Setting up a living trust might sound complicated, but it doesn’t have to be. This step-by-step guide on how to set up a living trust will walk you through the essentials—what it is, why it matters, and how to create one with clarity and confidence.

Whether you’re planning for retirement, protecting your assets, or ensuring your loved ones avoid probate, this guide breaks down the process into manageable steps—no legal jargon, just practical advice you can trust.

What you’ll learn:

- What Is a Living Trust and Why You Might Need One

- Types of Living Trusts Explained

- Step-by-Step: How to Set Up a Living Trust

- Who’s Involved in a Living Trust (and What They Do)

- What Assets Should and Shouldn’t Go Into a Living Trust

- Common Mistakes to Avoid When Creating a Living Trust

- Living Trusts and the Probate Process

- How Trust Guru Makes Trust Creation Simple

- FAQs About Setting Up a Living Trust

What Is a Living Trust and Why You Might Need One

A living trust is a legal arrangement that allows you to transfer ownership of your assets—like your home, bank accounts, or investments—into a trust while you’re still alive. You maintain control of those assets during your lifetime, and after your death, they’re distributed to your chosen beneficiaries without going through probate. In other words, a living trust is a powerful estate planning tool designed to protect your legacy and simplify the process for your loved ones.

Think of a living trust like a personal treasure chest: you place your valuable items inside while you’re living, you hold the key, and you decide who gets what and when. When the time comes, your appointed trustee takes over, ensuring everything is handled according to your wishes—efficiently and privately.

One of the biggest reasons people choose to create a living trust is to avoid probate, the court-supervised process that can delay asset distribution and rack up legal fees. Unlike a will, which must go through probate, a living trust allows your estate to be settled without court involvement, saving time, money, and stress for your family.

Privacy is another major benefit. While wills become public record during probate, a living trust keeps your financial affairs confidential. You also gain more control over how and when your assets are distributed—for example, setting conditions for when a child inherits money, or protecting a loved one with a trust fund with a special needs trust.

Here’s a quick real-world example:

A couple in California owned a home, some rental property, and retirement accounts. They set up a revocable living trust and transferred their assets into it. When the husband passed away, everything was smoothly managed by the successor trustee—no court, no delays, no family disputes. The surviving spouse was able to stay financially stable and avoid the emotional toll of probate proceedings.

A living trust is one of the smartest moves you can make if you’re serious about preserving your wealth, protecting your family, and maintaining control over your estate.

Key takeaway: A living trust helps you simplify the estate planning process, avoid probate, and ensure your assets are distributed according to your wishes—without court delays or public exposure.

