critical legal requirements that vary by state and asset type, making them vulnerable to being challenged or disregarded altogether.

Common DIY Mistakes

While online trust tools may seem convenient, they rarely account for:

- State-specific legal requirements

- Unique family dynamics (e.g., blended families, estranged relatives)

- Complex assets like business ownership, out-of-state property, or retirement accounts

- Proper funding instructions and titling guidance

- Detailed successor trustee planning or incapacity provisions

Most templates use generic language that might look official but lacks the customization needed to match your life. As a result, you may end up with a trust that is legally valid—but practically ineffective.

Why DIY Can Backfire

Here’s the reality: even small mistakes in a DIY trust can lead to:

- Unintended beneficiaries receiving your assets

- Family disputes due to unclear instructions

- Assets being excluded from the trust and sent through probate

- Legal costs down the road that far outweigh the initial “savings”

For example, David used a free trust form he found online and assumed everything was covered. But he didn’t realize the form was based on another state’s laws, and his trust didn’t properly account for his California property. When he passed, the property had to go through probate—delaying access for his family and costing thousands in legal fees.

If you’re weighing whether to DIY or hire a professional, it’s worth understanding the true cost of setting up a living trust—including what’s included, what’s not, and how investing in expert help can actually save you in the long run.

Why Professional Support Matters

Creating a legally sound, fully funded, and personalized trust takes more than a template—it takes expert guidance. At Trust Guru, we work with clients nationwide to:

- Customize trust documents based on their unique goals

- Ensure compliance with local laws

- Offer step-by-step help through the funding process

- Provide ongoing support as life and laws change

Pro Tip: Saving money upfront isn’t worth the risk

Takeaway: A DIY trust might feel like a shortcut, but it often leads to detours. Work with professionals to build a trust that truly protects your legacy. Work with professionals to build a trust that truly protects your legacy. We offer our full range of services to support you throughout your planning process.

9. Not Understanding Revocable vs. Irrevocable

When setting up a living trust, one of the first—and most important—decisions you’ll face is choosing between a revocable and irrevocable trust. Unfortunately, many people make this choice without fully understanding the long-term implications, which can impact everything from taxes to asset protection and control.

What’s the Difference?

Here’s a quick breakdown:

Revocable Living Trust:

- Can be changed, updated, or revoked at any time during your lifetime

- You retain full control of the assets placed in the trust

- Offers no asset protection from creditors or lawsuits

- Becomes irrevocable upon your death

Irrevocable Living Trust:

- Cannot be changed or undone (with few exceptions)

- You give up control of the assets to the trust

- Offers stronger asset protection and potential estate tax advantages

- Often used for advanced estate planning or Medicaid strategies

Why This Choice Matters

Choosing the wrong type of trust can lead to:

- Loss of control over your assets when you didn’t intend it

- Missed tax planning opportunities

- Inadequate protection from creditors or lawsuits

- Complex legal restructuring if changes are needed later

For example, Susan created an irrevocable trust thinking it was the safest option—but didn’t realize she couldn’t access the funds for personal needs afterward. She later had to hire an attorney to explore costly legal workarounds just to modify the trust.

If you want a deeper breakdown of how these trust types compare, check out our detailed guide on revocable vs. irrevocable living trusts for examples, pros and cons, and use-case recommendations.

How to Choose the Right Fit

Before making a decision:

- Ask yourself how much control you want to retain over your assets

- Consider whether asset protection or tax minimization is a priority

- Think about your long-term goals (e.g., Medicaid planning, generational wealth)

If you’re unsure which is best, contact our team for expert guidance tailored to your goals—we can help match the right trust type to your needs and walk you through the pros and cons of each.

Pro Tip: One size doesn’t fit all

Takeaway: Not all trusts are created equal. Trust validity and structure can vary by state, so choosing the right type—revocable or irrevocable—requires careful consideration and possibly professional guidance.

