Planning your estate is a crucial step in securing your legacy and protecting your loved ones. For California residents, understanding the cost of creating a living trust is an essential part of that process.

This article explores the question, “how much is a living trust cost in California?” and breaks down the various fees and options to help you make informed financial and legal decisions.

A living trust can help safeguard your assets, ensure a seamless wealth transfer, and avoid the costly probate process.

Below is a detailed breakdown of the factors that affect the cost of setting up a living trust in California, empowering you to choose the most cost-effective and legally sound approach.

Article Preview

- Attorney Fees vs. DIY Trust Costs

- Complexity of Your Estate and Associated Costs

- Additional Fees to Consider

- Common Pricing Variations Across California

- Benefits of a Living Trust Despite the Costs

- How to Save Money When Creating a Living Trust

- Why Trust Guru Can Help You Navigate Living Trust Costs

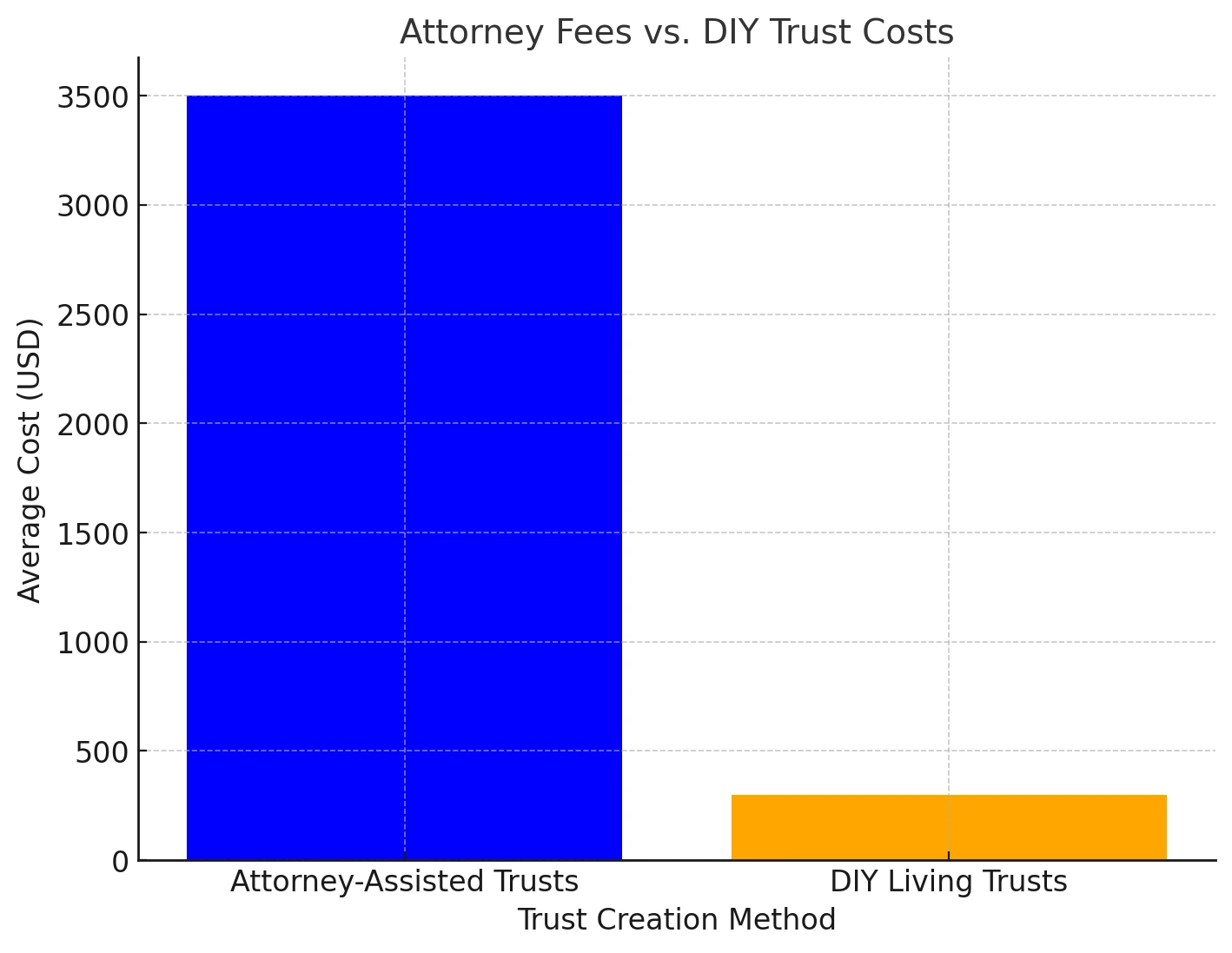

Attorney Fees vs. DIY Trust Costs

One of the first decisions you’ll face is whether to create a living trust yourself or hire a professional. Here’s a comparison of the two options:

Attorney-Assisted Trusts

- Average Cost: $2,000 to $5,000, depending on the attorney’s expertise.