Types of Living Trusts Explained

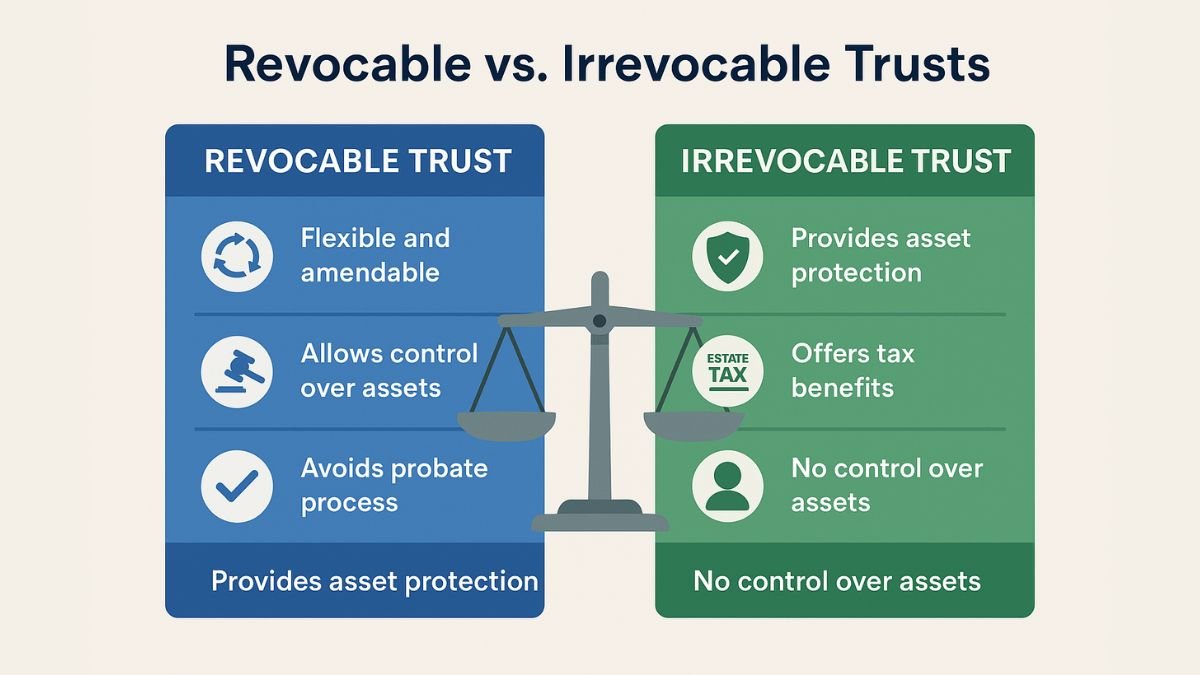

Not all living trusts are created equal. Depending on your financial goals, family situation, and long-term planning needs, you’ll want to choose the type of trust that offers the right balance of control, protection, and tax efficiency. The two main categories are revocable living trusts and irrevocable trusts, but there are also specialized options worth knowing about.

To better understand the difference between the two, check out our guide on revocable vs. irrevocable trusts.

Revocable Living Trusts

A revocable living trust is the most common type of trust for estate planning—and with good reason. As the name implies, this trust can be changed or amended at any time during your lifetime, as long as you’re mentally competent.

This type of trust is often used to streamline the transfer of assets, and is recommended by the American Bar Association as a key tool for those seeking privacy and probate avoidance.

Benefits:

- Full control while you’re alive

- Avoids probate after your death

- Easy to amend if circumstances change (e.g., divorce, new grandchild)

- Maintains privacy and streamlines distribution

Considerations:

- Does not protect assets from creditors or lawsuits

- Does not reduce estate taxes for high-net-worth individuals

This flexibility makes revocable trusts an excellent choice for most families, retirees, and individuals who want to keep things simple but effective.

Irrevocable Trusts

An irrevocable trust, on the other hand, is a more permanent structure. Once created and funded, you generally can’t change or cancel it without court approval or the consent of all beneficiaries.

Why would someone choose a less flexible option? Because irrevocable trusts offer stronger asset protection and can provide tax advantages, especially for high-value estates.

Benefits:

- Removes assets from your taxable estate

- May help reduce or eliminate estate taxes

- Offers protection from creditors, lawsuits, and Medicaid spend-down rules

Considerations:

- Loss of control—you no longer legally own the assets

- Requires careful planning and legal guidance

This type of trust is often used in more complex estate planning scenarios or when preserving wealth for future generations is a priority.

