When it comes to long-term financial planning, the irrevocable trust tax benefits available to high-net-worth individuals can be game-changing. From reducing estate taxes to protecting investment income and optimizing gift strategies, these trusts offer powerful advantages for those looking to preserve wealth across generations.

In this article, we’ll break down how irrevocable trusts work from a tax perspective—without the confusing legal jargon. Whether you’re planning for retirement, succession, or simply want to minimize your tax exposure, you’ll find clear explanations and real-world examples to guide your next steps.

Here’s what we’ll cover:

- What Is an Irrevocable Trust and Why It Matters for Taxes

- How Irrevocable Trusts Reduce Estate Taxes

- Income Tax Considerations for Irrevocable Trusts

- Gift Tax Benefits of Irrevocable Trusts

- Generation-Skipping Transfer Tax (GST) Advantages

- Is an Irrevocable Trust the Right Move for You?

- FAQs About Irrevocable Trust Taxation

First, let’s understand what an irrevocable trust is—and why it plays such a crucial role in tax planning.

What Is an Irrevocable Trust and Why It Matters for Taxes

An irrevocable trust is a legal structure that allows you to transfer ownership of assets—such as real estate, investments, or life insurance—into a trust that cannot be modified or revoked without the permission of the named beneficiaries or a court. Once assets are placed into an irrevocable trust, they are no longer considered part of your personal estate. This shift in ownership plays a pivotal role in how those assets are taxed during your lifetime and after your death.

Unlike revocable trusts, which allow the grantor to retain control and make changes at will, irrevocable trusts come with one important condition: you give up direct control in exchange for strategic financial protection and significant tax benefits. This trade-off is especially appealing to high-net-worth individuals who are concerned about estate tax exposure or long-term wealth preservation.

To learn how this fits into a broader wealth preservation strategy, explore our comprehensive estate planning services.

Key Features of an Irrevocable Trust

To understand the tax advantages of irrevocable trusts, it’s essential to recognize how they are structured and why that structure matters:

- Irrevocability: Once created and funded, the terms of the trust generally cannot be changed without consent from all beneficiaries or court approval.

- Asset Removal: Assets transferred into the trust are removed from your taxable estate. This can reduce your estate’s overall value and help avoid or minimize estate taxes.

- Loss of Control = Strategic Gain: While it may seem counterintuitive to relinquish control, doing so allows your assets to be shielded from estate taxes, certain lawsuits, and creditors.

This makes irrevocable trusts a valuable option when considering creditor protection solutions or asset protection trusts.

For individuals with estates approaching or exceeding the federal estate tax threshold—or living in states with their own estate taxes—this shift in ownership can provide substantial tax relief for both you and your heirs.

Why Tax Planning Starts Here

Transferring assets into an irrevocable trust is more than just a legal move—it’s a foundational step in a broader tax strategy. By removing assets from your estate, you reduce your potential estate tax liability.

Additionally, depending on the trust type, income generated by those assets may be taxed separately from your personal income, creating further opportunities for tax efficiency.

Takeaway: By understanding how irrevocable trusts shift ownership and control, you unlock the door to powerful tax strategies that can protect your wealth for the next generation and beyond.

How Irrevocable Trusts Reduce Estate Taxes

For individuals and families with substantial wealth, estate taxes can significantly diminish the legacy passed on to heirs. One of the most effective ways to minimize this burden is by placing high-value assets into an irrevocable trust. Doing so removes those assets from your taxable estate, which can dramatically reduce or even eliminate your estate tax liability.

This approach is often used in conjunction with will drafting services and broader estate strategies to preserve wealth and ensure proper legacy planning.

Estate Tax Basics (Simplified)

Estate taxes are levied on the total value of your estate at the time of death. As of 2024, the federal estate tax exemption is $13.61 million per individual (or $27.22 million for a married couple). Any estate value above that amount is subject to a tax rate that can reach up to 40%.(IRS 2024 inflation adjustments)

However, estate taxes don’t stop at the federal level. Several states—including New York, Massachusetts, and Oregon—impose their own state-level estate taxes, with lower exemption thresholds and varying rates. That means even estates well below the federal limit could still face significant tax obligations depending on where you live. For a closer look at this, see our guide to state taxes and estate planning.

