Setting up a trust doesn’t have to mean hiring a lawyer or spending thousands in legal fees. If you’re wondering how to set up a revocable trust on your own, this step-by-step guide will walk you through the entire process—clearly, confidently, and without the legalese.

In this article, you’ll learn what a revocable living trust is, why many people choose the DIY route, what documents and decisions are needed, and exactly how to create and fund your trust from start to finish. Whether you’re planning for retirement, protecting your family, or simply organizing your estate, this guide will help you get it done—on your terms.

Here’s what we’ll cover:

- What Is a Revocable Living Trust?

- Why You Might Want to DIY Your Revocable Trust

- What You’ll Need Before You Begin

- Step-by-Step: How to Set Up a Revocable Living Trust Without a Lawyer

- When to Call in a Professional Instead

- Common Mistakes to Avoid When Doing It Yourself

- Final Thoughts: You Can Do This – with the Right Help

- FAQ

First, let’s understand what a revocable trust actually is and how it fits into your estate planning toolbox.

What Is a Revocable Living Trust?

A revocable living trust is a legal document that allows you to manage and distribute your assets during your lifetime and after your death—without going through probate. “Revocable” means you can change or cancel the trust at any time, as long as you’re alive and mentally capable. “Living” means it’s created while you’re still alive, not through a will after you pass away.

Think of it like a financial container: you move your property, bank accounts, or investments into the trust, and name yourself (and possibly someone else) as the trustee to manage those assets. When you’re gone or incapacitated, a successor trustee you’ve chosen takes over and follows your instructions.

For a deeper legal overview of how revocable trusts work, refer to this guide from the American Bar Association.

How It Compares to a Will

While both wills and revocable trusts are used for estate planning, there’s one major difference:

- A will only takes effect after you die and typically requires probate—a court-supervised process that can be time-consuming and expensive..

- A revocable trust can take effect immediately, and it allows your heirs to skip probate, gaining faster access to what you leave behind.

Want to understand how revocable and irrevocable trusts differ? See our full breakdown on revocable vs. irrevocable trusts.

When It’s Useful

A revocable living trust is especially helpful if:

- You own property in multiple states (avoids probate in each state)

- You want to keep your estate private (unlike wills, trusts aren’t public records)

- You’re planning for incapacity, allowing a trusted person to manage your assets without court involvement

Let’s say Maria, a 62-year-old retiree with a home, a brokerage account, and two adult children, wants to make sure everything passes smoothly to her kids without legal hassles. A revocable living trust lets her outline exactly how that happens, while still retaining full control over her assets today.

Takeaway: A revocable living trust is a flexible, private, and probate-avoiding way to manage your assets now and pass them on later—making it a smart choice for many individuals who want more control and less red tape in their estate plan.

Why You Might Want to DIY Your Revocable Trust

Creating a revocable living trust doesn’t always require an attorney—and for many people, that’s a major relief. If your estate is relatively straightforward and your goals are clear, handling the process yourself can save you time, money, and stress while still ensuring your assets are protected.

Let’s break down some of the most common reasons people choose the DIY route.

Cost Savings Without Compromising Control

Hiring an estate planning attorney can cost anywhere from $1,500 to $5,000 or more for a basic revocable trust. For individuals with manageable estates, that’s a large investment for a process that can often be done with online tools or guided platforms.

For a breakdown of typical estate planning costs, including DIY vs. professional services, see this guide from Nolo.

When you DIY your trust:

- You retain full control over the content and structure

- You avoid hourly legal fees or bundled service packages

- You can update your trust on your own terms, without paying for revisions

Simplicity and Speed

The modern DIY approach isn’t about drafting legal documents from scratch—it’s about using easy-to-follow templates or digital platforms that guide you through each step. If you’re comfortable managing your own finances, filing taxes, or handling insurance paperwork, setting up a revocable trust is well within your skill set.

Curious about the pros and cons of self-prepared trusts? FindLaw has a helpful article on how to make your own living trust.

Privacy and Peace of Mind

Creating your trust privately, at your own pace, keeps sensitive financial decisions out of the public eye. Unlike wills, which go through probate and become part of the public record, a trust offers greater discretion—and handling it yourself avoids unnecessary exposure to multiple third parties.