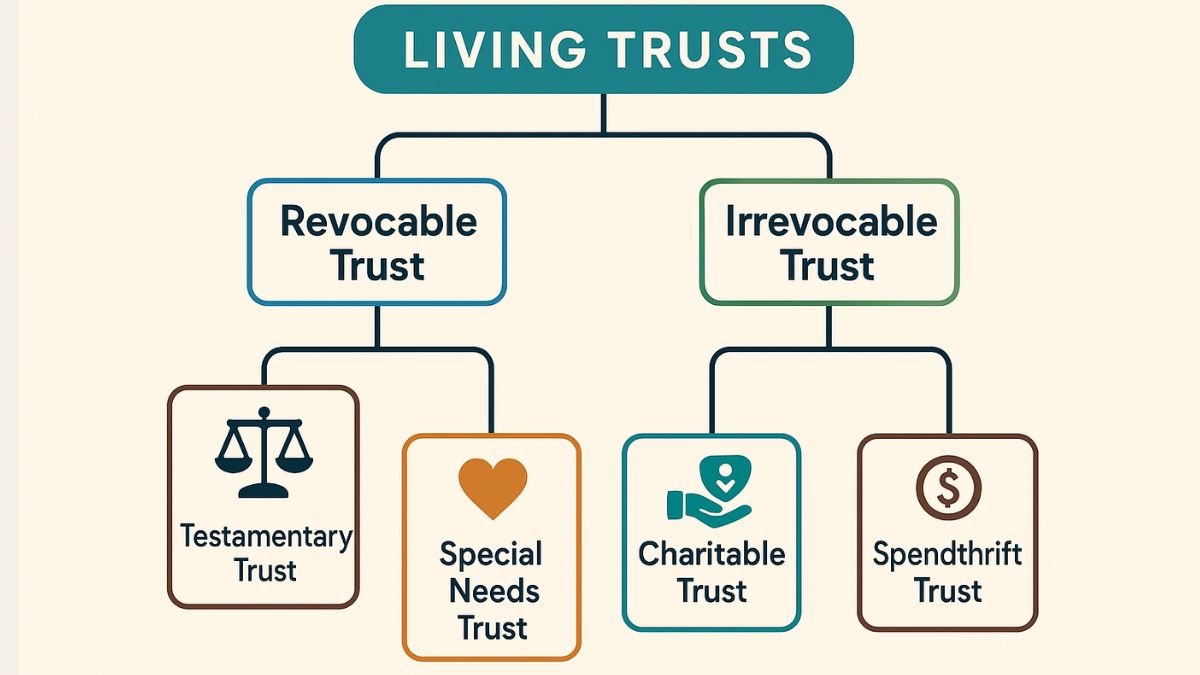

Other Types of Trusts to Know About

Beyond revocable and irrevocable living trusts, there are a few specialized trusts that serve unique purposes:

- Testamentary Trust: Created through a will and activated after death; often used for minor children or staggered inheritance plans.

- Special Needs Trust: Designed to provide for a beneficiary with a disability without affecting their eligibility for government benefits.

- Charitable Trust: Allows you to donate assets to a nonprofit while potentially receiving tax benefits.

- Spendthrift Trust: Protects a beneficiary’s inheritance from poor financial decisions or creditors.

These trusts can often be layered into a broader estate strategy and may be recommended based on your family’s specific needs.

Key takeaway: Choosing the right type of living trust depends on how much control you want to retain, the level of asset protection you need, and your estate’s value. Revocable living trusts offer flexibility and simplicity, while irrevocable trusts provide stronger protection and tax advantages—but require a long-term commitment.

Step-by-Step: How to Set Up a Living Trust

Creating a living trust may sound overwhelming at first, but the trust process is actually quite manageable when broken down into simple steps. Whether you’re looking to create a revocable living trust for flexibility or setting up a more permanent structure, this step-by-step guide will walk you through everything you need to know—from the very first decision to the final signature.

Step 1 – Decide What Type of Trust You Need

Before you can create a trust, you’ll need to determine which type fits your goals:

- A revocable living trust gives you flexibility and control, making it a popular choice for general estate planning.

- An irrevocable trust may be more suitable for those looking to reduce estate taxes or protect assets from creditors.

Ask yourself: Do I want to maintain control and make changes later? Or am I ready to lock in long-term benefits?

To compare options and understand which trust might suit your situation, visit Charles Schwab’s guide to selecting a trust.

For guidance on choosing the right professional, here’s what an estate planning attorney does.

Step 2 – Choose Your Trustee and Successor Trustee

The trustee is the person or institution responsible for managing the trust assets. While you’re alive, you can serve as your own trustee, maintaining full control. But you’ll also need to name a successor trustee—someone who steps in after your death or if you become incapacitated.