- Benefits: Customized legal advice, protection against errors, and assistance with state-specific requirements. If you’re looking for a comprehensive service that covers all aspects of creating a living trust, check out our Living Trust Services.

DIY Living Trusts

- Average Cost: Average Cost: $100 to $500 for online templates, making it possible to find options as affordable as a living trust cost $500 California residents often seek when choosing budget-friendly services.

- Risks: Lack of legal oversight, potential errors, and failure to meet California regulations.

Hiring a professional may seem costly upfront, but it ensures peace of mind and fewer future legal complications.

For an additional comparison of DIY versus professional services, you can refer to our related blog post on Comparing DIY vs Professional Services.

For additional insights on DIY and professional estate planning services, see Benedictine University Estate Planning Resources.

Complexity of Your Estate and Associated Costs

The cost of a living trust often depends on the complexity of your assets and the legal provisions you need. Here are some factors that increase costs:

- Multiple Real Estate Properties: Requires additional documentation and amendments. To protect your real estate assets, consider our Real Estate Protection Services.

- Business Ownership: Trusts that include business assets often require specialized clauses. Learn more about our Business Asset Protection Services.

- Out-of-State Assets: These assets may need additional legal documentation.

For a straightforward estate with few assets, the costs may stay on the lower end. However, for complex estates, hiring an experienced trust attorney is advisable.