Meet Maria, a 62-Year-Old Retiree

Maria owns a modest home, a rental property, and a few investment accounts. She wants to ensure her two adult children receive her assets quickly and without court involvement. After some research, Maria realized that hiring an attorney would add cost and complexity she didn’t need. With the help of a trusted DIY estate planning platform, she completed her revocable living trust in just a few days—entirely on her own terms.

DIY Revocable Trust: Pros and Cons

Pros:

- Significantly more affordable than hiring a lawyer

- Faster and more convenient process

- Maintains privacy and discretion

- Full control over the structure and decisions

Cons:

- Not ideal for complex or high-value estates

- No personalized legal advice

- Requires attention to detail to avoid mistakes

Takeaway: If your estate is simple and your goals are clear, creating a revocable trust without a lawyer can be a smart, empowering move—and one that puts you in control of your legacy.

What You’ll Need Before You Begin

Before you start drafting your revocable living trust, it’s important to gather the right documents and make a few key decisions. Having this information ready will make the process faster, smoother, and less overwhelming. Think of it as preparing a blueprint before building your estate plan.

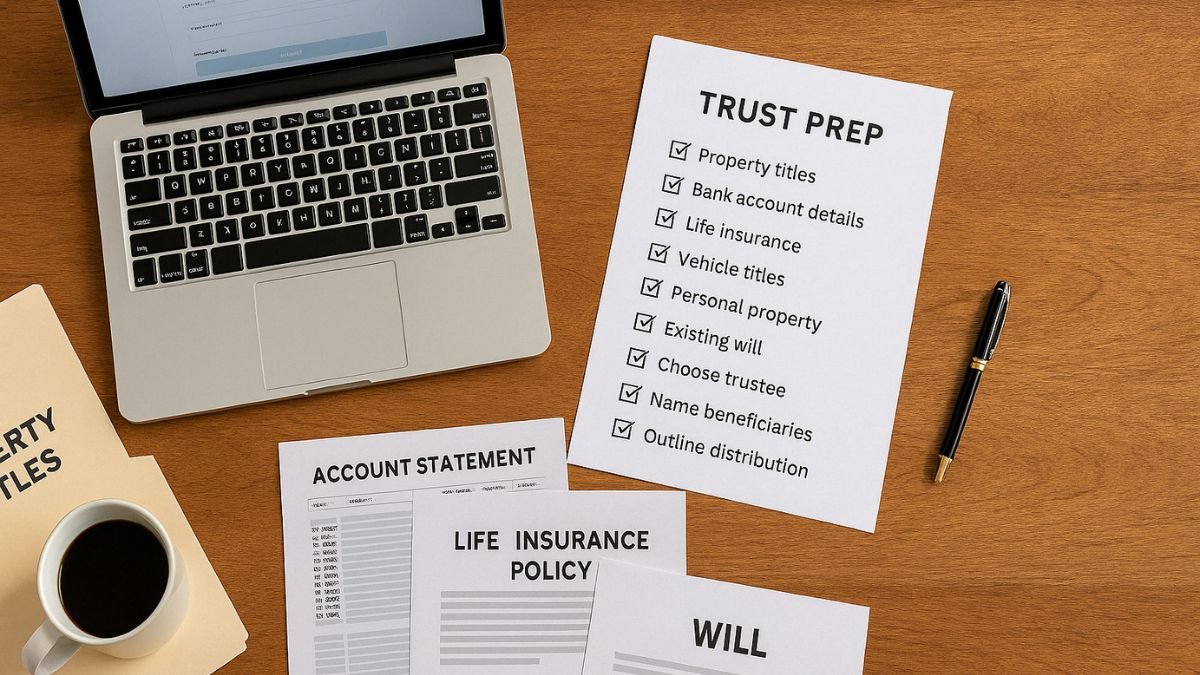

Key Documents and Information to Gather

To create a legally sound and effective trust, you’ll need accurate details about your assets and the people involved in managing or receiving them. Here’s what to collect:

- Property titles – This includes your primary residence, rental properties, vacation homes, or land. You’ll need the full legal descriptions and proof of ownership.

- Bank and investment account details – Include account numbers, financial institutions, and current balances for checking, savings, brokerage, and retirement accounts.

- Life insurance policies – Have copies of your policy documents, including beneficiary designations.

- Vehicle titles (if applicable) – Especially for high-value or collectible vehicles.

- Personal property of value – Items like jewelry, art, or heirlooms you intend to specify in the trust.