Understanding how these taxes are calculated is key: the larger your estate, the greater the potential tax. This is where irrevocable trusts become a powerful planning tool.

Asset Removal = Estate Shrinkage

When you fund an irrevocable trust, the assets transferred into it are no longer counted as part of your estate for tax purposes. This “removal” can apply to a wide range of asset types, including:

- Real estate holdings, such as investment properties or vacation homes

- Privately owned businesses, stock portfolios, or partnership interests

- Life insurance policies, especially when held in an Irrevocable Life Insurance Trust (ILIT)

Because the trust—not you—now owns these assets, their value does not inflate your estate total at death. The result? A smaller taxable estate, and in turn, a smaller (or zero) estate tax bill for your heirs.

Scenario: Retired Couple with $10M in Assets

Let’s say a retired couple has a $10 million estate composed of a primary residence, investment properties, brokerage accounts, and a life insurance policy. Without planning, their estate may be just below the federal exemption but still vulnerable to state-level estate taxes.

Now imagine they place $3 million worth of assets into an irrevocable trust—such as a vacation property and a life insurance policy. Their taxable estate drops to $7 million, well below most state and federal thresholds. This proactive move could save their beneficiaries hundreds of thousands in taxes and help ensure a smoother, faster distribution process.

Takeaway: By reducing the size of your taxable estate, irrevocable trusts allow you to protect more of your legacy and minimize what the IRS or state tax authorities can claim.

Income Tax Considerations for Irrevocable Trusts

While irrevocable trusts offer compelling estate tax advantages, understanding how income taxes apply to trust-held assets is just as important. Unlike revocable trusts—where income typically flows through to the grantor—irrevocable trusts can be taxed as separate entities. Whether income is taxed at the trust level, the grantor level, or passed on to the beneficiaries depends on how the trust is structured.

Consider exploring our trust tax compliance services to ensure your trust structure aligns with your long-term tax goals.

Who Pays the Taxes: The Trust, the Grantor, or the Beneficiary?