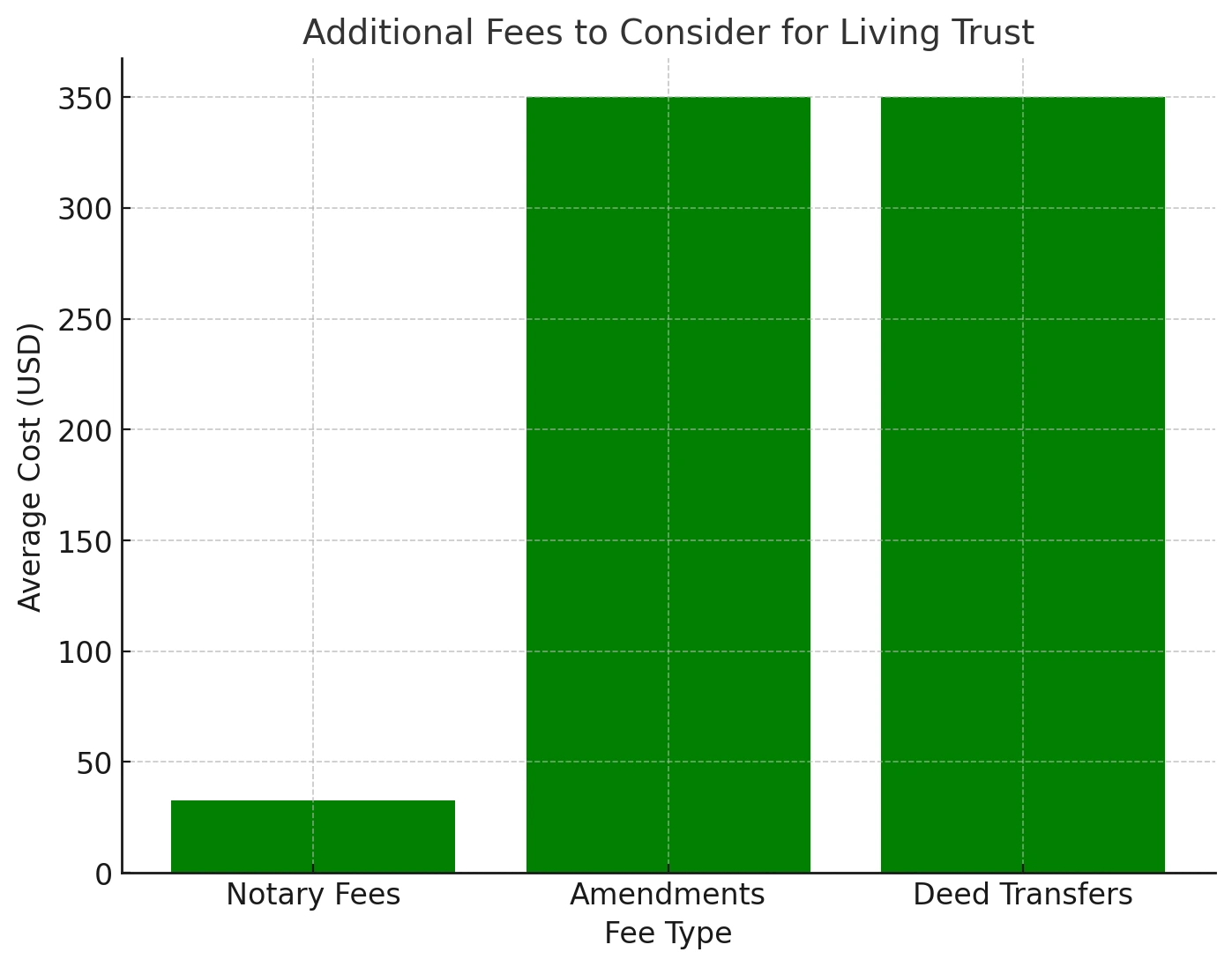

Additional Fees to Consider

When calculating the total cost of a living trust, don’t forget these additional fees:

- Notary Fees: $15 to $50 per signature in California.

- Amendments: $200 to $500 per amendment when you need to update your trust. Our Trust Amendment and Restatement Services can help make the process seamless.

- Deed Transfers: $200 to $500 for transferring real estate into the trust.

These extra fees can add up, so it’s essential to account for them when budgeting for your living trust.

Common Pricing Variations Across California

Prices for living trust services can vary significantly based on location and the law firm’s reputation. Here’s what you can expect:

- Large Metropolitan Areas (e.g., Los Angeles, San Francisco): Higher legal fees due to demand.

- Smaller Cities and Suburbs: Lower costs but potentially fewer experienced estate planners.

- Online Legal Services: Fixed lower fees but limited customization and guidance.

For a customized estate planning strategy that aligns with your specific needs, explore our Estate Planning Services to receive expert guidance and comprehensive support.

Benefits of a Living Trust Despite the Costs

Although the upfront cost of a living trust may seem high, the long-term benefits often outweigh the expense:

- Avoiding Probate: Probate fees can range from 4% to 7% of the estate’s value, costing tens of thousands of dollars.

- Privacy Protection: Unlike wills, living trusts aren’t public records, ensuring your family’s financial details remain private.

- Smooth Asset Distribution: A living trust helps avoid disputes and ensures your beneficiaries receive their inheritance efficiently.

Enhance the security of your wealth and minimize financial risks with our comprehensive Asset Protection Trust Services, designed to shield your assets from legal claims and unforeseen liabilities.

For further estate planning guidance, visit the American Bar Association’s Estate Planning Guide.

How to Save Money When Creating a Living Trust

To make the process more affordable, consider these cost-saving tips:

- Compare Quotes: Request estimates from multiple attorneys or legal service providers.

- Bundle Services: Some law firms offer discounted rates if you combine estate planning services (e.g., will, power of attorney, and living trust). You can explore our Healthcare Directives and Power of Attorney Services.

- Ask About Flat Fees: Some attorneys offer flat-rate pricing instead of hourly billing, which can prevent unexpected costs.

- DIY with Caution: If you have a simple estate, a DIY option may suffice, but make sure to research California-specific legal requirements.

By taking these steps, you can create a comprehensive living trust without overspending.

Why Trust Guru Can Help You Navigate Living Trust Costs

At Trust Guru, we understand how overwhelming it can be to navigate the complexities of creating a living trust. Our team is known for fast response times, high-quality service, and safeguarding our clients’ trust funds. Here’s how we can assist you:

- Expert Guidance: Our experienced professionals tailor solutions based on your unique estate needs.

- Transparent Pricing: We provide clear, upfront pricing with no hidden fees.

- Efficient Process: We ensure your living trust is set up quickly and correctly, so you have peace of mind.

Whether you need a basic living trust or a complex estate plan, Trust Guru is here to help you every step of the way with services like Trustee Services and Trustee Transition Planning.

Final Thoughts

Understanding how much is a living trust cost in California empowers you to make informed financial decisions and protect your assets. While costs vary based on factors like legal assistance, estate complexity, and additional fees, a well-prepared living trust can save you and your beneficiaries significant time and money.

For personalized assistance and expert advice, contact Trust Guru today to get started on your estate planning journey and ensure your financial legacy is secure.