Choose someone trustworthy, financially responsible, and organized. This could be a family member, a trusted friend, or a professional fiduciary.

Tip: It’s wise to name an alternate successor trustee in case your first choice is unavailable.

Step 3 – Draft Your Trust Document

Now it’s time to put it all in writing. Your trust document outlines key details like your legal instructions and oversight.

- The name of the trust

- The terms of the trust (how and when assets are distributed)

- Who the beneficiaries are

- Instructions for the trustee

This step often requires legal expertise to ensure your trust agreement is valid, especially if you have complex assets or family dynamics. Trust Guru offers attorney-reviewed solutions that make this part simple and compliant.

Step 4 – Fund the Trust by Transferring Assets

This is where many people make a critical mistake—they forget to fund the trust. Once your trust is created, you need to transfer ownership of your assets into the trust. This could include:

- Real estate titles (see real estate protection strategies)

- Bank accounts

- Investment portfolios

- Business interests

- Personal property

This process is known as trust funding, and it ensures your trust property is actually controlled by the trust.

Note: Any assets not transferred to the trust may still go through probate.

Step 5 – Sign, Notarize, and Store Your Trust Safely

After reviewing everything carefully, it’s time to make it official. You’ll sign the trust in front of a notary, and in some cases, witnesses may be required (depending on your state).

Keep your original trust document in a secure location, such as a fireproof safe or with your estate attorney. Make sure your successor trustee knows where to find it and has access when the time comes.

Pro Tip: Keep copies on hand and provide them to financial institutions or professionals managing your trust assets.

Key takeaway: To set up a living trust, you’ll need to choose the right type, name responsible people, prepare legal documents, and properly transfer your assets. Missing any step—especially funding the trust—can weaken the benefits you’ve worked to build. Following a clear, guided process like this helps you protect your legacy with confidence.

Who’s Involved in a Living Trust (and What They Do)

A living trust isn’t just a legal document—it’s a relationship between key people who each play an important role in managing and distributing your assets. Understanding who does what will help you set up your trust correctly and ensure it runs smoothly when it’s needed most.

Beneficiary education is also a crucial part of this, helping recipients understand their role in the process.

Here’s a breakdown of the main players involved:

| Role | What They Do |

| Grantor | The person who creates the trust and transfers assets into it. |

| Trustee | Manages the assets in the trust according to its terms. Often the grantor at first. |

| Successor Trustee | Steps in to manage or distribute the assets if the original trustee dies or becomes incapacitated. |

| Beneficiaries | The individuals or organizations who will receive the assets from the trust. |

Grantor (also called “Trustor” or “Settlor”)

The grantor is you—the person establishing the trust. You’re the one who puts your assets into the trust, outlines how they should be managed or distributed, and selects the other key people involved.

As the grantor, you can:

- Amend or revoke a revocable trust

- Serve as your own trustee while you’re alive

- Set specific instructions for how assets should be handled

Trustee

The trustee is the person (or entity) responsible for managing the trust. In a revocable living trust, this is often the grantor to start with. The trustee has a fiduciary duty, meaning they must act in the best interest of the beneficiaries and according to the terms of the trust.

Duties may include:

- Paying bills or taxes on trust property

- Investing trust assets

- Keeping records

- Distributing assets to beneficiaries as outlined

If managing the trust sounds daunting, some people choose a professional trustee (like a financial advisor or trust company) to ensure accuracy and accountability.

Successor Trustee

The successor trustee is your backup—the person who takes over managing the trust after your death or if you become incapacitated. This role is critical, as they’ll be responsible for executing your wishes without the need for court involvement.

Choose someone:

- You trust to act responsibly and fairly

- Who’s organized and capable of handling financial matters

- Who understands (or is willing to learn) the responsibilities involved

Tip: Always name at least one alternate successor trustee, just in case.