10. Ignoring Tax Implications

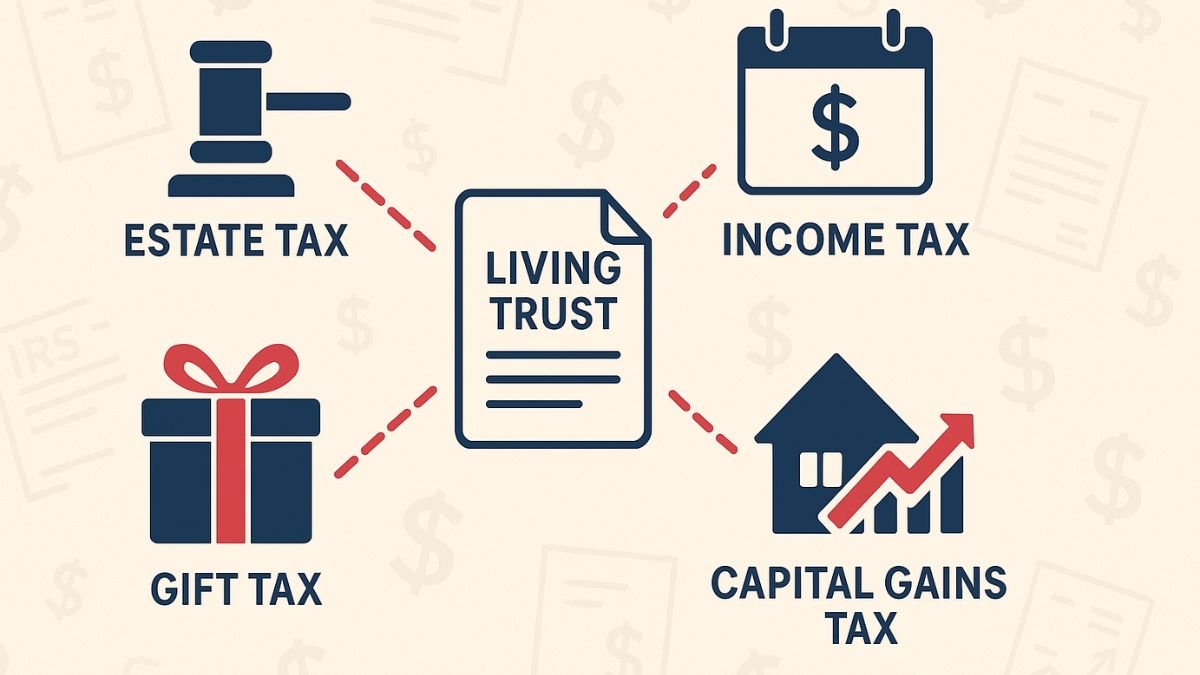

One of the biggest misconceptions about living trusts is that they automatically shield your estate from taxes. While trusts offer many benefits, completely eliminating tax obligations isn’t one of them. Ignoring the tax implications of your trust can lead to costly surprises for you or your beneficiaries.

What Types of Taxes Could Be Involved?

Depending on your financial situation, the assets in your trust, and how the trust is structured, you may encounter:

- Estate Taxes: Federal estate tax may apply if your estate exceeds the IRS threshold (currently over $13 million per individual as of 2025). Some states also impose their own estate or inheritance taxes.

- Income Taxes: Trusts that earn income may be subject to high tax rates if not distributed to beneficiaries in a timely manner.

- Gift Taxes: Transferring assets into certain types of irrevocable trusts may trigger gift tax obligations, especially if you exceed annual or lifetime exclusion limits.

- Capital Gains Taxes: Improper handling of real estate or investment assets may cause a loss of step-up in basis, resulting in higher taxes for heirs.

The Mistake: Thinking a Trust Is a Tax Shelter

While some irrevocable trusts can help minimize estate taxes or protect assets, revocable living trusts do not reduce your tax liability during your lifetime. They’re designed primarily to avoid probate and streamline asset distribution—not to act as a tax avoidance tool.