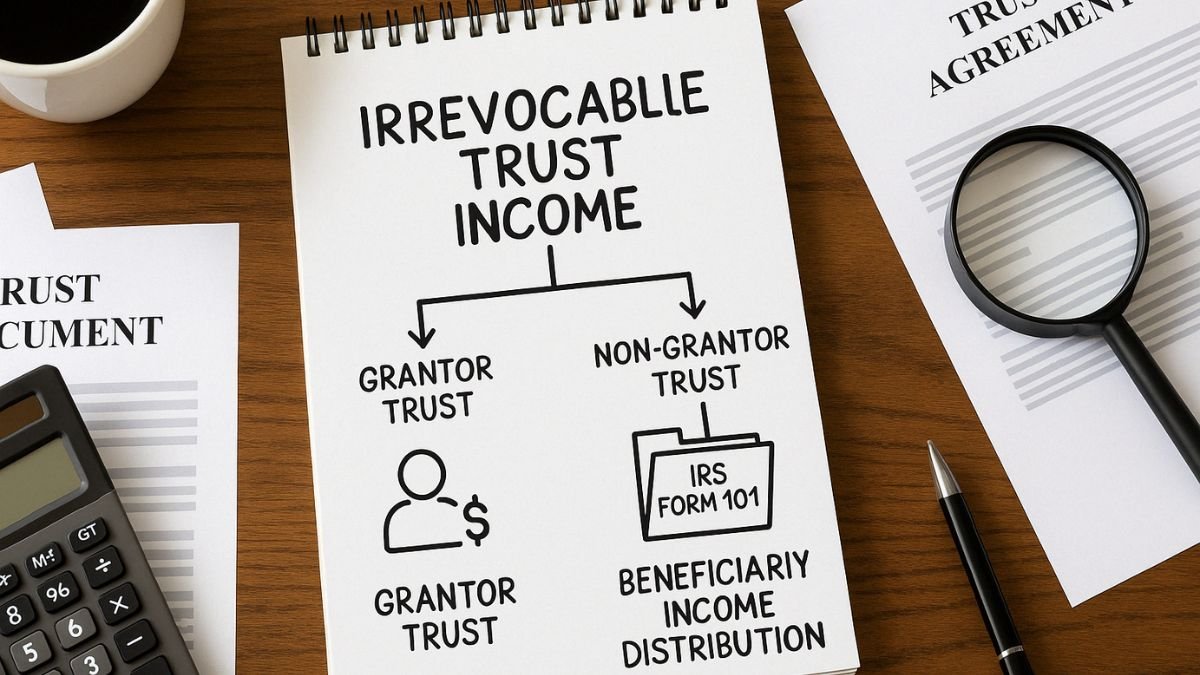

The way an irrevocable trust is taxed hinges on whether it’s classified as a grantor or non-grantor trust:

- Grantor Trust: In this setup, the original creator (grantor) retains certain powers or rights defined by the IRS, which means they remain responsible for paying taxes on all income generated by the trust—even though the assets are no longer technically theirs.

- Non-Grantor Trust: Here, the trust is treated as a separate taxpayer. It must file its own tax return (IRS Form 1041) and pay income taxes on earnings not distributed to beneficiaries. If the trust distributes income, the beneficiaries must report and pay tax on the amount they receive. (Are estate distributions taxable?)

Each structure has its pros and cons. Grantor trusts are useful for continued tax responsibility and asset growth, while non-grantor trusts may be preferred when the grantor wants to shift both control and tax liability.

High Tax Brackets for Trusts – and How to Plan Around Them

One key consideration with non-grantor trusts is the steep tax brackets they face. Unlike individuals, who don’t hit the top income tax rate until they earn over $600,000+, trusts reach the highest federal income tax bracket (37%) at just $14,450 (as of 2024).

To minimize tax liability, many trust strategies include:

- Distributing income to beneficiaries who are in lower tax brackets

- Timing income distributions before year-end to reduce retained earnings

- Investing in tax-efficient assets, like municipal bonds or index funds

These methods may be supported through income distribution management tools, tailored for effective tax efficiency.

Scenario: Passive Income from Investment Property in a Trust

Consider a non-grantor irrevocable trust that holds a rental property generating $30,000 in annual net income. If the trust retains the income, it will face a steep tax bill due to compressed trust tax brackets.

However, if the income is distributed evenly to two beneficiaries in moderate income brackets, each reports $15,000 of income on their personal tax return—potentially avoiding the trust’s top-tier rates.

Takeaway: Income earned by irrevocable trusts can trigger higher taxes if not managed properly. Structuring the trust carefully—and timing distributions strategically—can significantly reduce tax exposure and preserve more wealth for your beneficiaries.

Gift Tax Benefits of Irrevocable Trusts

Beyond estate and income tax advantages, irrevocable trusts are also powerful tools for gift tax planning. By leveraging both the annual gift tax exclusion and the lifetime gift exemption, high-net-worth individuals can transfer significant wealth to their heirs while minimizing or avoiding federal gift taxes altogether.

When structured correctly, an irrevocable trust allows you to make tax-efficient gifts that reduce the size of your taxable estate while securing your legacy for the next generation. Learn how trust funding assistance can make the gift transfer process smoother and more compliant.

Using the Annual Gift Tax Exclusion Through a Trust

As of 2024, the IRS allows you to gift up to $18,000 per recipient per year without triggering any gift tax or using up your lifetime exemption. This exclusion applies whether gifts are made directly or through an irrevocable trust—provided the trust is properly structured to qualify.