Beneficiaries

The beneficiaries are the people or organizations you choose to receive the assets in your trust. This could include family members, friends, charities, or even a pet trust for a beloved animal.

You can get specific—such as delaying access until a beneficiary turns a certain age or distributing in stages. These instructions help ensure your assets are used according to your values and wishes.

Key takeaway: A living trust is only as strong as the people behind it. By clearly defining the roles of grantor, trustee, successor trustee, and beneficiaries, you ensure your estate is managed and passed on exactly the way you intend—without unnecessary delays or complications.

What Assets Should and Shouldn’t Go Into a Living Trust

One of the most important—yet often overlooked—steps in creating a living trust is deciding which assets to include. Funding a trust correctly ensures your estate plan works as intended and avoids unnecessary probate.

If you skip it, your trust won’t be able to do its job, and your estate may still end up in probate. You may also need to think about tax filing and trust compliance as you organize your assets.

You can read more about proper asset transfer in our trust funding guide.

Here’s a breakdown of the types of assets that typically belong in a living trust—and a few that don’t.

Common Assets to Include in a Living Trust

These are some of the most common trust assets people transfer into their trust to protect and control their distribution:

- Real estate: Your primary residence, vacation home, rental properties, or land. Title must be retitled in the name of the trust (e.g., John Smith, Trustee of the Smith Family Trust).

- Bank accounts: Checking, savings, CDs, and money market accounts. Some banks may have their own process for changing account ownership to the trust.

- Investment accounts: Non-retirement brokerage accounts, stocks, and bonds can typically be transferred with help from your financial advisor.

- Personal property: Valuable items like jewelry, collectibles, antiques, or vehicles.

- Business interests: Ownership shares in an LLC or corporation can be placed in a trust, but this may require amending operating agreements.

By placing these assets in a living trust, you ensure they’re managed or distributed according to your instructions—without court interference.

Assets You Shouldn’t (or Usually Don’t Need to) Include

Some assets either can’t legally be transferred to a trust or may create unintended tax or legal consequences if they are:

- Retirement accounts (IRA, 401(k), etc.): These accounts are individually owned and have designated beneficiaries. Instead of transferring ownership, you can name the trust as a beneficiary if appropriate—but speak to a financial advisor first to avoid tax complications.

- Life insurance policies: Similar to retirement accounts, you’ll typically name a beneficiary rather than transferring ownership. In some cases, people create irrevocable life insurance trusts (ILITs) to manage large policies.

- Health savings accounts (HSAs) and flexible spending accounts (FSAs): These accounts must stay in your name but can be used alongside your trust in broader planning.

- Vehicles: While you can place a vehicle in a trust, it’s usually not necessary unless the vehicle is of significant value.

How to Transfer Assets to Your Trust

To make your trust effective, you need to transfer ownership of the assets—not just list them in the trust document. This might involve:

- Signing new deeds for real estate

- Changing account ownership with banks or investment firms

- Creating an assignment of ownership for personal property

- Updating business ownership records

Be sure to keep a detailed schedule of trust assets, which acts as an inventory of everything placed in the trust. This helps your trustee manage and distribute trust property efficiently at your death.

Key takeaway: Placing the right assets into your living trust ensures your estate plan works the way you intended. Real estate, financial accounts, and valuable personal property are typically great fits.

But for assets like retirement accounts or life insurance, you’ll need to take a different approach—often by naming beneficiaries or using companion planning tools. Always double-check your asset transfers to keep your trust legally sound and effective.