For example, Robert created a revocable trust assuming it would shield his heirs from estate taxes. When he passed, his estate exceeded the taxable threshold, and his beneficiaries ended up with an unexpected tax bill—because no tax planning had been done.

How to Plan Smartly

To avoid costly missteps:

- Work with a qualified estate planner or tax advisor when creating your trust

- Understand how different types of trusts are taxed

- Evaluate how asset transfers may affect your overall estate and gifting strategy

- Keep tax planning in mind if your estate involves high-value property, business interests, or significant investment gains

At Trust Guru, we collaborate with financial and tax professionals to help clients manage trust tax compliance services and avoid issues that affect your heirs.

Pro Tip: A trust without tax planning is only half the plan

Takeaway: Trusts don’t automatically protect you from taxes. Understanding the tax impact of your estate plan—and getting professional guidance—is essential to preserving more of your legacy.

11. Not Communicating with Beneficiaries

A well-crafted trust lays out your wishes clearly on paper—but failing to communicate those wishes with your beneficiaries can still lead to confusion, hurt feelings, or even legal disputes. One of the most preventable mistakes in estate planning is leaving your heirs in the dark.

Why Communication Matters

Estate planning is about more than documents—it’s about preparing the people involved. Without clear conversations, even the most carefully structured trust can cause:

- Mistrust or resentment if someone feels blindsided or left out

- Misinterpretation of your intentions, especially in blended families

- Delays in distribution if beneficiaries are unaware of what to expect or how to access their inheritance

- Family conflict, which may escalate to litigation

For example, Barbara set up a trust that divided her estate unevenly among her three children based on their needs. Because she never explained her reasoning, the children were left confused and frustrated—leading to months of strained relationships and a contested trust.

What to Share—and How

You don’t have to disclose every financial detail, but it helps to:

- Let beneficiaries know that a trust exists and who the trustee is

- Explain the general purpose of the trust and how you’ve structured it

- Clarify any decisions that may seem unexpected, such as unequal distributions or special provisions

- Put your wishes in writing in a letter of intent, if you prefer not to discuss details in person

These conversations can be done privately or as part of a family meeting, and they often prevent future misunderstanding.

Pro Tip: Communication = Clarity

At Trust Guru, we encourage clients to view estate planning as an ongoing dialogue—not just a transaction. We can help facilitate conversations or provide documentation tools to make sharing your plan easier and more comfortable.

Takeaway: Silence can spark conflict. Communicating openly with your beneficiaries ensures your trust isn’t just legally sound—but emotionally thoughtful and conflict-free.

12. Failing to Update Beneficiary Designations

Even the most thorough living trust can be undone by a simple oversight: outdated or mismatched beneficiary designations. Many financial accounts—such as retirement plans, life insurance policies, and investment portfolios—have their own beneficiary forms that override the instructions in your trust.

Beneficiary education resources can help prepare your heirs with the tools and understanding they need to honor your legacy.

Why This Matters

These accounts are known as non-probate assets—meaning they pass directly to the named beneficiaries, regardless of what your trust or will says. If those designations haven’t been updated to align with your estate plan, you risk:

- Disinheriting loved ones unintentionally

- Giving assets to an ex-spouse or deceased relative

- Causing delays or legal challenges if there’s a conflict between documents

- Disrupting the balance of your intended asset distribution

For example, Michael updated his living trust to leave everything equally to his children, but never changed the beneficiary on his life insurance, which still listed his former spouse. After his death, the life insurance payout went to the ex, leaving the children confused and empty-handed.

Common Accounts to Review

To avoid this mistake, double-check beneficiary designations on:

- 401(k)s and IRAs

- Pensions and annuities

- Life insurance policies

- Bank and brokerage accounts with POD (Payable on Death) or TOD (Transfer on Death) options

- Health savings accounts (HSAs)

What You Should Do

- Review and update beneficiary forms anytime your trust changes or after major life events (marriage, divorce, new child, etc.)