- Existing estate planning documents – Such as wills, power of attorney forms, or old trust documents, if you plan to replace or align them.

Having these materials in one place can prevent delays or confusion later in the process. A printable or digital checklist is a great way to track your progress.

Decisions You’ll Need to Make

In addition to collecting documents, you’ll need to think through a few important decisions that determine how your trust works and who’s involved.

- Choose your trustee and successor trustee

Your trustee is the person (or institution) who manages the assets in your trust. Most people name themselves as the initial trustee and appoint a successor trustee to take over if they become incapacitated or pass away. - Name your beneficiaries

These are the individuals or organizations who will receive your assets. Be specific—use full names and relationships to avoid confusion or disputes. - Outline distribution instructions

Decide how and when your assets should be distributed. Do you want your children to inherit everything at once, or receive it in stages? Would you prefer a lump sum or scheduled payouts? These details go into the trust and help ensure your wishes are honored.

Takeaway: Preparing the right documents and making clear decisions up front will save time, prevent errors, and make the DIY trust setup process far more efficient and stress-free.

Step-by-Step: How to Set Up a Revocable Living Trust Without a Lawyer

Once you’ve gathered your documents and made key decisions, you’re ready to begin. Below is a practical, step-by-step breakdown of how to set up a revocable trust on your own—no legal degree required. Each step is designed to be approachable, actionable, and easy to follow, especially for individuals with straightforward estates.

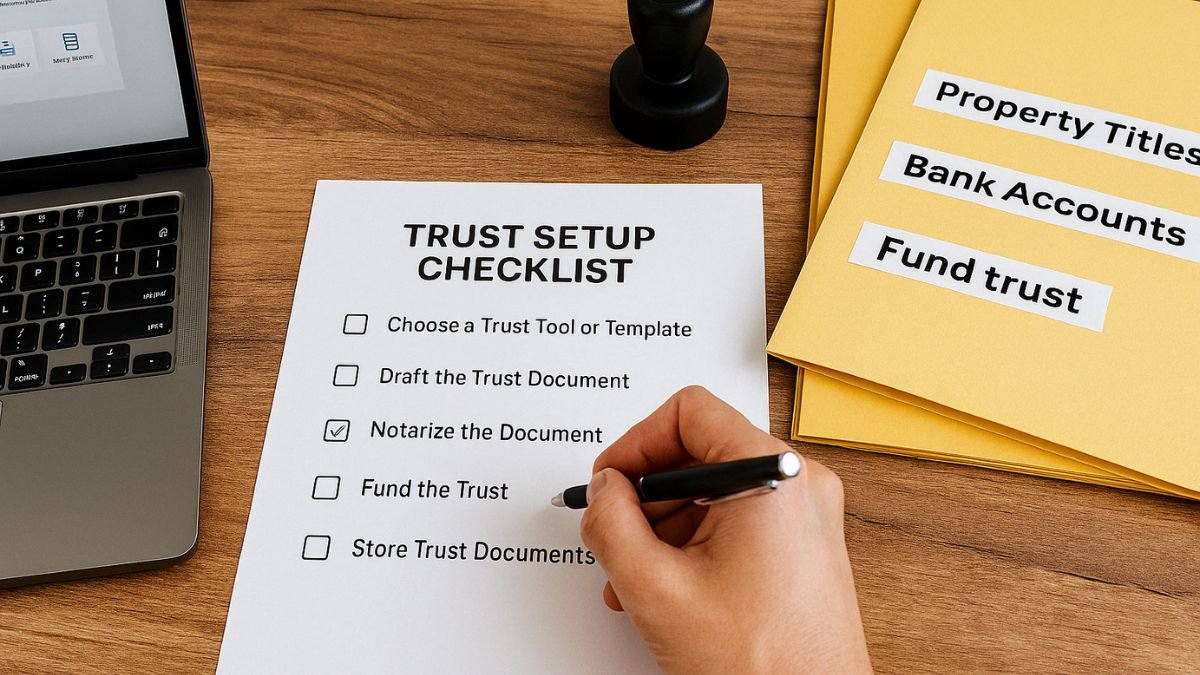

Step 1 – Choose the Right Trust Tool or Template

Start by selecting the method you’ll use to create your trust. You have a few options:

- Online estate planning platforms – These guide you through the process with customizable templates and state-compliant language.

- Downloadable legal forms – Pre-made templates available from legal sites, often for a one-time fee.