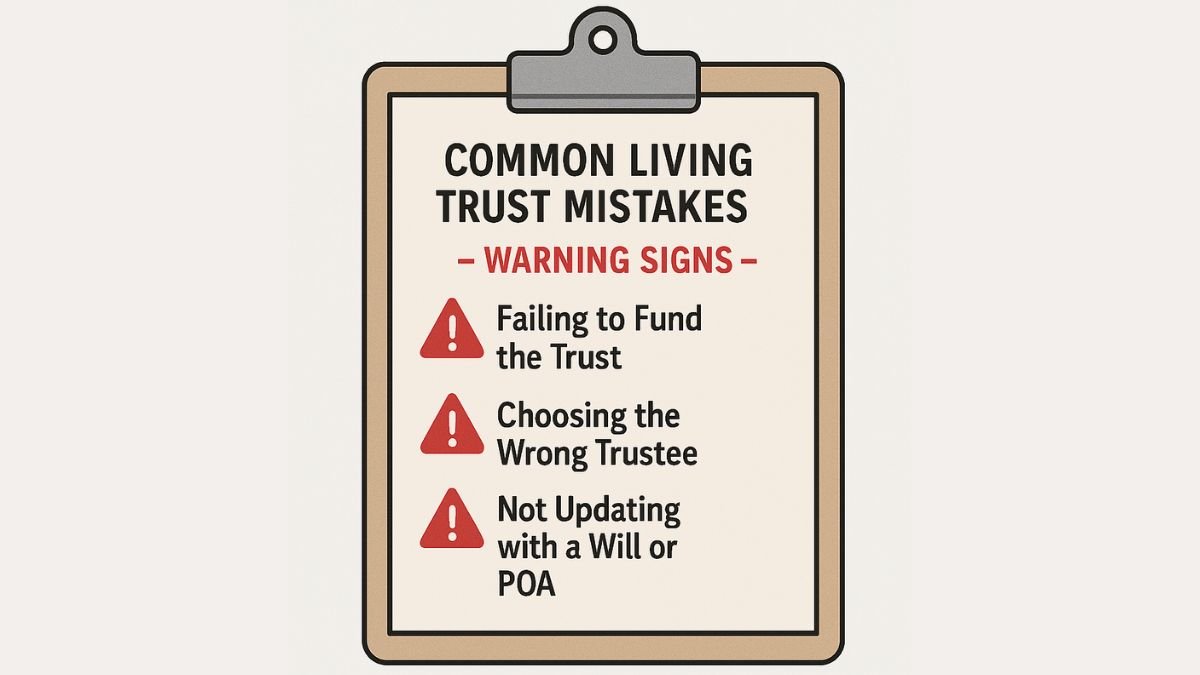

Common Mistakes to Avoid When Creating a Living Trust

Setting up a living trust is one of the smartest steps you can take in protecting your legacy—but like any legal process, there are pitfalls to watch out for. These common mistakes can reduce the effectiveness of your trust or create unintended complications for your loved ones.

Avoiding them upfront will save your family time, money, and stress down the road.

1. Failing to Fund the Trust

Creating a trust is only half the battle—funding the trust is what makes it legally and practically functional. This means transferring your assets into the trust so it actually owns them. If you skip this step, the trust won’t control those assets, and they may end up in probate anyway.

Solution: After signing your trust, follow through by retitling real estate, updating financial accounts, and assigning ownership of valuables.

2. Choosing the Wrong Trustee

Your trustee plays a crucial role in managing and distributing your assets according to your instructions. Selecting someone who is disorganized, unreliable, or not up for the task can lead to delays, mismanagement, or family tension.

Solution: Choose a trustee who is trustworthy, detail-oriented, and capable of handling financial responsibilities. Consider a professional trustee if no ideal individual is available.

3. Not Updating the Trust as Life Changes

Life doesn’t stand still—and neither should your trust. Major events like marriage, divorce, births, deaths, or significant changes in assets or goals may require you to change the trust.

Solution: Review your trust every few years or after major life events to ensure your wishes and terms of the trust still reflect your intentions.

4. Not Coordinating with a Power of Attorney or Will

Your living trust doesn’t cover everything. For a comprehensive estate plan, you also need a power of attorney (to manage financial or medical decisions if you’re incapacitated) and a last will and testament (to cover assets outside the trust or appoint guardians for minor children).

Ensure you have healthcare directives and powers of attorney in place for comprehensive coverage.