This strategy becomes even more effective when:

- You have multiple beneficiaries—spreading gifts across children, grandchildren, or other heirs

- You make annual gifts consistently over time

- The trust includes a Crummey provision, which gives beneficiaries limited-time withdrawal rights, satisfying IRS requirements for the annual exclusion

For example, a married couple with four grandchildren could contribute $144,000 annually into an irrevocable trust (2 spouses × 4 beneficiaries × $18,000), all without dipping into their lifetime exemption or owing any gift tax.

Lifetime Gift Exemption and Trust Contributions

In addition to annual exclusions, individuals have a lifetime gift and estate tax exemption, which is $13.61 million per person in 2024. This exemption applies to gifts that exceed the annual exclusion limit and is shared with the estate tax.

When you contribute larger sums to an irrevocable trust—whether to fund long-term investments, life insurance policies, or business interests—those contributions are considered taxable gifts, but they simply reduce your lifetime exemption balance.

To better grasp these rules, it helps to start by understanding how the gift tax works, especially when planning strategic trust contributions. By making these gifts now, you lock in today’s historically high exemption levels, which are scheduled to drop significantly in 2026 unless legislation extends them.

This makes irrevocable trusts an ideal vehicle for pre-funding future inheritances while optimizing current tax law advantages.

Scenario: Business Owner Funding an ILIT (Irrevocable Life Insurance Trust)

Let’s say a small business owner, Angela, wants to ensure her heirs receive a tax-free inheritance to cover estate taxes or buy out a family business share. She establishes an Irrevocable Life Insurance Trust (ILIT) and funds it annually with $36,000 (using the $18,000 exclusion per beneficiary for two children). The trust uses these contributions to pay life insurance premiums.

When Angela passes away, the life insurance proceeds pass to the trust beneficiaries completely free of estate and income tax—while her estate remains smaller and potentially outside the taxable threshold.

Takeaway: Irrevocable trusts allow you to strategically use annual exclusions and lifetime exemptions to pass wealth tax-efficiently. Whether gifting cash, insurance premiums, or appreciating assets, these trusts help reduce future tax burdens while supporting your long-term legacy goals.

Generation-Skipping Transfer Tax (GST) Advantages

For families planning to pass wealth not just to their children—but also to their grandchildren or future generations—irrevocable trusts can offer meaningful protection against a lesser-known but significant federal tax: the Generation-Skipping Transfer (GST) Tax. This long-term legacy strategy is a pillar of charitable trust solutions and beneficiary education resources, ensuring heirs understand and protect the assets they inherit.

Fortunately, irrevocable trusts—particularly those designed for multigenerational planning—can be structured to avoid or significantly reduce GST liability.

What Is the GST Tax?

The Generation-Skipping Transfer Tax is a federal tax assessed on transfers of wealth that “skip” a generation. It was created to prevent families from bypassing estate taxes by leaving assets directly to grandchildren instead of children.

Here’s how it works in simple terms:

- If you leave a $1 million inheritance to your child, it may be subject to estate tax.

- If you skip your child and leave that $1 million directly to your grandchild, it may still be subject to estate tax plus the GST tax—potentially adding another 40% tax burden.

To address this, the IRS allows each individual a GST exemption, which as of 2024, matches the lifetime estate and gift tax exemption: $13.61 million per person. If your trust is designed correctly, transfers up to this amount can bypass both estate and GST taxes.

Using a Trust to Create a Long-Term Family Legacy

One of the most powerful ways to avoid GST taxes while preserving wealth across generations is through a “dynasty trust.” This type of irrevocable trust is built to hold assets for the long term—providing financial support to multiple generations without triggering new estate or GST taxes with each transfer.

Key benefits include:

- Avoiding estate and GST tax at each generational level

- Protecting assets from divorce, creditors, or poor financial decisions

- Retaining centralized control over family wealth while supporting heirs

For example, a couple can place $27.22 million (combined GST exemption for 2024) into a dynasty trust. The assets can grow over time and provide financial distributions to their children, grandchildren, and great-grandchildren—without being taxed again at each generational handoff.