- Coordinate with your estate planner or financial advisor to ensure designations don’t conflict with your trust instructions

- Use trust-compatible wording or consult a pro when planning for healthcare directives and powers of attorney to ensure every document is aligned (e.g., “John Smith Revocable Trust dated MM/DD/YYYY”)

At Trust Guru, we help clients not only create their trusts but ensure all designations and account titles are aligned for a seamless, unified estate plan.

Takeaway: Beneficiary forms can override your trust—so make sure they reflect your most up-to-date wishes and work in harmony with your estate plan.

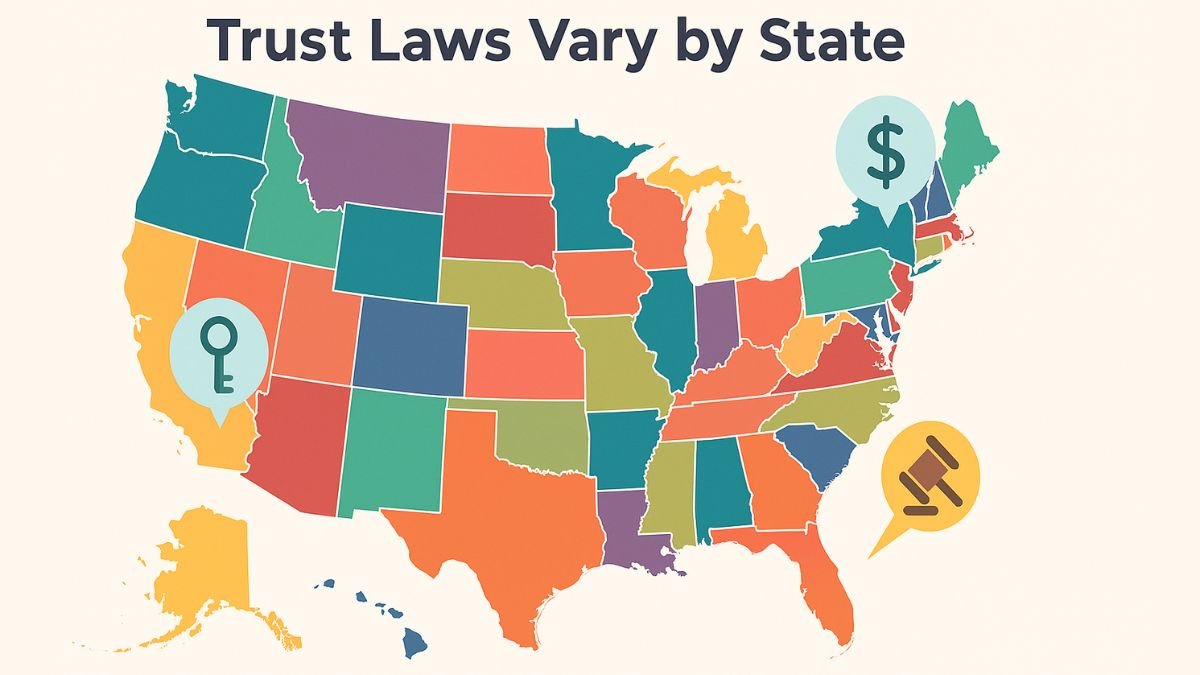

13. Overlooking State-Specific Laws

One of the most easily overlooked yet critical mistakes in creating a living trust is assuming that trust laws are the same in every state. In reality, estate planning regulations can vary widely, and using a generic or out-of-state template can leave your trust noncompliant—or even invalid—in your home state.

Why State-Specific Compliance Matters

Each state has its own rules regarding:

- Trust formation and language requirements

- Trustee powers and duties

- Witness and notary standards

- Community property vs. separate property laws

- State-level estate or inheritance taxes

When you move or your situation changes, it’s time to review your trust with experts who understand Medicaid asset protection planning and regional nuances.