Solution: Work with an estate planning professional to align your trust with these other essential documents. They should complement—not contradict—each other.

Key takeaway: Even a well-drafted trust can fall short if it’s not properly maintained. Be proactive: fund the trust, choose the right trustee, keep it updated, and ensure it integrates with your broader estate plan. These small steps can make a big difference when it matters most.

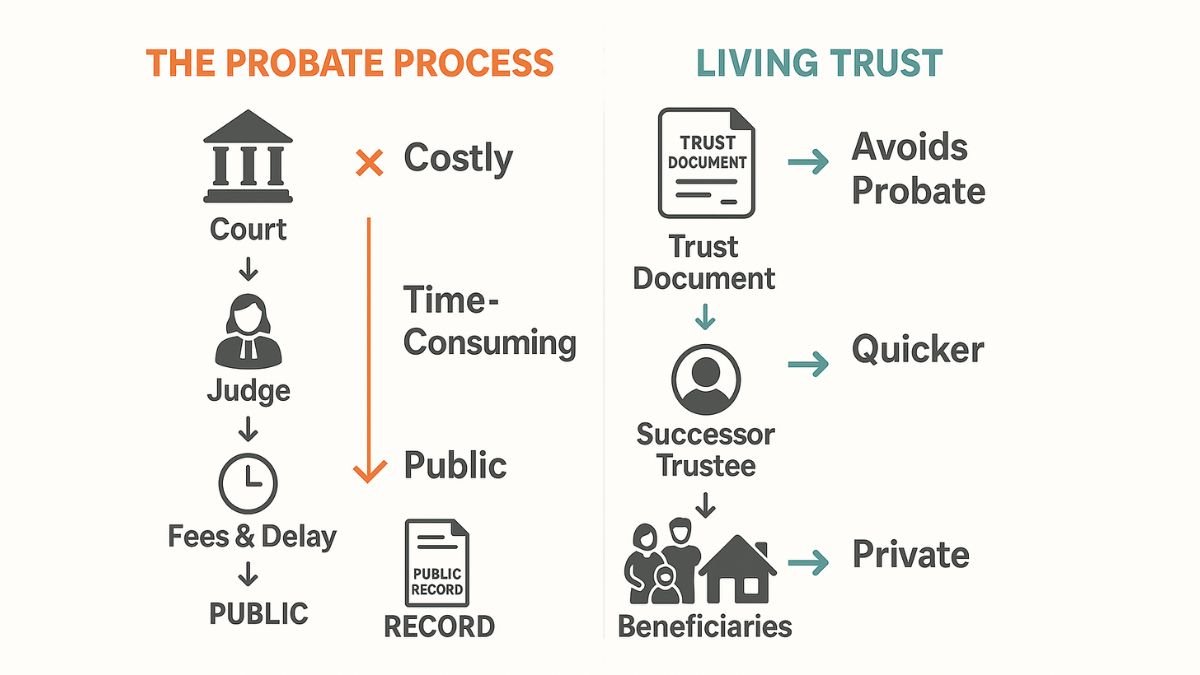

Living Trusts and the Probate Process

One of the biggest reasons people choose to set up a living trust is to avoid the probate process—and with good reason. Probate can be time-consuming, expensive, and emotionally draining for families already dealing with loss. A properly funded living trust helps you bypass this legal hurdle and keep control of what happens to your estate.

How a Living Trust Helps You Avoid Probate

When you place assets into a living trust, you’re essentially removing them from your personal ownership and transferring them into a legal entity—the trust itself. Since these trust assets are no longer technically owned by you at the time of your death, they don’t need to go through the probate process to be distributed.

Instead, your successor trustee steps in and follows the terms of the trust, distributing property directly to your beneficiaries—privately, efficiently, and without court oversight.

Benefits of avoiding probate:

- Faster distribution of assets

- Lower legal and administrative costs

- Greater privacy (wills become public record; trusts do not)

- Less stress and fewer delays for your loved ones

Avoiding probate is one of the main benefits of a living trust. Proper funding and maintenance also help with creditor protection, so your assets stay safe.