Takeaway: If your goal is to build a lasting legacy that supports multiple generations, using an irrevocable trust with GST planning built in can help you do so tax-efficiently and strategically—ensuring your wealth stays where it matters most: within your family.

Is an Irrevocable Trust the Right Move for You?

While irrevocable trusts offer powerful tax advantages, they’re not a one-size-fits-all solution. Choosing to give up control over certain assets is a significant decision—but for many high-net-worth individuals and families, the long-term benefits far outweigh the trade-offs.

To discuss whether an irrevocable trust fits your estate planning goals, contact our team for a personalized consultation.

If you’re also considering how this move fits into our full range of services, we can help you map a complete strategy.

Here’s a quick checklist to help you evaluate whether an irrevocable trust could align with your financial goals and family needs:

Do you have a taxable estate?

If the total value of your estate exceeds the federal exemption limit (currently $13.61 million per individual), you may benefit from reducing your estate size to minimize potential estate tax liability.

Are you funding life insurance for your heirs?

Placing a life insurance policy inside an Irrevocable Life Insurance Trust (ILIT) can ensure the payout is excluded from your estate and passes to your beneficiaries tax-free.

Do you want to protect assets from legal risks or divorce?

Assets held in an irrevocable trust are typically shielded from lawsuits, creditors, or marital disputes, making them a valuable tool for protecting family wealth.

Are you planning to pass wealth to grandchildren?

If your goal is multigenerational wealth transfer, an irrevocable trust can help you avoid the Generation-Skipping Transfer Tax (GST) and ensure your legacy supports multiple generations.

Are you comfortable giving up ownership in exchange for tax savings?

Irrevocable trusts require relinquishing direct control over the assets you contribute—but in return, you gain significant tax advantages and asset protection.

If you answered “yes” to several of the above, an irrevocable trust may be a smart and strategic addition to your estate plan.

Takeaway: An irrevocable trust isn’t just a legal tool—it’s a forward-thinking strategy for individuals who want to reduce tax burdens, preserve wealth, and create a secure legacy for generations to come. Consider speaking with an estate planning professional to explore whether this path is right for your specific situation.

FAQs About Irrevocable Trust Taxation

Understanding how irrevocable trusts work from a tax standpoint can feel overwhelming—especially with so many variables involved. Below are some of the most common questions people have about irrevocable trust taxation, answered in plain terms to help you make informed decisions.

No, irrevocable trusts are not automatically tax-exempt. While they can remove assets from your taxable estate (helping reduce estate taxes), the trust itself may still be subject to income tax if it earns revenue. However, when structured properly, an irrevocable trust can minimize overall tax exposure by shifting liability to beneficiaries in lower tax brackets or leveraging exclusions and exemptions.

It depends on whether the trust is a grantor or non-grantor trust.

In a grantor trust, the person who created the trust (the grantor) pays the income taxes.

In a non-grantor trust, the trust itself pays taxes on retained income, while beneficiaries pay tax on any distributed income.

Yes—placing assets into an irrevocable trust removes them from your taxable estate, which can significantly reduce or eliminate your estate tax liability. This is especially useful for estates that exceed the federal or state exemption thresholds. However, it’s important to work with a professional to ensure your trust is structured properly to meet IRS requirements.

The main difference lies in who pays the income tax:

Grantor Trust: The grantor pays taxes on income, even though they no longer own the assets.

Non-Grantor Trust: The trust pays taxes on income it retains; beneficiaries pay taxes on distributed income.

This distinction impacts both tax planning and control over the trust’s operation.

Irrevocable trusts allow you to make tax-free gifts by using the annual gift tax exclusion ($18,000 per beneficiary in 2024) and your lifetime gift exemption. This helps reduce the size of your estate and transfer wealth efficiently, especially when combined with strategies like funding an Irrevocable Life Insurance Trust (ILIT).