- Word processor-based DIY – You can build your trust manually, but this is only recommended if you’re experienced and comfortable interpreting legal language.

Whichever route you choose, ensure that the tool is state-specific, customizable, and up to date with current estate planning laws.

Step 2 – Draft Your Trust Document

This is where you outline how the trust works and who’s involved. Your document should clearly include:

- Name of the trust and the date it was created

- Grantor (you) – the person creating the trust

- Trustee – who manages the trust

- Successor trustee – who takes over if the trustee can’t serve

- Beneficiaries – who will receive your assets

- Instructions for distributing your assets

Be specific with names and relationships, and use plain, unambiguous language. If your tool allows it, use pre-filled fields to help reduce errors.

Step 3 – Get the Document Notarized

Once your trust is drafted and finalized, it must be signed and notarized to become legally binding. This can typically be done at:

- A notary public’s office

- A local bank or credit union

- Online, via a remote notarization service (in states where allowed)

Some states also require witness signatures, so check your state’s requirements before finalizing.

Step 4 – Fund the Trust (Re-title Your Assets)

A trust only works if it owns the assets. This is known as “funding the trust,” and it’s a critical step that many DIYers overlook. Make sure to move your assets into the trust—a critical step in making it legally functional.

You’ll need to transfer ownership of your assets to the trust by re-titling them. This includes:

- Real estate – File a new deed with the county naming the trust as the owner

- Bank accounts – Update account titles or create new accounts in the trust’s name

- Investment and brokerage accounts – Complete transfer forms with your financial institution

- Life insurance or retirement plans – Update beneficiary designations, if applicable

Each institution may have its own process, so be sure to contact them for specific instructions.

Step 5 – Store and Share Your Trust

Once your trust is created and funded, store it in a safe, accessible location. You should:

- Keep the original signed trust in a secure place like a fireproof home safe

- Give copies to your successor trustee and, if appropriate, your beneficiaries

- Consider storing a digital copy with secure cloud storage for backup

Let your trustee know where to find the document and when to act. Clarity now will prevent confusion later.

Takeaway: Creating a revocable trust without a lawyer is entirely doable when you follow a structured, step-by-step approach. With the right tools, attention to detail, and preparation, you can build a legally sound plan that protects your assets and your loved ones.

When to Call in a Professional Instead

While setting up a revocable living trust on your own can be empowering and cost-effective, it’s not the best path for everyone. Certain life circumstances and estate complexities can make professional legal guidance not just helpful—but necessary.

Here are a few scenarios where it’s wise to pause the DIY route and consult with an estate planning expert:

1. You Have a Blended Family or Unique Family Dynamics

If you’ve remarried, have stepchildren, or need to balance competing interests among beneficiaries, trust language becomes more sensitive and strategic. A professional can help you structure the trust to avoid future conflict or legal disputes.

2. Your Estate Is Large or Complex

Managing multiple properties, businesses, or high-value assets? In larger estates, estate tax exposure, asset protection, and trust layering (such as combining revocable and irrevocable trusts) may come into play. DIY tools typically don’t cover these nuances.

3. You’re Planning for a Dependent with Special Needs

If one of your beneficiaries relies on government benefits or needs lifelong care, you’ll need to create a special needs trust alongside or within your revocable trust. This requires precise legal language to ensure eligibility and support are preserved.

4. You Anticipate Legal Challenges or Disputes

Families don’t always agree, especially after a loved one passes. If you suspect someone may contest your trust or question your intentions, working with an attorney adds a layer of protection and clarity that DIY documents can’t always provide.

5. You Have Out-of-State or International Property

Property located in different states—or abroad—can complicate your estate plan. Legal professionals understand how to handle these variables and structure your trust for multi-jurisdictional compliance.

If any of these situations apply to you, it doesn’t mean you have to abandon the idea of a revocable trust—it just means you might benefit from expert help. Trust Guru offers personalized consultations to help you decide the right path forward, whether that’s DIY or attorney-assisted.

Takeaway: Knowing when to ask for help is a strength, not a setback. In more complex situations, a professional can help ensure your estate plan works exactly as intended—and gives your loved ones peace of mind.

Common Mistakes to Avoid When Doing It Yourself

Creating your own revocable living trust can be a smart and efficient move—but like any legal process, there are important details that can’t be overlooked. Even small oversights can lead to delays, confusion, or unintended outcomes for your beneficiaries.