For example, California has strict guidelines around real estate transfers into a trust, while Florida requires specific language for homestead property. What works in Texas may not hold up in New York—and failing to comply can result in probate exposure, legal disputes, or unintended asset distribution.

Real-Life Example

Jennifer moved from Illinois to Florida but never updated her living trust. When she passed, some elements of her original trust didn’t meet Florida’s legal requirements. As a result, her family had to spend months in probate court to sort out the inconsistencies—costing time, money, and peace of mind.

How to Avoid This Mistake

- Ensure your trust is drafted or reviewed by someone familiar with your state’s laws

- Revisit your trust if you relocate to another state, especially if property or tax laws differ

- Avoid one-size-fits-all online templates, which may not meet your state’s legal standards

At Trust Guru, we offer nationwide support and work with experienced professionals who ensure your living trust is fully compliant—no matter where you live.

Pro Tip: One trust doesn’t fit all states

Takeaway: A trust that works in one state may fall short in another. Working with a provider that understands state-specific laws is essential to ensuring your plan holds up where it counts—legally and financially.

Final Thoughts – Set Your Trust Up Right from the Start

Creating a living trust is a powerful step toward protecting your legacy—but how you set it up matters just as much as the decision to do it in the first place. As we’ve seen, even small oversights—like not funding the trust, skipping updates, or using generic documents—can unravel your estate plan and create unnecessary stress for your loved ones.

The good news? These mistakes are entirely avoidable with the right guidance.

At Trust Guru, we believe estate planning should be clear, approachable, and built to last. Whether you’re starting from scratch or reviewing an existing trust, we’re here to walk you through the process with expert support and state-specific compliance in mind.

If you’re unsure about your trust, we’re here to help. Book a free consultation with Trust Guru today and gain peace of mind knowing your plan is solid.

Top 5 Fixes You Can Make Right Now

Here’s a quick action list to strengthen your living trust today:

- Double-check that your trust is fully funded—transfer titles to avoid probate.

- Review your trust annually and after any major life event.

- Update your beneficiary designations to match your trust.

- Name a qualified successor trustee and confirm their willingness to serve.

- Have your trust reviewed by a professional for state compliance.

A well-structured trust can protect your assets, honor your wishes, and make life easier for your heirs—but only if it’s done right. Start strong, stay updated, and don’t go it alone—Trust Guru is here to guide you every step of the way.

Frequently Asked Questions (FAQs)

If you don’t transfer your assets into your trust—known as “funding”—those assets won’t be covered by the trust’s instructions. Instead, they may have to go through probate, which can delay distribution and increase costs for your beneficiaries. An unfunded trust is essentially an empty document with no real legal power over your estate.

Yes, in most cases, especially if the trust is revocable, you can amend or restate it to correct errors. Common fixes include updating trustees, beneficiaries, or specific asset details. If your trust is irrevocable, changes are more complex but sometimes still possible with legal support. It’s best to work with a professional to ensure changes are valid and compliant with your state laws.

Yes—they serve different but complementary purposes. A living trust helps manage and distribute your assets while avoiding probate, but it doesn’t cover everything. A will can name guardians for minor children, address personal items not in the trust, and serve as a safety net through a “pour-over” clause that moves leftover assets into the trust.

A revocable trust can be changed, updated, or revoked during your lifetime, giving you flexibility and control. An irrevocable trust, once established, cannot be altered (in most cases), but offers benefits like asset protection and potential estate tax reduction. The right choice depends on your goals—control vs. protection.

If your trust is revocable, absolutely. You can amend individual parts or completely restate it to reflect new wishes, beneficiaries, or assets. It’s recommended to review and update your trust after major life changes or at least every few years to keep it aligned with your goals and current laws.

These questions reflect the most common concerns people have when evaluating or creating a trust.

Still have questions? Trust Guru offers personalized guidance to ensure your plan is on the right track.