What Still Might Go Through Probate

While a living trust covers most of your estate, some assets that would go through probate include:

- Property not retitled in the name of the trust (e.g., a second home or bank account you forgot to transfer)

- Assets without a named beneficiary and not placed in the trust

- Personal property not listed in a trust inventory

That’s why funding your trust and keeping it up to date is so important. Even a great trust won’t work if your assets never make it into it.

Living Trust vs. Will in Probate Court

A will is a valuable estate planning tool, but it does not avoid probate. Wills must be filed with the probate court, where a judge oversees the process of validating the will, paying off debts, and distributing assets.

In contrast, a trust would go into effect immediately upon your death or incapacity, with no court involvement if properly structured. This is especially helpful if you have real estate in more than one state, as it allows you to avoid multiple probate processes.

Key takeaway: A living trust is one of the most effective ways to avoid the probate process and ensure your estate is distributed smoothly and privately. Just make sure you’ve transferred all the right assets and reviewed your trust regularly to keep everything on track.

How Trust Guru Makes Trust Creation Simple

Creating a living trust doesn’t have to mean expensive attorney fees or endless paperwork. Here’s what it actually costs to set up a living trust and why it’s more affordable than many people assume.

At Trust Guru, we’ve designed an easier way to protect your legacy—without the hassle or high cost of a traditional law firm.

Our process is fully remote, attorney-reviewed, and legally valid in all 50 states, making comprehensive estate planning more accessible than ever. Whether you’re a busy professional, a retiree, or a small business owner, you can set up a customized living trust from the comfort of your home—with expert support every step of the way.

Here’s how it works:

- Answer a few simple questions online about your goals, assets, and family.

- Our estate planning attorneys review your information to ensure everything is legally sound.

- You receive your completed trust documents—ready to sign, notarize, and fund.

No confusing legal jargon. No in-person appointments. Just a streamlined process built for real life.

At Trust Guru, we believe estate planning should be transparent, affordable, and trustworthy. That’s why our team of attorneys and financial professionals is here to guide you—not overwhelm you.

Ready to begin? Contact our team or start online today.

FAQs About Setting Up a Living Trust

Still have questions? You’re not alone. Below are some of the most common questions we hear from people considering a living trust for their estate planning. These quick answers can help clarify key points and guide your next steps with confidence.

To legally create a living trust, you’ll need to:

Decide on the type of trust (revocable or irrevocable).

Choose your trustee and successor trustee.

Draft a trust document that outlines your wishes and names your beneficiaries.

Sign and notarize the trust.

Transfer assets into the trust to make it effective.

Working with an estate planning attorney or a trusted platform like Trust Guru ensures your trust complies with state law and meets your needs.

You must retitle each asset so it’s owned by the trust rather than you personally. For example:

Real estate requires a new deed with the trust listed as owner.

Bank and investment accounts need updated ownership forms.

Personal property may need an assignment of ownership.

This step is critical to ensure those assets are distributed through the trust and not subjected to probate.

Yes! One of the biggest advantages of a living trust is its ability to avoid probate. When your trust is properly funded, your successor trustee can distribute assets directly to your beneficiaries without court involvement. This saves time, reduces legal costs, and keeps your affairs private.

You can serve as your own trustee while you’re alive and well. However, you’ll need to appoint a successor trustee to manage or distribute your assets after your death or if you become incapacitated.

Choose someone trustworthy, organized, and financially responsible—or consider a professional if you prefer neutral oversight.

A last will and testament takes effect after your death and must go through probate court, while a living trust goes into effect during your lifetime and avoids probate if funded correctly. Wills are public record; trusts offer privacy. Ideally, your estate plan should include both to ensure full coverage of your wishes.

Still have questions? Schedule a free consultation with Trust Guru, and one of our experts will walk you through your unique situation—no pressure, just clarity.