Learn more about the most common living trust mistakes people make and how to avoid them.

Here are the most common mistakes people make when setting up a trust without professional help—and how to avoid them.

1. Naming Vague or Unclear Beneficiaries

It’s critical to be specific when naming who will receive your assets. Using general terms like “my children” or “my family” can lead to legal challenges, especially in blended families or if your relationships change.

Tip: Use full legal names and clearly define relationships (e.g., “John A. Smith, my son”) to prevent ambiguity.

2. Forgetting to Fund the Trust

A revocable trust only works if it holds your assets. Many people complete the paperwork but never transfer ownership of their property, bank accounts, or investments into the trust—rendering it ineffective.

Tip: Follow through with retitling your assets and updating beneficiary designations where needed.

3. Not Updating the Trust as Life Changes

A trust isn’t a “set it and forget it” document. Major life events like marriage, divorce, births, deaths, or the sale of property should trigger a review and update of your trust.

Tip: Review your trust every couple of years or after any significant life event to keep it current.

4. Overlooking Successor Trustees

It’s common to name yourself as the initial trustee—but what if something happens to you? Failing to designate a successor trustee can leave your estate in limbo when the trust is needed most.

Tip: Always name at least one trusted individual or institution as a backup trustee.

5. Using Generic or Outdated Templates

Online trust templates can be convenient, but not all are legally compliant or tailored to your state’s laws. Using the wrong form can create loopholes or result in rejection during key processes.

Tip: Choose a reputable, up-to-date platform that accounts for state-specific legal requirements.

Top 5 DIY Trust Fails to Watch For:

- Vague or missing beneficiary information

- Unfunded trusts (assets still titled in your name)

- Failure to name a successor trustee

- Trust not notarized or improperly executed

- Outdated or non-compliant legal templates

Takeaway: With a bit of extra care and attention to detail, you can avoid the most common DIY missteps and ensure your revocable living trust does exactly what it’s meant to—protect your legacy and simplify life for your loved ones.

Final Thoughts: You Can Do This – with the Right Help

Setting up a revocable living trust without a lawyer might feel intimidating at first—but as you’ve seen, it’s entirely achievable with the right preparation and tools. By taking a thoughtful, step-by-step approach, you can create a trust that’s legally sound, easy to manage, and perfectly tailored to your needs.

A well-executed DIY trust offers more than just cost savings. It gives you:

- Control over how your assets are managed and distributed

- Simplicity in your estate planning process

- Peace of mind knowing your loved ones will avoid probate delays and complications

Whether you’re protecting your family’s future, organizing digital assets, or planning for long-term care, a trust offers peace of mind, a revocable trust is one of the smartest ways to secure your legacy—and doing it yourself is not only possible but often practical.

At Trust Guru, we’re here to make that journey even easier. Our DIY-friendly platform is designed to walk you through each step with confidence, and our team is always available if you need guidance along the way.

Ready to get started? Contact our team or explore our full range of services to begin building your trust today.

Frequently Asked Questions

Yes, it is completely legal to create a revocable living trust without hiring an attorney—as long as the trust complies with your state’s legal requirements. Many people with simple estate planning needs use online tools or templates to set up their trust successfully. Just be sure the document is properly signed and notarized where required.

In most states, yes. Notarizing your revocable trust makes it official and legally enforceable. Some states may also require witnesses during the signing process. Always check your local laws or use a platform that includes state-specific guidance.

Absolutely. One of the main advantages of a revocable trust is flexibility. You can update it at any time—whether you want to change trustees, add new assets, or revise beneficiary instructions. Just be sure to formally document and sign any amendments you make.

You can include a wide range of assets in your trust, such as:

Real estate (your home, rental properties)

Bank accounts (checking, savings)

Investment and brokerage accounts

Life insurance (with updated beneficiary designations)

Valuable personal property (art, jewelry, vehicles)

Some assets—like retirement accounts or annuities—may not be transferred into a trust directly but can be coordinated through beneficiary designations.

The cost of creating a DIY revocable trust varies based on the method you choose.

Online platforms typically range from $100 to $500

Downloadable templates may cost $20 to $100

Hiring an attorney, by contrast, can cost $1,500 to $5,000 or more

DIY solutions are generally much more affordable, especially for straightforward estates, and are often backed by expert-reviewed templates to ensure compliance.